By Pepper Parr By Pepper Parr

December 1st, 2023

BURLINGTON, ON

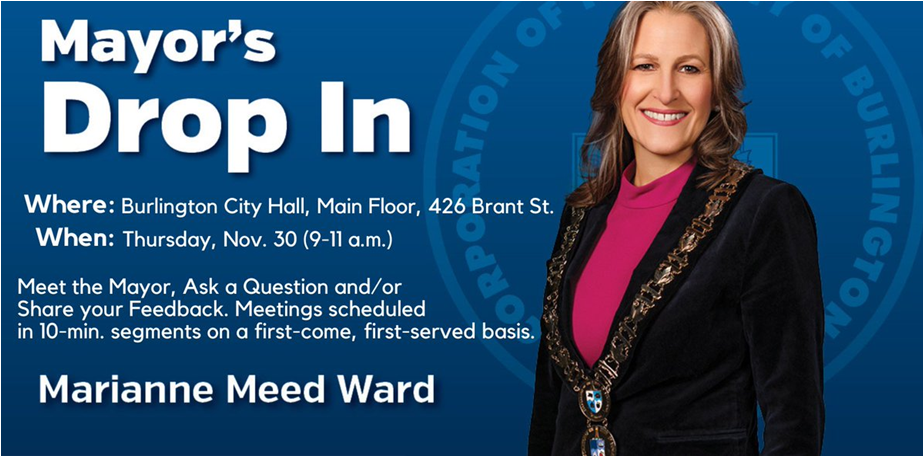

Mayor Meed Ward waiting in City Hall lobby for people who wanted to know more about the budget approved earlier in the week. Short notice, so maybe that was the reason the number of people who took part in the Drop In Mayor Meed Ward held yesterday was very small.

In the photograph the Mayor posted on her Facebook page she is seated with her Chief of Staff sitting to her right and two unidentified people face her.

Mayor with a couple that took part in the Drop In on Thursday Who are they and what did they have to say: we will never know. All we do know is that the event took place and the Mayor now has another poster to add to her collection.

By Pepper Parr By Pepper Parr

December 1st, 2023

BURLINGTON, ON

This is not good news on one level.

On another – it is very good news.

Aislinn Clancy won the Kitchener Centre by-election yesterday. It was a seat the Liberal Party needed to win if they expect to convince the people of the province that they can defeat Doug Ford. Having an additional Green Party member in the provincial Legislature is good news. The Greens have never wavered from the environment as THE issue we face as a society.

Given we have a government that doesn’t really believe there is a climate disaster heading our way have another Green in place is good news.

The challenge is that the current government needs to be replaced or at least that is what a lot of people think.

Not all that many in Kitchener: just 27% of the voters turned out to elect the Green candidate, Aislinn Clancy who won the Kitchener Centre by-election yesterday.

The new MPP gives the green party two official seats in the Ontario Legislature.

Kitchener residents didn’t buy into the Liberal story that they can defeat Doug Ford if elected.

Well they weren’t elected in Kitchener which suggests there may be some serious issues ahead that need to be resolved.

By Pepper Parr By Pepper Parr

December 1st, 2023

BURLINGTON, ON

We are still on that budget.

Mayor Meed Ward’s original intention was to have Council endorse

Directing the Chief Financial Officer to prepare the draft operating and capital budgets for 2025 and 2026 whereby the city’s portion of the overall property tax increase is not to exceed 3.99% of which approximately:

-

- 2.99% is for city services; and

- 1% is for city infrastructure renewal funding;

- and that the draft budgets be provided to the Mayor in preparation of the Mayor’s Proposed Budget in each year

but two Councillors wanted to ensure that the public had an opportunity to comment on the idea.

Sensing that she didn’t have the support she needed to proceed Meed Ward withdrew the 2025 and 2026 budget references and put the item on a future Council agenda.

The problem now is the item is not yet on the agenda for the series of meetings taking place next week.

In order to address Council delegators have to get their requests in before noon today.

Instead of working with the Clerk’s Office to get the agenda concerns taken care of Mayor Meed Ward chose to hold a drop in (on very short notice with no media notice) at City Hall on Thursday. Mayor still has the cart before the horse on engagement with the public.

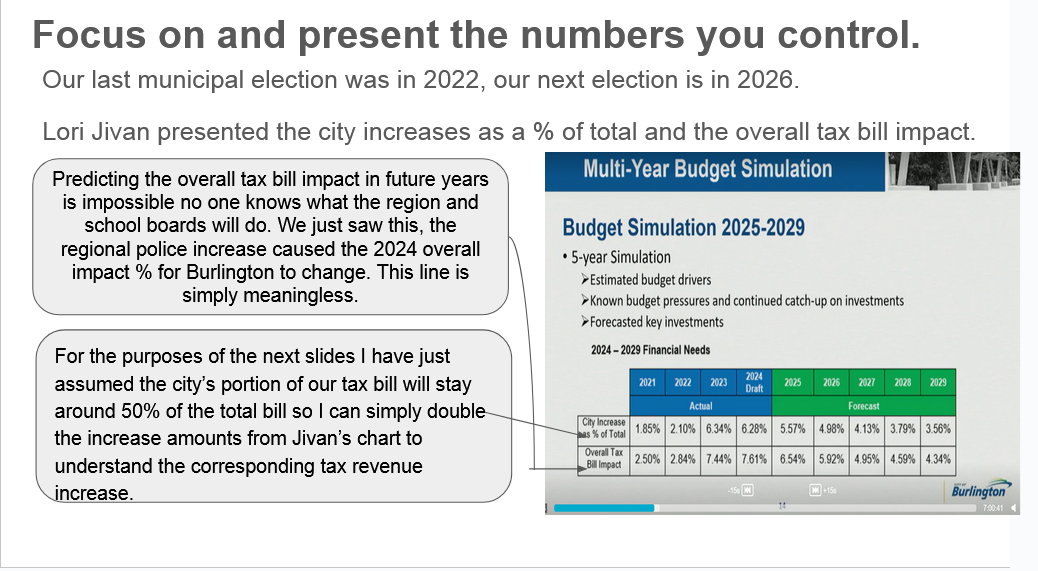

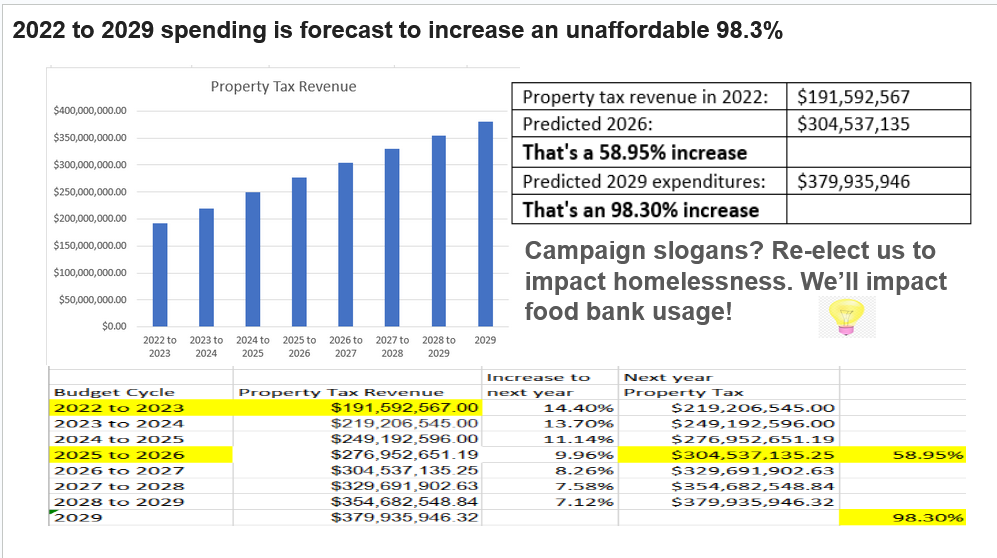

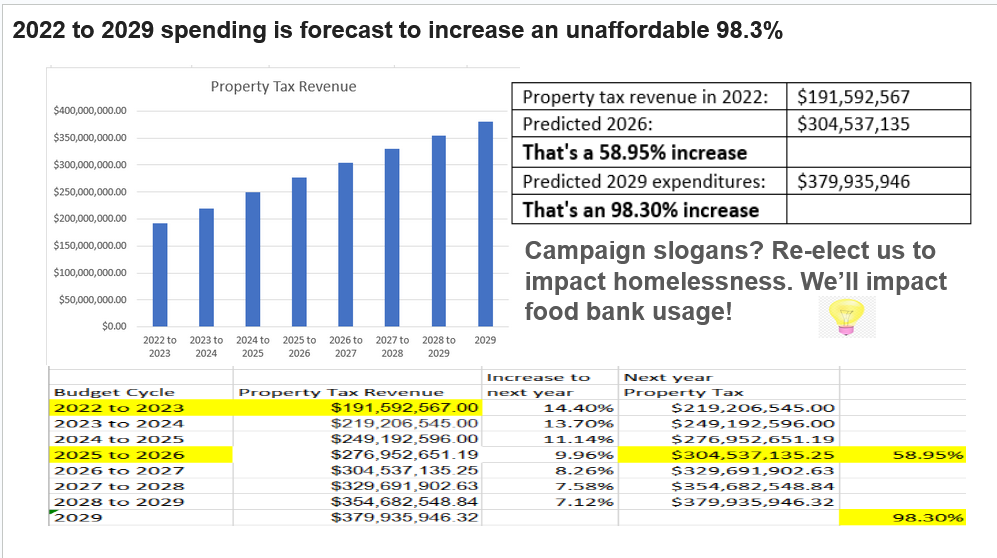

While all this is going on Eric Stern, one of the Aldershot citizens who delegated, wants people to fully understand what happened during the budget debates during November.

It is not a pretty picture.

Stern said that the “90s generation has called and they want their tax cuts back.

