By Staff By Staff

November 22, 2023

BURLINGTON, ON

On the weekend of November 25-26, Lakeshore West rail service will be modified as follows:

Service will be modified for two weekend days. Saturday, November 25:

- Trains will run every half-hour between Union Station and Oakville GO and hourly service between Oakville GO and West Harbour GO all day in both directions.

- Some eastbound and westbound trip times will be adjusted with some trains departing up to four minutes earlier.

Sunday, November 26:

We have created a special schedule to accommodate customers travelling to and from the Toronto Santa Clause parade that will also ensure our crews can perform work safely.

- Trains will run every half hour between Union Station and Oakville GO all day.

- Between approximately 11a.m. – 4:30p.m., there will be hourly service between Oakville GO and Aldershot GO.

- Some trips will be adjusted, with some trains departing up to 2 minutes earlier.

Niagara Falls trips will also be adjusted over the weekend, please plan ahead on our website to view up to date schedules for your trip.

Regular service will resume on Monday, November 27.

Riders are encouraged to use gotransit.com or triplinx.ca to plan their trips as schedules and connection times have changed for this weekend. Customers can also check the GO Transit Service Updates page for real-time details.

By Pepper Parr By Pepper Parr

November 22, 2023

BURLINGTON, ON

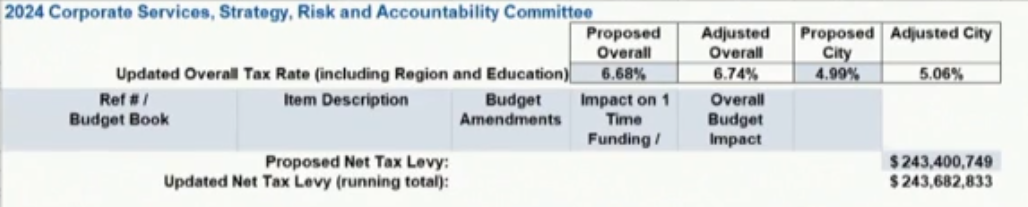

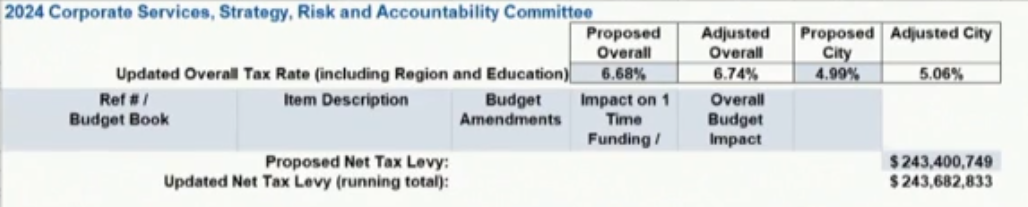

After a twelve hour session during which Motions were withdrawn or deferred Council reported on what they had achieved. It was a 5.06% increase for the city’s portion; the blended rate came in at 6.74%.

But they weren’t done.

They will be back at it on Thursday when they expect to complete the budgeting exercise.

Chief Information Officer Chad Macdonald For a bunch of important technical reasons the tax recommendation is expected to go to City Council on November 28th.

Mayor Meed Ward lost one battle on a project she dearly wanted. She appeared to have lost track of what had been deferred and what had been withdrawn. It will be interesting to see how the Mayor manages the process to get the item back on.

There were a number of technical jobs that are going to go unfilled. There were three in particular that Chief Information Officer Chad Macdonald wanted but didn’t get.

Both he and City Manager were not happy.

Commisso gave it a shrug as he looked toward Macdonald

By Pepper Parr By Pepper Parr

November 21st, 2023

BURLINGTON, ON

To help with more housing options and supply throughout the City of Burlington, City Council approved a motion to declare its intention to allow four residential units per lot. This direction supports the City’s Housing Strategy to:

- help with a healthy supply of rental units