“We can’t go back in time, past mismanagement means future pain. It’s time for a zero-based budgeting approach. Every service, every position, “needs” have to be reviewed and “wants” eliminated. City Hall caused this mess – share the pain.”

Stern questions the hiring of somewhere between 50 and 90 new employees? “The province has a hiring freeze. Are Community gardens – volunteers, firefighters what we can afford. Stern suggests expanding the existing volunteer force. Middle management? – promote internally. “Investing” in new hires does not improve reserve fund balances.

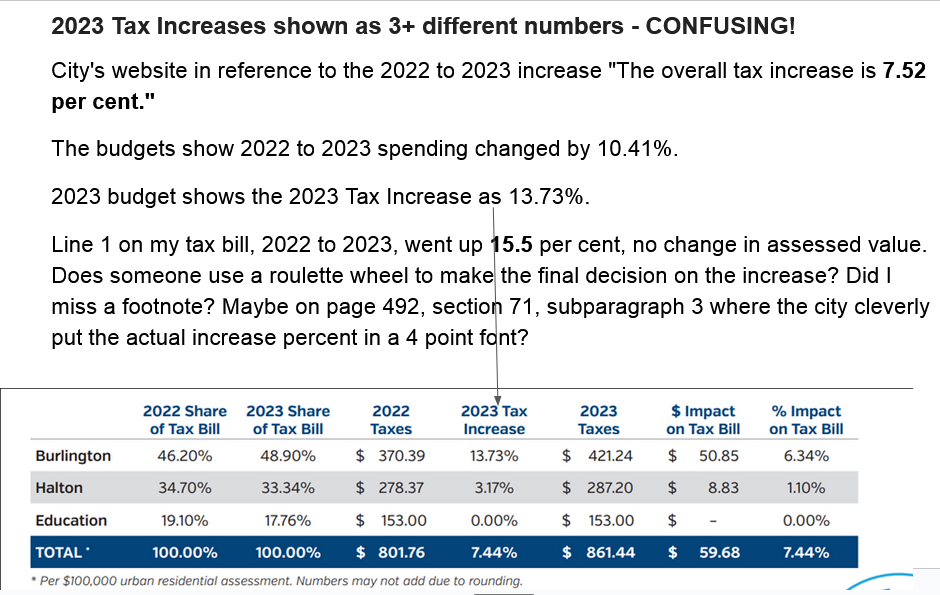

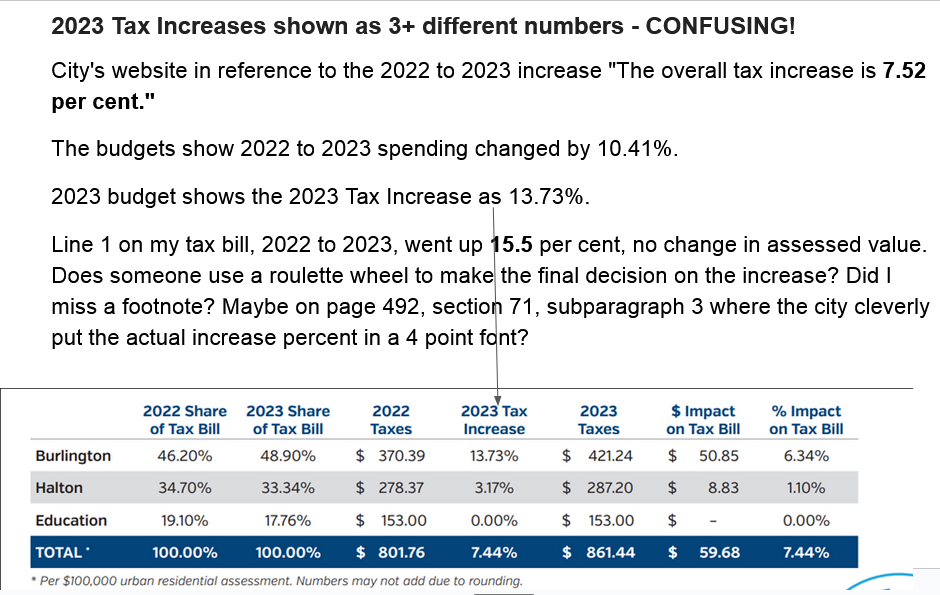

“City hall has created a world where “investment” means “spending”, “impacts” have to be doubled to understand increases, and Doug Ford “forced” the mayor to rush this process and limit citizen input. Ultimately we get a bill where the increase bears no relation to any of the information presented to us.

“Why is this so complex? ” asks Sterns. “Taxpayers trust city hall with OUR money. What has gone wrong? We are discussing $438 million dollars in spending, this is a major corporation, not an episode of Parks and Recreation.”

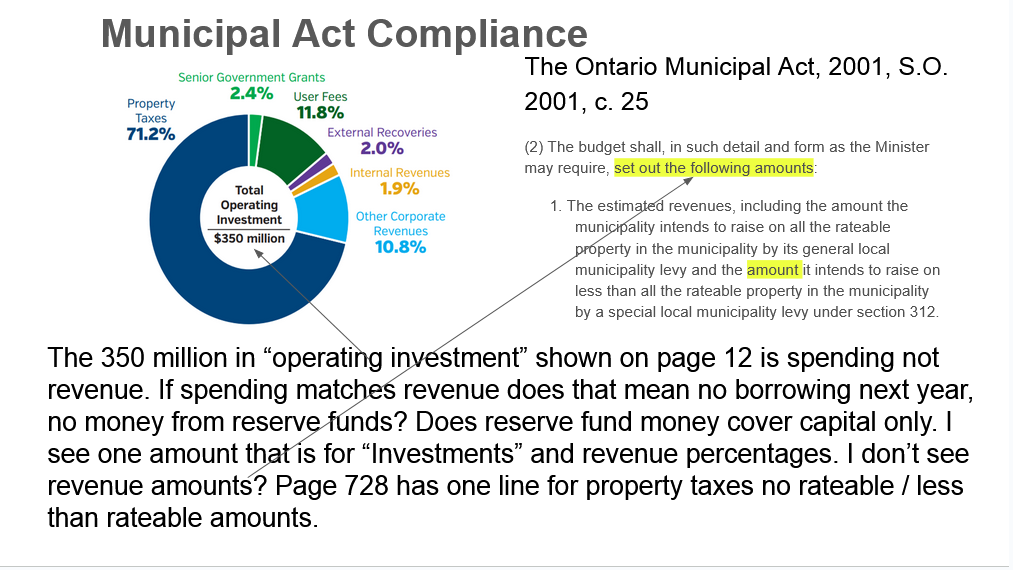

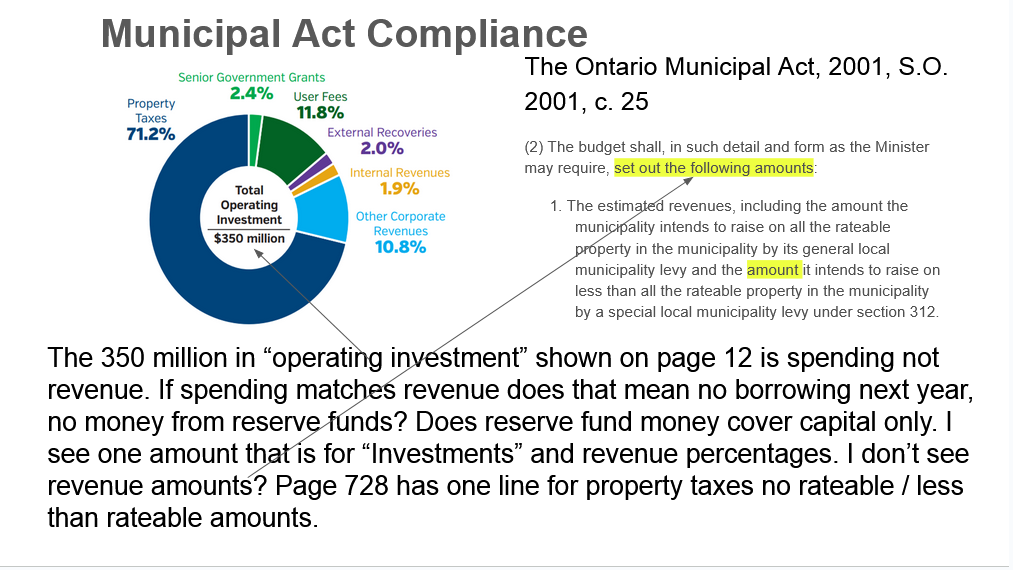

In the slides set out below Stern makes a number of very significant points where he believes the city failed to meet the Municipal Act – the provincial legislation that sets out the relationship between the province and the 400 municipalities in the province. A couple of them are glaring.

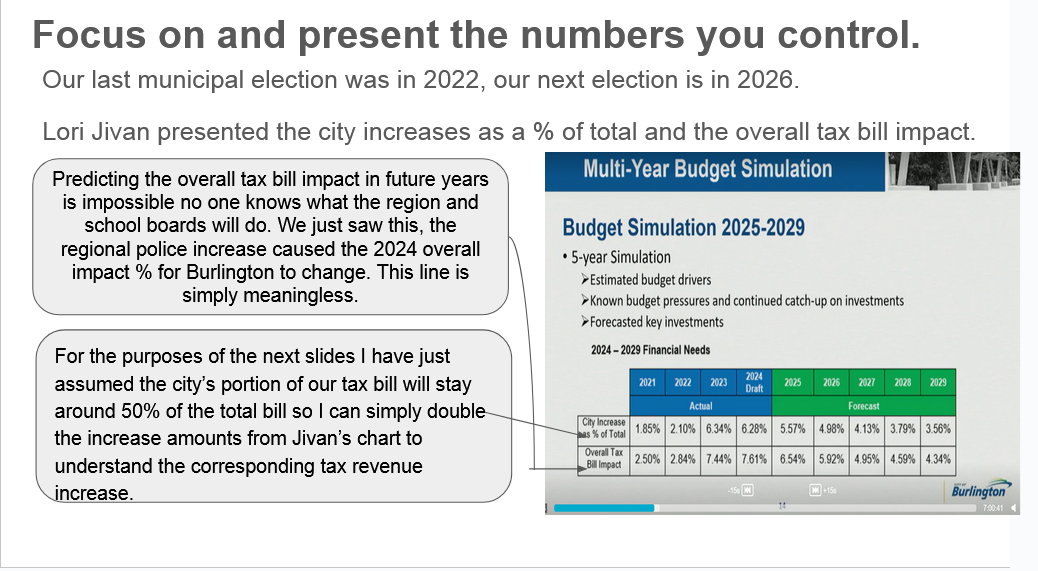

Eric Stern delved into the data the city provided and came up with more questions and not enough in the way of an understanding how everything was going to be paid for – he could see a wave of tax increases coming and a community that he felt could not afford what the city wanted to do.

Stern presented slides that set out where he felt mistakes had been made. The budgeting process is complex but doesn’t have to be as bad as this. References were made to how much better the Oakville budget presentation is – changes are need said Stern along with several other delegations.

Stern pointed out where the data the Finance department didn’t make any sense.

Stern put together data with startling projections. City Manager Tim Commisso pointed out that for a nine year period there were 0 tax increases. Maintenance and planning for growth were not given the attention they deserved – now the city is playing catch up – and it is proving to be very expensive. There is the sense that the process of putting a budget in place is not under control. The Mayor chose to use the Strong Powers that were available to her; that resulted in a rush to get the document completed and approved. Many citizens felt there was a rush that wasn’t necessary.

To add to the pace of things the city is now looking for a new City Manger. Tim Commisso announced a few weeks ago that he would not seek an extension of his contract.

By Darren Burke By Darren Burke

December 1st, 2023

BURLINGTON, ON

A distinguished scientist and serial entrepreneur, is set to disrupt the world of sports science and nutrition with an innovative new AI software called VITAI. This cutting-edge technology promises to mimic human clinical trials research, predict outcomes, and transform the way individuals approach the marketing and use of dietary supplements. Dosages and combinations of ingredients can be quickly tested to determine expected results on muscle strength, exercise recovery, hormone levels, weight loss, and more.

The groundbreaking AI software, developed by Dr. Darren Burke and his team of experts, leverages the power of artificial intelligence, natural language processing (NLP), and machine learning to simulate complex clinical trials scenarios. Phase one developed for athletes, uses human physiological responses to predict how exercise interventions and supplement formulations would impact muscle strength, exercise recovery, hormone levels, weight loss and many more important variables. The groundbreaking AI software, developed by Dr. Darren Burke and his team of experts, leverages the power of artificial intelligence, natural language processing (NLP), and machine learning to simulate complex clinical trials scenarios. Phase one developed for athletes, uses human physiological responses to predict how exercise interventions and supplement formulations would impact muscle strength, exercise recovery, hormone levels, weight loss and many more important variables.

Key Features of the AI Software:

Accurate Predictions: The software uses natural language processing (NLP), advanced algorithms and data analytics to provide highly accurate predictions of how different exercise and supplement interventions can affect specific outcomes in athletic populations.

Reduced Trial Costs and Time: By simulating clinical trials in silico, this innovative technology significantly reduces the time and costs associated with traditional human trials, making it more accessible to researchers, coaches, and athletes alike.

Data-Driven Insights: The software generates comprehensive insights and reports, personalized recommendations, enabling researchers and trainers to make data-driven decisions about exercise and supplement regimens.

The gap between scientific research and practical application is filled by people that look for the bigger picture. These people are called entrepreneurs – they do this every day. Dr. Darren Burke, the mastermind behind this AI powered innovation, is a renowned exercise scientist and serial entrepreneur with a track record of pioneering advancements in the fields of sports science and nutrition. With this AI software, he aims to bridge the gap between scientific research and practical application, enabling athletes and fitness enthusiasts to optimize their performance and well-being, and most importantly make the right decisions with supplement purchases and usage.

“I am excited to introduce this game-changing AI software that will revolutionize the way we approach exercise, nutrition, and performance enhancement,” said Dr. Burke. “By providing a precise understanding of how various interventions impact the human body, we empower athletes and individuals to make informed choices to achieve their fitness goals efficiently.”

A well structured and balanced exercise program supplemented by nutrients has proven to be very effective. As an example of the potential usages of this novel technology, Dr Burke and his team are launching the worlds 1st sports nutrition brand built using AI, called CIRCUT. It is a brand built for athletes – beginner, professional and retired and demonstrates the power of their AI to scour millions of peer-reviewed publications on the effect of natural products on athletic performance and build custom formulations to help other achieve similar results. The potential applications of Dr. Burke’s AI software extend beyond athletes to include the general population, and healthcare professionals seeking evidence-based guidance for their clients or patients. This technology promises to drive innovation in the health and wellness industry, offering new avenues for research and improved outcomes for consumers worldwide.

For media inquiries or further information about VITAI click HERE

For more information on Dr. Darren Burke, please contact him via his website at DrDarrenBurke.COM or via LinkedIn.

By Georgia Cavalcanti By Georgia Cavalcanti

December 2nd, 2023

BURLINGTON, ON

Bitcoin and the blockchain are well-known to everyone nowadays. However, the inner mechanisms of cryptocurrency technology often elude many. One of the primary assumptions is that Bitcoin is like digital gold.

Bitcoin emerged as an alternative to fiat currency in 2008. While that might be true, much more is happening with Bitcoin and cryptocurrencies. In this article, we’ll clarify some important concepts and explain some intriguing proposals that can show the value of these assets as much more than a medium to store value.

It’ll become evident how important and disruptive this technology is and why there are such things as crypto casino games, decentralised apps, and many other interesting concepts.

How It Works

Bitcoin emerged as an alternative to fiat currency in 2008. Naturally, it’s a concept tied to economics, so it’s used profusely in online casinos. However, let’s briefly forget Bitcoin’s economic value and delve into the technical aspects.

Bitcoin is a network with no central authority. That means all users participating in this network are at the same level. In this network, users can send and receive bitcoins and store them in a Bitcoin wallet.

That’s when the concept of “blockchain” shows up. It’s a public ledger, meaning it’s a registry of all transactions throughout the network. Each user has all the data everybody else has. This is why it’s called a decentralised network.

There are enormous implications for this. First, you can send and receive bitcoins anywhere, at all times. Since no one controls it, there are low to no fees, depending on the transaction type. Plus, there can’t be any manipulation.

For example, central banks control the supply of money in a country. They can decide to enable certain policies to exert control, which might be unfavourable for people. This isn’t the case with Bitcoin.

Since it works by consensus, it’s almost impossible to tamper with. If a hacker wanted to manipulate the network, they would have to somehow control a significant amount of participating devices, which is almost impossible.

Gold, Casinos, and More

Some of the best examples of Bit Coin use are online casinos. Bitcoin was purposely developed as a finite asset. Only 21 million bitcoins are possible, and only about 1.5 million are left to be rewarded. In this respect, it’s the same as gold because it also is a finite resource.

This scarcity and the novel approach to economics have led to the incredible Bitcoin revolution as a store of value. However, there are many other uses for it.

Some of the best examples are online casinos. On such websites, you can play casino games of various kinds, and many allow transactions with Bitcoin. It means that you can deposit and withdraw with it. Generally, other cryptocurrencies are available, too.

This is important, as there are yet few entertainment outlets that have fully embraced cryptocurrencies as a valid payment method. It validates these digital assets and likely helps pave the way for more options.

Even though Bitcoin is primarily used as a financial-related network, the principles it pioneered were used for other, more intriguing purposes.

For example, other networks, such as Ethereum, offer the ability to develop decentralised apps. It means that instead of operating from a central server or computer, the app operates in a network.

This is a significant development. Imagine there’s a decentralised news app covering a government scandal. Since all participants have the information, it would be impossible to censor. This is why Bitcoin and its peers are more than assets for speculating their values.

Closing Thoughts

Bitcoin is much more than digital gold and a payment method for online casinos. How much more – we don’t know yet. Bitcoin is much more than digital gold and a payment method for online casinos. It’s a proof of concept on how society could dispense with current monetary control and all the ramifications that might happen, good and bad.

Furthermore, it shows how disruptive technology can impact society and shake its foundations. Whether we’ll live in a centralised or decentralised world remains to be seen, but the discussion wouldn’t exist without Bitcoin.

By Pepper Parr By Pepper Parr

November 28th, 2023

BURLINGTON, ON

This one gets a little technical. But the end result is very important.

This Council is learning to listen. How long this lasts is another issue but two Council members asked important questions about how future budgets would be prepared.

In the recommendation that came out of the Standing Committee meetings asking Council to endorse:

Directing the Chief Financial Officer to prepare the draft operating and capital budgets for 2025 and 2026 whereby the city’s portion of the overall property tax increase is not to exceed 3.99% of which approximately:

-

- 2.99% is for city services; and

- 1% is for city infrastructure renewal funding;

- and that the draft budgets be provided to the Mayor in preparation of the Mayor’s Proposed Budget in each year

Ward 5 Councillor Paul Sharman was prepared to have 2025 and 2026 budget council in the hands of the Mayor with no public input.  Ward 1 Councillor Galbraith followed Sharman on putting the motion before Council. The next item required Council to waive the rules of procedure to get the item on the agenda. That took place: Councillors Sharman and Galbraith moved to allow motion memorandum 2025 and 2026 budget direction to be added and discussed at this meeting of the Special Counsel, November 28 2023.

The Clerk out the Motion up on the screen where the public could see the details and Mayor Meed Ward said: “I will open the floor for any questions. Go ahead. Counsellor Nisan: Could it not be sent the committee?

Ward 3 Councillor Rory Nisan Nisan wanted to know why the question related to the 2025 and 2026 budgets were being pushed at this point, adding “I thought it would be helpful in light of the considerable feedback that we heard from the community to deal with this at the same time as the budget.

“I am in your hands” said the Mayor. It needs a two thirds vote to table it and to have the discussion in a holistic manner with the rest of our budget items so folks know what our roadmap is for 2025 and 2026 as we prepare the 2024 budget okay. I’m not seeing anything further, the questions have been answered. The motion is there. This is just the wave procedure. We’re not dealing with the item yet. So we need to waive procedure to get the item on the floor.

So put your hand up. Yes. If you want to talk about it and keep your hand down if you don’t want to talk about it. All right. I’m not seeing anything else. It does need two thirds to go ahead.

At that point Councillor Kearns said: “If this goes forward, then we’ll be addressing the motion which is to endorse the staff direction at the Special Council meeting having given no opportunity for the public to have input or delegate on this endorsement. Is that correct? At that point Councillor Kearns said: “If this goes forward, then we’ll be addressing the motion which is to endorse the staff direction at the Special Council meeting having given no opportunity for the public to have input or delegate on this endorsement. Is that correct?

Mayor: “Yes, it was part of the agenda package that did go out. And it also responds to the 3000 plus folks and others that have asked for us to look at ways to reduce the tax increase. So it’s in direct response to the community input that we’ve heard throughout this process. If you wish it to be handled in a different way, then you wouldn’t support this.

Councillor Nissan: “I just want to suggest this go to committee next week and give the public more opportunity. And we have a lot we have a lot of things we have to respond to but I think this will be better off at committee.

Councillor Kearns? “I just said I would try to do better and this doesn’t feel like me trying to do better so I’d like this to come to committee.

Sensing that she was going to lose this vote, Mayor Meed Ward decided to pull the item from the agenda which meant that the public would have a chance to comment during the first week of December. Mayor: “All right, any further questions or comments? Alright, so in light of the feedback from committee and council, I withdraw the item and we will bring it through committee. One way or the other, it will come forward and we’ll deal with it when we deal with it. So we don’t have anything on the floor right now to speak to so you’re gonna have to save your comments. Unless you have questions for me related to the wave procedure while it’s been withdrawn, so just hang on.”

That was it. Any discussion on the 2025 and 2026 budgets will be heard at a Standing Committee where the public will have an opportunity to delegate of they wish

Complex, confusing – most certainly but from time to time members of this Council do the right thing.

The agendas will be revised and the public will be heard.

By Pepper Parr By Pepper Parr

November 30th, 2023

BURLINGTON, ON

Just in case you missed it – we did – not a word to media on this event.

Mayor Marianne Meed Ward is going to give anyone who wants to trot down to city hall ten minutes of her time.

Interesting to note that there is no place to register and pick a time that works for you.

It’s first come – first served.

Will there be line ups outside city hall stretching out to Civic Square?

By Pepper Parr By Pepper Parr

November 30th, 2023

BURLINGTON, ON

The ballots have been cast – they weren’t dropped into a ballot box – but they were cast and they have been ranked and on Saturday the Liberal Party of Ontario will announce who the next leader of the party will be.

Nate Erskine Smith, the federal member for Beaches- East York.  Ted Shu, currently a member of the provincial legislature (MPP) representing Kingston and the Islands. Running for the leadership are Bonnie Crombie, currently Mayor of Mississauga, Ted Shu, currently a member of the provincial legislature (MPP) representing Kingston and the Islands, Nate Erskine Smith, the federal member for Beaches- East York, and Yasir Naqvi who has served is as the MPP and then the MP for Ottawa Centre

Yasir Naqvi was a member of the Wynn government that was defeated by Doug Ford in YEAR.

The vote for the leadership this time around is being done on a ranked ballot basis – every member of the Ontario Liberal Party (there are more than 100,000 registered to vote0 which they did on Saturday, November 25, 2023 and Sunday, November 26, 2023.

Each member of the Ontario Liberal Party named their first choice on the ballot. When those first choices are counted the person with the most votes is the leader, providing they have 50% of the votes.

If not, the candidate with the fewest votes is taken off the second count and the ballots are counted again, this time they count the second choice on each ballot.

It’s complex, given the way it is set up there shouldn’t be more than two counts.

Bonnie Crombie walking to the provincial Liberal convention looked more like a triumphal march; she was seen as the leader from the get go. Bonnie Crombie appears to be the leader – she was certainly a strong choice for many until she suggested that some of the Greenbelt land could be converted and used for housing. She wasn’t wrong but at the time it was not what the public wanted to hear – she began to be described is as Doug Ford Lite – not where you want to be in a race for the Liberal leadership.

Nate Erskine Smith looked good, spoke about values and the need to build relationships. He was an very active federal MP – but was never seen is as a cabinet choice by the people advising Justin Trudeau. Nate didn’t seem to be able to generate the kind of buzz that was needed to win the leadership contest.

Yasir Naqvi has served is as the MPP and then the MP for Ottawa Centre. He was a member of the Wynn government that was defeated by Doug Ford in 2018. Within the last three weeks he joined forces with Yasir Naqvi asking their followers to make the other their second choice on the ballot – hoping this way to blunt the lead that most people believe Crombie had going for her.

The decision was described by many is as a desperate move – which it could well have been. But they felt they had to do something.

The surprise to many is Ted Shu – he came across is as a bit of a bumbler – which he certainly isn’t.

There is something quiet but very steady about the man. He isn’t pushy but he is very enthusiastic. I’m not sure he was really listened to.

If it is to be Crombie – she will certainly go after Doug Ford – something he isn’t looking forward to and something he doesn’t need at this point.

The RCMP are investigating the deals that were made under Steve Clark who seemed to have forgotten just what a Cabinet Minister is supposed to do. Doug Ford wasn’t much at understanding what Cabinet is supposed to do.

Assuming Bonnie is chosen as the leader – what is the first thing she will do?

I think she should run for a seat in the Legislature and be in the Premier’s face every day.

Right now Marit Stiles, the NDP leader of the opposition is doing all the talking – Crombie has to fill that space.

She has a profile and she is well known across the province. She has raised a tonne of money and would appear to have support in most ridings.

It is not unusual for a leadership winner to arrange for a sitting member of the party to resign which would will result in a by-election which she should win.

The big question about Bonnie Crombie is – will she be there to do the job for two terms – eight years ?

Salt with Pepper is the musings, reflections and opinions of the publisher of the Burlington Gazette, an online newspaper that was formed in 2010 and is a member of the National Newsmedia Council.

By Staff By Staff

November 28th, 2023

BURLINGTON, ON

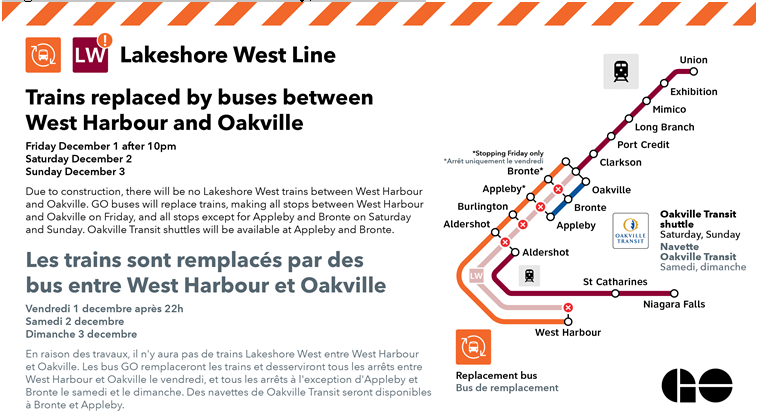

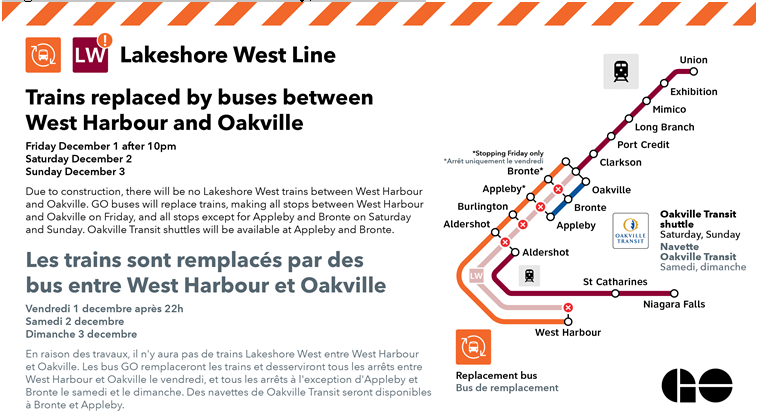

Starting this Friday, Lakeshore West rail service will run only between Union Station and Oakville to allow for critical track works and infrastructure updates.

What customers need to know:

Starting at approximately 10 p.m. on Friday, December 1, there will be no train service between Oakville GO and West Harbour GO stations until end of service on Sunday, December 3. Replacement GO buses will be available for customers and Oakville Transit will be running hourly shuttles to and from Oakville GO for customers wishing to access Appleby GO or Bronte GO stations.

In addition, our Friday 10:50 p.m. train to Niagara Falls GO will be adjusted to start at Aldershot GO. For customers travelling to Niagara Falls from Union Station, we recommend taking the 10:17 p.m. Lakeshore West train to connect with the Niagara Falls bound train departing at Aldershot GO.

Regular service will resume on Monday, December 4.

By Joe Gaetan By Joe Gaetan

November 29th, 2023

BURLINGTON, ON’

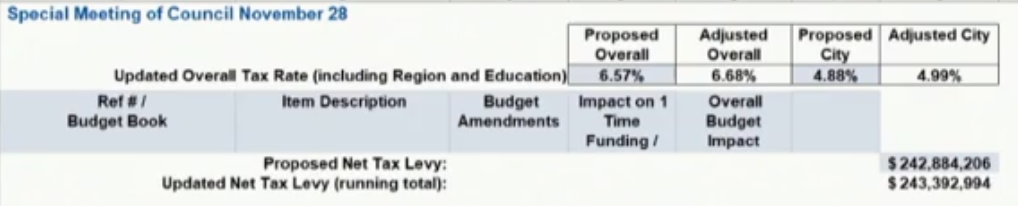

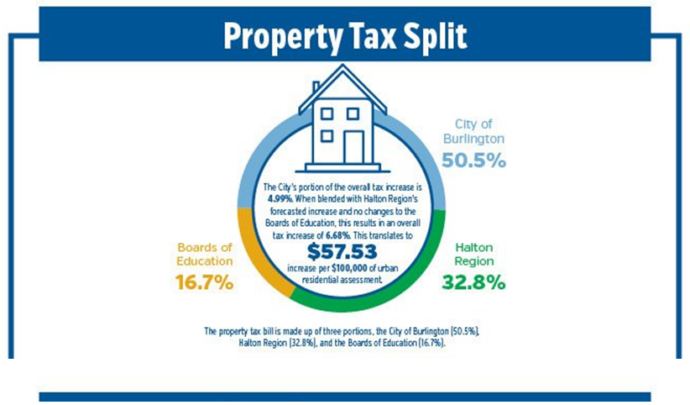

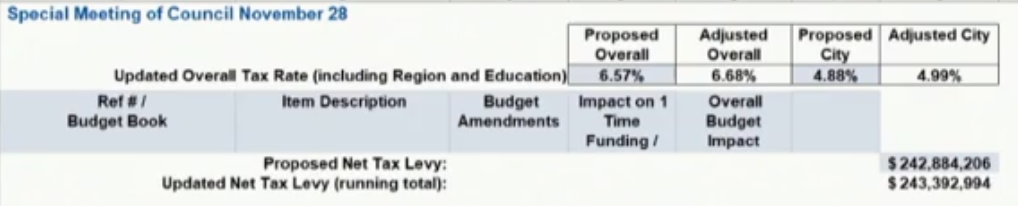

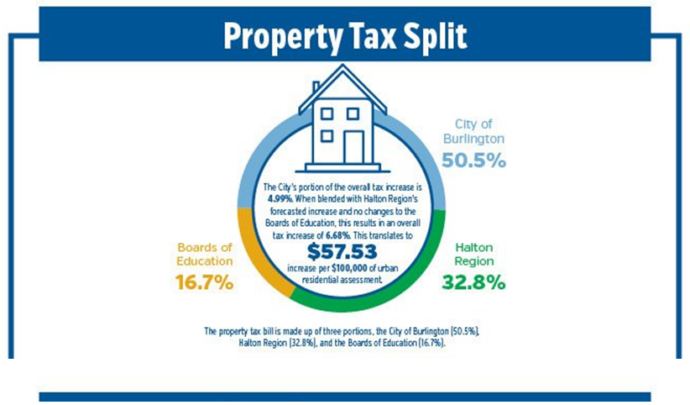

What the 4.99% TAX increase means to the average Burlingtonian.

First: The average cost of housing per segment in Burlington is as follows:

Condo’s – $547,739

Condo Towns – $710,936

Freeholds- $881,798

Detached houses – $1,222,381

Next: The COB website- Read More/Learn More

“The City’s portion of the overall tax increase is 4.99%. When blended with Halton Region’s forecasted increase and no change to the Boards of Education, this results in an overall tax increase of 6.68%. This translates to $57.53 increase per $100,000 of urban residential assessment.”

Here is what the TAX increase means to you in pocket dollars.

On average, if you live in a Condo, you will be paying $315.11 more,

a Condo Town $409.00 more,

a Freehold $507.30 more and

a Detached home $703.24 more per next year.

By Pepper Parr By Pepper Parr

November 29th, 2023

BURLINGTON, ON

So it is done.

The budget for 2024 is cast in stone. The budget for 2024 is cast in stone.

Tax bills will get sent out and people can then compare what their tax bill was in 2023 and compare with what they are asked to pay during 2024

This was a contentious budget – there were several dozen letters to Council and five very strong personal delegations that took Council to task.

Lydia Thomas  Dave Chapman Dave and Vera Chapman spoke to Council in a way they have not been talked to in some time.

Lydia Thomas was very direct and showed Council time and again where they just plain got it wrong.

Eric Stern put data before Council to point out where the mistakes were made.

None of it made much in the way of a difference other than to show that there are people in the city who are prepared to speak out.

The Mayor continues to maintain that she had to use the Strong Powers – she did not have to – she chose to – which is fine but don’t try to convince the public that Doug Ford made you do it.

In the closing minutes of the Special Council meeting two members of Council took the Mayor to task when she set out to include the early drafts of the 2025 and 2026 budgets.

Council was being asked to:

Endorse a Mayoral Direction to the Chief Financial Officer for the 2025 and 2026 budget years as follows:

Direct the Chief Financial Officer to prepare the draft operating and capital budgets for 2025 and 2026 whereby the city’s portion of the overall property tax increase is not to exceed 3.99% of which approximately:

-

- 2.99% is for city services; and

- 1% is for city infrastructure renewal funding;

- and that the draft budgets be provided to the Mayor in preparation of the Mayor’s Proposed Budget in each year

Councillors Nisan and Kearns wanted the mention of the 2025 and 2026 budget plans be discussed and not rubber stamped at a Special Council Meeting where the public had little warning that this was coming.  Councillors Nisan and Kearns didn’t want to go along with this and suggested that the matter be sent to a Standing Committee meeting where the public would be able to comment. Councillors Nisan and Kearns didn’t want to go along with this and suggested that the matter be sent to a Standing Committee meeting where the public would be able to comment.

Councillor Nisan said: “I just want to suggest this go to committee next to next week and give the public more opportunity. We have to respond to but I think this will be better off that committee.

Councillor Kearns said: “Yeah, thanks. I feel like I just said I would try to do better and this doesn’t feel like me trying to do better so I’d like this to come to committee.

Mayor: “Alright, so in light of the feedback from committee and council, I withdraw the item and we will bring it through committee, having said that, the agendas for committee already are out.”

For those who want to ensure that the 2025 and 2026 elections are not a repeat of what took place this year – your chance to delegate is just a couple of weeks away.

By Staff By Staff

November 29th, 2023

BURLINGTON, ON

In their media release the City communications department said: More information about the municipal budget process under Bill 3, the Strong Mayors, Building Homes Act, 2022, can be found on the Provincial website.

They got that part wron The Strong Mayor legislation that applied to Burlington is set out in Bill 39

A link to that Bill is set out below along with the regulations. Bill 39 gave Mayor Meed Ward the authority to put forward a budget, which she did. However, the Mayor was not required to put forward a budget – she chose to do so

At today’s Special Council Meeting, Burlington City Council finalized the 2024 budget. Next year’s budget is focused on essentials, front line services and preparing for growth. At today’s Special Council Meeting, Burlington City Council finalized the 2024 budget. Next year’s budget is focused on essentials, front line services and preparing for growth.

The City’s portion of the overall tax increase is 4.99%. When blended with Halton Region’s forecasted increase and no change to the Boards of Education, this results in an overall tax increase of 6.68%. This translates to $57.53 increase per $100,000 of urban residential assessment.

The property tax bill is made up of three portions, the City of Burlington (50.5%), Halton Region (32.8%), and the Boards of Education (16.7%).

The 2024 budget has been broken down into three categories:

Essentials – This area covers projects and items the City of Burlington must address and/or have already committed to, such as cost of inflation, necessary capital projects and infrastructure renewal.

Frontline Service – This area covers enhanced services that directly improves the quality of life of Burlington residents.

Planning for Growth – This area plans for and prepares for the expected increase in population, our Community Investment Plan, and allow us to catch up and prepare for the future.

This was the first budget under the new provincially legislated Strong Mayor Powers. The Mayor proposed the budget for 2024. The budget was based on the 2024 Financial Needs and Multi-Year Forecast Reference Document prepared by staff earlier this year.

Council brought 62 changes through amendment motions to modify the budget. Of those amendments, 27 were adopted into the budget. These were presented at Committee meetings on Nov. 21 and 23 and the Special Council Meeting on Nov. 28. The budget was finalized at the Special Council Meeting on Nov. 28.

Key investments

- Enhancing frontline service delivery with additional transit operators, firefighters, by-law licensing clerks and customer experience staff to respond to your concerns

- Funding for 3 new community facilities – Skyway Community Centre, the newly renovated Mountainside pool and the former Robert Bateman High School

- $88.6 million of capital investment in 2024 to keep our infrastructure assets like buildings, roads and parks in a state of good repair

- Funding dedicated to future land and facility needs for our growing and changing community

- Free all-day transit for Seniors

- Support for our Community Planning Housing Initiative

- Support to bring the city’s Information Technology (IT) infrastructure into the 21st century

Joint statement from Burlington Mayor Marianne Meed Ward and Deputy Mayor for Strategy and Budgets Paul Sharman

“We know these are difficult times for everyone with increased living and housing costs and Council had to make some difficult budget decisions. Working with each other and staff, while hearing from the community, we balanced the needs of the city with our current affordability crisis as best we could. At the end of the day, this is a Mayor and Council budget that focuses investments on essentials, frontline services and planning for future growth. It was created through a lot of hard work and learning through a new provincially-legislated budget process this year. It is our hope this budget sets us up for success in 2024 and for years to come in creating an inclusive, affordable, eco-friendly and caring community for all our neighbours. The 2024 Budget impacts people through the programs and services they receive every day in our city. Each time you have your road plowed, use a City park or trail, or cool off in a municipal pool or splash pad, you are using a City service and seeing your tax dollars at work. This budget continues to build on investments our community has asked for and needs and will only improve Burlington today and into the future.”

Burlington Chief Financial Officer, Joan Ford said: “The adoption of this budget gives much needed support to essential city projects, front line services and infrastructure. As this was our first time establishing a budget under the Strong Mayor Powers, I’m thankful for the work and dedication of City staff and the collaboration with the Mayor, Deputy Mayor for Strategy and Budgets and members of Council to support this new process.

Ford announced that the 2024 budget would be her last.

The City’s mission continues to be to balance the needs of all residents both today and in the future while maintaining the high quality of services that residents enjoy.”

In their media release the City communications department said: More information about the municipal budget process under Bill 3, the Strong Mayors, Building Homes Act, 2022, can be found on the Provincial website.

This is just plain not true. The Strong Mayor legislation that applied to Burlington is set out in Bill 39

A link to that Bill is set out below along with the regulations. Bill 39 gave Mayor Meed Ward the authority to put forward a budget, which she did. However, the Mayor was not required to put forward a budget – she chose to do so.

Bill 3: Strong Mayors, Building Homes Act, 2022 Applies to Toronto and Ottawa

Bill 39: Better Municipal Governance Act, 2022 Applies to Burlington and other Ontario municipalities

O. Reg. 530/22 – Municipal Act

By David Jones By David Jones

November 29th, 2023

BURLINGTON, ON

You aren’t going to get this kind of commentary from the newsletters that the two Burlington MP’s provide.

Policy Options, a think tank produced the following which puts the housing situation in context and points to where the mistakes were made that got us into this mess.

Federal strategies must not inadvertently weaken provincial incentives to act, and they need to focus on housing that wouldn’t otherwise get built.

The federal government has announced considerable extra funding for housing in recent months: the GST rebate on construction of new rental units; the first beneficiaries of the $4-billion Housing Accelerator Fund; and additional low-cost financing through the Canada Mortgage and Housing Corp. (the CMHC).

These recent announcements constitute a switch in government strategy from ”demand-side” measures (such as support for first-time buyers) to ”supply-side” measures – a welcome development because the former have likely buoyed property prices without addressing underlying supply issues.

While there are still plenty of supply-side factors outside the federal government’s control – interest rates being chief among them – there are two issues that require federal attention: ensuring a genuine additional housing supply and encouraging provincial leadership in the field.

The need for “additionality”

Additionality (or “incrementality”) refers to the additional housing supply generated by new funding over and above what would have been built without the funding.

For government funding to be effective – and offer good value for money – it needs to deliver this additional housing and not just subsidize units that would have been built anyway. In the context of rising federal government spending, taxpayer value-for-money cannot be ignored.

The challenge for these new supply-side measures is that money isn’t the only constraint on housing supply. In particular, there are shortages in the construction labour force, as well as expensive regulatory barriers

The new federal incentives do not guarantee a genuine additional or substantial increase in the housing supply.

For example, both the GST rebate and the extra CMHC financing cover all new units constructed, not just those considered to be additional supply. While these initiatives could ease financial constraints for development, the risk is that the financial incentives aren’t specifically earmarked for additional units.

The Housing Accelerator Fund provides more incentives because it targets funding only for proposed additional housing.

Yet there are also risks with that approach. Because municipalities are tasked with projecting the hypothetical supply of new housing without funding, there is an incentive to “‘lowball” that number: the lower the hypothetical supply without funding, the greater the calculated additional supply, resulting in higher Housing Accelerator Fund contributions.

Ultimately, it is impossible to say precisely what the housing supply will be without Housing Accelerator Fund contributions and it will be a challenge for the CMHC to determine what is genuine additional supply. Several approaches can help with that.

Delivering additionality

First, the CMHC needs to scrutinize the hypothetical (without-funding) supply projections from municipalities before agreeing to provide Housing Accelerator Fund money. There should be strong evidence that money from the fund will generate additional housing over and above the basic supply.

Housing Accelerator Fund disbursements are currently running behind the original budgeted proposal. If political pressure mounts to release funding to municipalities, the CMHC must be vigilant to ensure value-for-money by delivering a genuine additional housing supply.

Second, under the terms for the fund, the CMHC will make staggered payments to municipalities contingent on those municipalities reporting progress in meeting additional supply. It would be detrimental for the CMHC to set too high a bar for reporting – because that might prove a disincentive to municipalities – but there must also be a credible threat that CHMC will withhold money in the case of under-delivery.

Third, additional housing supply can be encouraged through investment in other sectors. For example, in the U.S. the Department of Transportation gives higher scores in its transport grant funding assessments to jurisdictions with land-use policies that promote density.

One way to implement this in Canada would be for the Canada Infrastructure Bank to favour investments that directly or indirectly support housing supply. For example, the bank recently announced a $7.9-million loan for investment in water, electricity and broadband connections in Netmizaaggamig Nishnaabeg, a First Nation in Northern Ontario, intended to help provide the infrastructure needed for housing development.

The need for provincial leadership

Federal parties are increasingly seeking to demonstrate leadership on housing. The Liberal government has issued a raft of new policies (as noted above), while the Conservatives recently announced that reversing the current “housing hell” is a headline priority.

On the one hand, there is a good case for some federal engagement. Ottawa has greater spending power and holds some levers that influence the housing market, such as immigration.

But ultimately, the provinces are constitutionally responsible for housing. As federal parties seek to assert control over how housing issues should be solved, that is crowding out the role of the provinces – at least in terms of political accountability – and possibly also in policy initiatives.

Of course, provinces are actively engaged in many ways. For example, in 2022, Ontario issued its housing supply action plan, and more recently announced measures to increase housing for homeless populations and to speed up planning approvals.

But crowding out is still a real risk. Political and public accountability creates strong incentives for governments to act, and the current federal strategies are inadvertently weakening provincial incentives by absorbing much of the political pressure. That must change.

Facilitating provincial leadership

First, the federal government needs to take a more balanced and consistent approach with its strategy and communications. Prime Minister Justin Trudeau recently appeared to “flip flop” around the federal role in housing – initially saying it was primarily a provincial responsibility, but then quickly announcing a series of significant policies.

Admittedly, the media’s coverage of the prime minister’s statements exaggerated the degree to which this appeared inconsistent. For example, he also stated that “it’s not just the federal government that can solve this” and that housing is an area that the federal government “can and must help with.”

Nonetheless, communications could be clearer. Ultimately, the federal government needs to remain committed to improving the housing situation but must leave ample space for the provinces to lead.

Second, Canada could learn from positive examples of intergovernmental collaboration from abroad. In Australia, a National Housing Accord was recently signed to “align for the first time the efforts of all levels of government, institutional investors and the construction sector to help tackle the nation’s housing problem.”

Let’s stop calling it a housing crisis

Ottawa picked the dicey road to lower rents; Quebec is right not to follow

Advancing a Team Canada approach to housing

In Canada, there is an intergovernmental housing forum. But whereas the Australian accord presents a detailed and specific action plan, including clear commitments for national and sub-national governments, the outcome of the most recent Canadian forum was largely vague, with only this statement issued: “Ministers agreed to work together to better align supportive housing and homelessness programs and explore further solutions.”

Third, for existing policies, the federal government should at least encourage provincial partnership. This is well underway for the GST rebate because the provinces have been encouraged to follow suit. However, the accelerator fund omits the provinces by design; its funds flow directly from the CMHC to municipalities. Provinces need to be kept in the loop to ensure housing actions are co-ordinated.

Canada is in the throes of a housing crisis and it is no surprise that significant federal resources are being targeted to address this. But success requires genuine provincial leadership and the creation of housing that would not otherwise get built. As the political pressure mounts, cool heads are needed at the federal government to ensure that its schemes deliver value for money and avoid inadvertently crowding out provincial accountability.

David Jones is a policy analyst and economist. He is a fellow at the Canadian Centre for Health Economics, a Telus research fellow and is studying public policy at the Munk School of Global Affairs and Public Policy, University of Toronto. David Jones is a policy analyst and economist. He is a fellow at the Canadian Centre for Health Economics, a Telus research fellow and is studying public policy at the Munk School of Global Affairs and Public Policy, University of Toronto.

This article is part of a series called How does Canada fix the housing crisis?

By Alice Long By Alice Long

November 29th, 2023

BURLINGTON, ON

Two people, a lap top and a cell phone – gaming on different sites at the same time.

When it comes to entertainment, locals in Burlington have more than a few memorable activities at their fingertips. Between Toronto, Hamilton, and other neighbouring areas, there’s always a holiday, restaurant opening, or similar event on the horizon. In other words, it’s hard to get bored—even during the darker winter months.

But what about when Burlington locals choose to stay indoors? After all, not everyone is a social butterfly who enjoys scheduling all of their time with friends and family. It can be refreshing and rejuvenating to spend some time alone—and there are few better choices than passing the time alone than gaming.

For many Canadians, not just those in the greater Toronto and Hamilton area, casino games are a popular pastime. Compared to other countries, Canada has an open and vibrant virtual casino industry. That means that players have dozens of quality options to choose from when they decide to play a game of blackjack, roulette, or slots. Still, that doesn’t mean that every casino platform is built the same.

Let’s cover the top three features of Canada’s best online casinos.

Innovative Games, like Live Dealer Options

Let’s zero in on one of Canada’s most popular casinos, Wildz, to highlight what types of games Canadians should be seeking out. While every basic casino will offer table games like roulette and blackjack, only the most innovative platforms will focus on how these games are played. Live dealer games are relatively new casino games that use a live video link to stream a live dealer onto a remote player’s device.

Two people can enjoy gaming. This live dealer experience adds a dash of realism and even a social dimension to gaming. As one of the most popular new trends in casinos, it should be a feature you look for in your next casino. Keep in mind that certain platforms will push live dealer games into new territory. Wildz, the same example from above, also offers live dealer games like Football Studio. This game, from Evolution, adds a brand-new twist to traditional titles and hasn’t been seen before—which means you won’t find it at many online casinos.

A High-Value Loyalty Program

Some casino players mistakenly think that a loyalty program is only for those who play often. While loyalty programs are certainly geared to reward players who game more often, they deliver value to every single player. Whether or not you think that you’ll play blackjack or slots often, you can still learn about deals, bonuses, and other promotions when you sign up for a loyalty program.

In fact, some of the best casino providers on the market automatically sign-up players for loyalty programs. This makes it easier for casual players to start taking advantage of time-sensitive offers, holiday bonuses, and other deals that they wouldn’t normally hear about. If you’re unsure about a casino’s loyalty program, simply head to a trusted review platform such as Trustpilot—it’s often one of the features that reviewers zero in on.

Jackpot Slots & Jackpot Games

Jackpot wins have in the past payed out in the millions. A jackpot game is a slot that has maxed out its potential payout. (Though you’ll see ‘jackpot games’, these still refer to slots.) Usually, slot players are more focused on jackpots than blackjack or roulette fans, but if you ever plan on spinning the virtual wheel, it makes sense to register with casinos that offer these games. That’s because jackpot wins usually pay out in the millions.

Fixed jackpots are slots that include a fixed payout amount, meaning they will never venture higher than what developers set them at. Progressive jackpots, on the other hand, will continue to balloon in terms of their potential payout. That’s because the more players, the more the jackpot total grows with each bet. Some jackpots are ‘network jackpots’ and ‘local jackpots’, meaning the total payout grows according to local players or those within a virtual network.

By Pepper Parr By Pepper Parr

November 28th, 2023

BURLINGTON, ON

It was going to happen at some point and I suppose it made sense to do so at the point where a very difficult budget was passed by City Council.

As the meeting was nearing the end City Manager Tim Commisso indicated that he wanted to say a few words – but a Council member asked, on a point of order, if that was appropriate. Why a Council member who lives in one ward and represents a different ward would take such a position was beyond most council members.

Council was forced to hold a vote that required a three quarters of the council members to vote for it. That passed and Commisso got to speak.

Joan Ford: Thinking through questions when Staff used to hold “budget bazaars” He thanked Staff, was generous in his praise and said he wanted CFO Joan Ford to have the last word.

Joan, taking part virtually thanked her staff, naming each Team Leader and the individual staff members and then added: “this will be my last budget.”

I don’t know how man years Joan has been the CFO. When I first met her she was in the Finance department. The City had decided to part ways with the City Treasurer at the time and Joan was put in place, realizing very quickly that many of her staff we a lot smarter than she was.

Jeff Fielding was the city manager at the time and he worked with Joan to get her into a classroom and earn a designation that would qualify her more clearly for the job.

There was never any question is as to whether or not she could do the job – she was doing it.

I’ve forgotten how long it took for her to earn the designation, don’t recall what the designation was. Do recall the conversations we have over how hard she was finding the studying.

There were evening classes and the once a month weekend session when her staff, several who were half her age, would work with her on the assignments and get the course material completed.

When she had earned the designation she showed me the scroll that graduates are given. It was rolled up with an elastic around it.

“When are you going to have it framed” I asked. It looked is as if she wasn’t going to frame it and hang it up in her office.

I think Jeff Fielding arranged to have it framed and put up in her office.

Then Director of Finance Joan Ford. Joan Ford has served Burlington very well.

Several of the delegations complained about the 775 page plus budget binder that was prepared this year. Joan didn’t create that process – she did build on what came before her.

There will be significant changes made in the budget process – those tasks will be carried out by team Joan Ford mentored and grew.

Using the occasion to give Joan a Round of Applause the Mayor had to once again ask for a vote.

They never make it easy.

No word on exactly when Joan will leave her office – it is a well-earned retirement.

By Staff By Staff

November 28th, 2023

BURLINGTON, ON

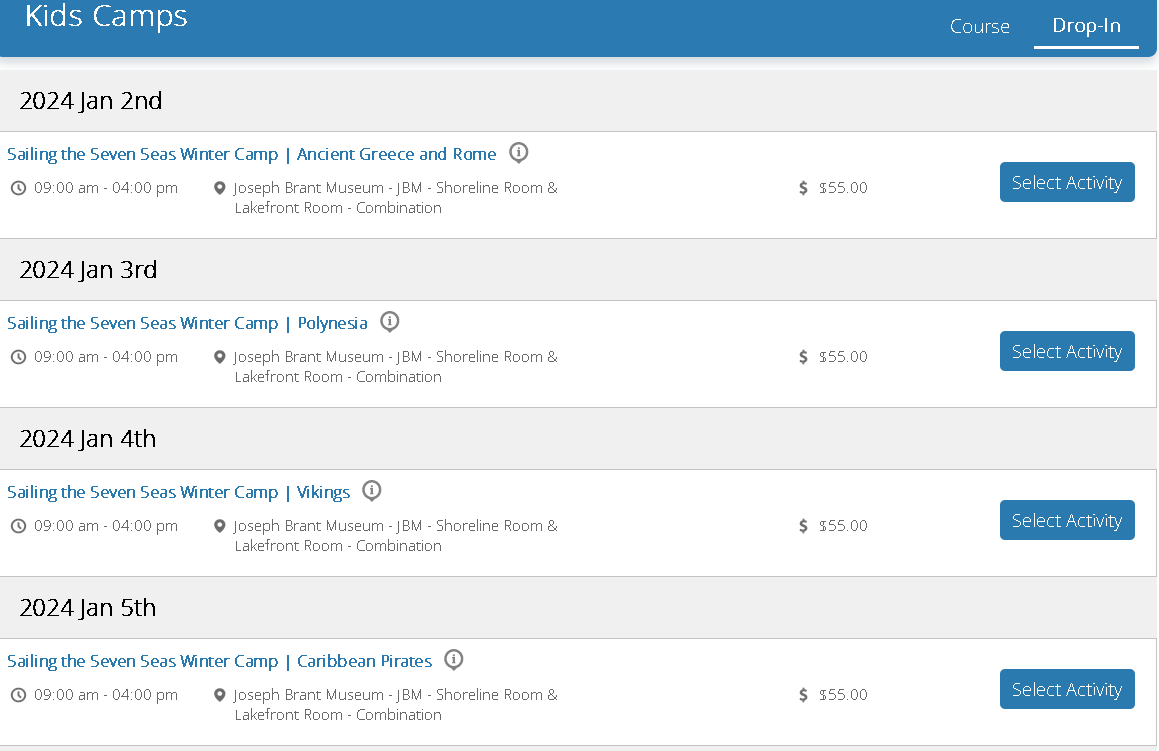

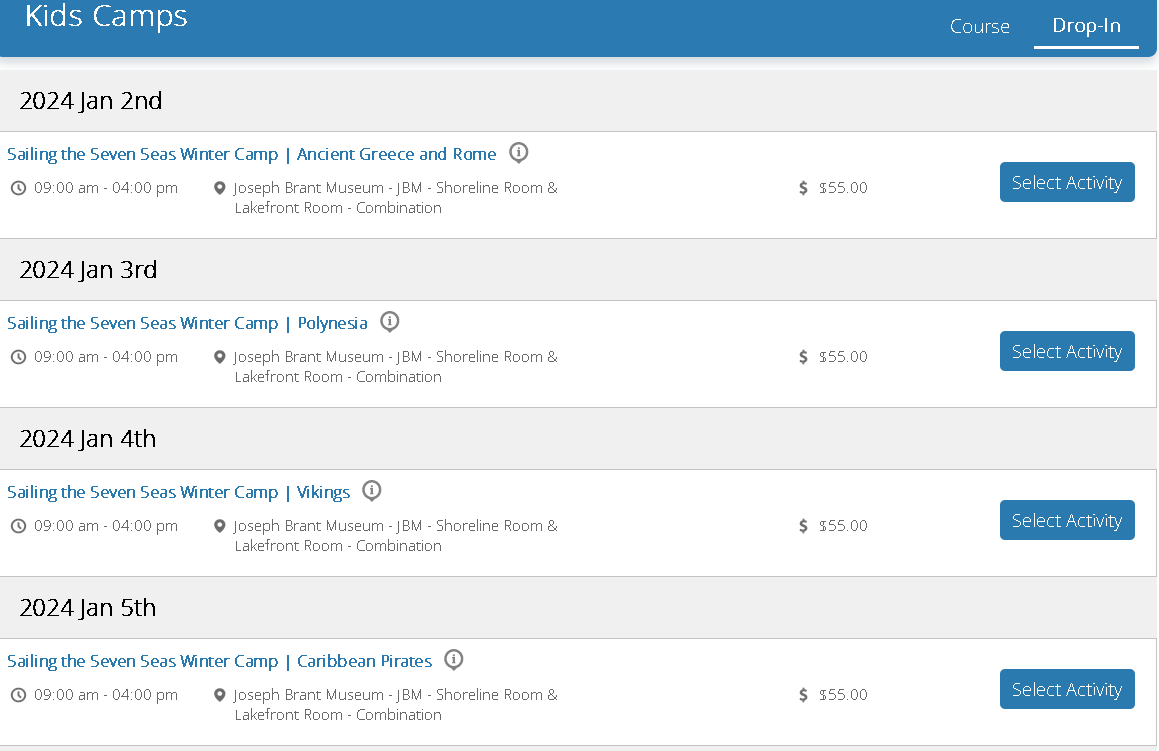

Winter Break Camp | Jan. 2 – 5 Winter Break Camp | Jan. 2 – 5

Camp runs January 2 – 5, from 9am – 4pm at Joseph Brant Museum.

The cost is $55/day, or $200 for the week. Museum members receive 10% off. Camp is designed for children between 5 – 12 years old. The theme is “Sailing the Seven Seas”. Campers will venture to classical civilizations, the Viking era, and the Polynesian islands!

Program list: Registration link below;

Click HERE to register

By Pepper Parr By Pepper Parr

November 28th, 2023

BURLINGTON, ON

They aren’t there yet – lot of juggling numbers and looking for ways to spend providing they can fund the money – somewhere.

Lori Jivan the Budget guru reports.

This Council is doing what it can to send a message to the people who pay the taxes – it is going to take more than this to recover from the anger that excellent delegators made clear – change the way you create the budget.

By Pepper Parr By Pepper Parr

November 28th, 2023

BURLINGTON, ON

Eric Stern’s last delegation raised the issue of whether the Mayor’s budget meets the Municipal Act requirements.

Eric Stern expects to delegate at City Council today. He might get a rough ride. Stern contends that expecting citizens to map the changes stated in the mayor’s proposed budget into the table on page 728 of the staff budget requires hours of work and does not meet the OMA’s (Ontario Municipal Act) requirement to state estimated expenses. By making this so complex the city has denied citizens the opportunity to easily review the budget.

It is also apparent that the mayor did not propose a budget but merely listed some changes to the city’s budget.

“This raises the issue of risk that some clever cookie will file a judicial review that the city budget is “ultra vires” i.e. without authority. A matter that the Burlington Ombudsman can decide if asked.”

While proven to be wrong on how she has interpreted the Strong Mayor Powers she has Mayor Meed Ward is sticking to her guns. Staff will merge the changes approved by council and issue an updated document and that will make the above sentence moot. I bet the updated document will be presented at the start of tomorrows meeting.

From what I have read the Ontario ombudsman will not repeal legislation that council has passed. Do we know if the Burlington Ombudsman has this power?

This has been the most challenged budget we have seen in the 12 years we have covered city council.

By Pepper Parr By Pepper Parr

November 28th, 2023

BURLINGTON, ON

The Mayor will be putting forward a Motion asking Council to:

Mayor Marianne Meed Ward will direct the CFO to draft operating and capital budgets for 2025 and 2026 as well. Endorse a Mayoral Direction to the Chief Financial Officer for the 2025 and 2026 budget years as follows:

-

Direct the Chief Financial Officer to prepare the draft operating and capital budgets for 2025 and 2026 whereby the city’s portion of the overall property tax increase is

not to exceed 99% of which approximately:

99% is for city services; and

1% is for city infrastructure renewal funding; and

That the draft budgets be provided to the Mayor in preparation of the Mayor’s Proposed Budget in each year

Background to 2024 Budget:

Under new provincial legislation, the Strong Mayors, Building Homes Act, 2022, introduced Nov. 23, 2022, and extended on July 1, 2023 to all municipalities that had already committed to a housing pledge, including Burlington, which unanimously committed to a housing pledge in March 2023, Mayors are now required to submit a budget for council review.

This responsibility cannot be delegated. Council has 30 days to amend the Mayor’s budget; the Mayor has 10 days to veto any amendments, and the Council has 15 days to issue and overrides to the veto, by 2/3 majority. At the end of this process, the budget is deemed to be approved. For the 2024 budget council deliberations are expected to conclude after council Nov. 28, and council will vote on whether to end the 30-day review period. I will not be exercising the ability to issue a veto, and will instead be issuing a mayoral decision at the end of council’s deliberations to end the veto period.

Once that is signed the budget will be deemed approved.

If the Mayor does not fulfill this obligation of preparing a budget by February 1 of a budget year, council can begin budget preparations at that time. However, it is not in the city or the community’s interest to wait, as we would not be able to take advantage of early procurement or preferred pricing by tendering projects months earlier. Waiting would cost the city, and residents, more, and risk being able to find bidders for capital projects.

Thus, the Mayor will work with staff, council and the community to prepare a budget by year end preceding each budget year (with the exception of an election year).

Planning for Budget 2025 and 2026

In fulfilling the obligation under the legislation to present a budget, the Mayor can provide direction to staff to prepare a budget.

There are a number of people who believe Sharman provided a lot more than support to the Mayor for her budget. Some believe has was the guiding force behind what was done. The Mayor does not need to seek council endorsement of any budget direction. However, she said: ” by way of this motion, I am doing so because of a continued commitment to collaborative and democratic team leadership and decision-making. I have consulted with and have the support of Councillor Paul Sharman, the Deputy Mayor of Strategy, Budgets, Process and Performance, in this approach and staff direction.”

As indicated, the Mayor will work closely with staff, council and the community to seek suggestions to improve the budget preparation and approval process and the manner in which we communicate the budget.

Direction for Tax Increase of 3.99%

“We are thus both seeking council’s endorsement for me to issue a Mayoral Direction to staff to prepare draft budgets such that the city’s portion of the overall tax increase is no more than 3.99%, including a separate dedicated infrastructure levy per year for the capital budget.

“Council has heard from thousands of residents during the 2024 budget deliberations, expressing concerns about affordability, inflation on basic items like groceries, and rising housing costs and interest rates. We have heard a range of perspectives about what the community would like us to do, from a zero tax rate increase or a tax cut, 3% tax increase up to 4 and 5% increase. We have also heard from residents supporting increased taxes. The GetInvolved budget survey commissioned by the city showed 55% of residents support a cut to services to maintain current taxes, or a cut to services to reduce taxes.

“Separately, the statistically valid community survey found that 57% of residents support increasing taxes to enhance services or to maintain services at current levels. This survey is considered an accurate predictor of the majority of Burlington residents, 95% of the time, within a range of 3% either way.

“Additionally, 91% of residents on the GetInvolved budget survey said that it was “somewhat important” or “important” to set aside funding to replace infrastructure, such as roads, to ensure they meet community needs now and into the future. The second part of the Mayor’s Direction responds to this feedback by separating out a dedicated infrastructure with a minimum 2% commitment each year.

“We must consider and balance all this input, as well as the long term financial sustainability of the city and all its services in preparing annual budgets, this one as well as future ones.

“We want residents to know we have heard them, and are working to respond to all the input we’ve received.

“The hope in providing this direction is to provide some predictability to staff and the community about future budgets, and respond to the request to keep the tax increases as low as possible.”

By Pepper Parr By Pepper Parr

November 27th, 2023

BURLINGTON, ON

There is a flicker to that flame that brought out a number of delegations that took Council to task on the way they were putting together the budget for 2024.

Vera Chapman, a recent delegator Eric Stern, Dan Chapman, Lydia Thomas and Vera Chapman are new to the Council Chamber podium. They are serving the citizens of the city exceptionally well.

We received a comment this morning that sets out what one of them thinks is wrong with the process and the way members of Council have found a way to become mute when it comes to how they behave when presented with the facts.

Said one of the delegators: “In terms of a “do over” on the budget I don’t know if that is a legislative requirement. I have to send my powerpoint in by noon today, someone will read it, notify the mayor, and then they will add an appendix to the budget book. The appendix will show revenue amounts by type of revenue and they will pass the budget. I don’t like this because they are hiding information from the public. Information that should have been available during the review process, but that is how this council operates. I don’t expect any change. Having the revenue by type in amounts will help with next year’s battle.

“The key point in MMWs twisted reasoning appears to be Burlington signed the housing pledge, therefor Burlington had to accept the strong mayor powers. So this needs to be refuted first.”

The Gazette has set out how the city managed to confuse the two pieces of legislation that were related to the creation of Strong Mayor Powers. So far they have ignored the legislation. An excerpt from that article is set out below.

Analysis of Regulatory Impact:

By amending this regulation, the strong mayor framework would apply to more municipalities. Currently the framework applies to two municipalities – the City of Toronto and City of Ottawa.

Local impacts will depend on how the heads of council (HOC) in designated municipalities choose to use these strong mayor powers and how the municipality will support the implementation of these powers and duties for the HOC.

There are no requirements in the regulations that would result in new administrative costs for municipalities. Municipalities may choose to update local processes and policies at any time, based on their local needs and circumstances.

Bill 3, sets out the Strong Mayor Powers for Toronto and Ottawa.

Bill 39 cover additional municipalities – includes Burlington

Bill 3: Strong Mayors, Building Homes Act, 2022

Bill 39: Better Municipal Governance Act, 2022

O. Reg. 530/22 – Municipal Act

|

|

By Pepper Parr

By Pepper Parr

The groundbreaking AI software, developed by Dr. Darren Burke and his team of experts, leverages the power of artificial intelligence, natural language processing (NLP), and machine learning to simulate complex clinical trials scenarios. Phase one developed for athletes, uses human physiological responses to predict how exercise interventions and supplement formulations would impact muscle strength, exercise recovery, hormone levels, weight loss and many more important variables.

The groundbreaking AI software, developed by Dr. Darren Burke and his team of experts, leverages the power of artificial intelligence, natural language processing (NLP), and machine learning to simulate complex clinical trials scenarios. Phase one developed for athletes, uses human physiological responses to predict how exercise interventions and supplement formulations would impact muscle strength, exercise recovery, hormone levels, weight loss and many more important variables.

By Georgia Cavalcanti

By Georgia Cavalcanti

At that point Councillor Kearns said: “If this goes forward, then we’ll be addressing the motion which is to endorse the staff direction at the Special Council meeting having given no opportunity for the public to have input or delegate on this endorsement. Is that correct?

At that point Councillor Kearns said: “If this goes forward, then we’ll be addressing the motion which is to endorse the staff direction at the Special Council meeting having given no opportunity for the public to have input or delegate on this endorsement. Is that correct?

By Pepper Parr

By Pepper Parr

By Pepper Parr

By Pepper Parr

The budget for 2024 is cast in stone.

The budget for 2024 is cast in stone.

Councillors Nisan and Kearns didn’t want to go along with this and suggested that the matter be sent to a Standing Committee meeting where the public would be able to comment.

Councillors Nisan and Kearns didn’t want to go along with this and suggested that the matter be sent to a Standing Committee meeting where the public would be able to comment. At today’s Special Council Meeting, Burlington City Council finalized the 2024 budget. Next year’s budget is focused on essentials, front line services and preparing for growth.

At today’s Special Council Meeting, Burlington City Council finalized the 2024 budget. Next year’s budget is focused on essentials, front line services and preparing for growth.

David Jones is a policy analyst and economist. He is a fellow at the Canadian Centre for Health Economics, a Telus research fellow and is studying public policy at the Munk School of Global Affairs and Public Policy, University of Toronto.

David Jones is a policy analyst and economist. He is a fellow at the Canadian Centre for Health Economics, a Telus research fellow and is studying public policy at the Munk School of Global Affairs and Public Policy, University of Toronto.

Winter Break Camp | Jan. 2 – 5

Winter Break Camp | Jan. 2 – 5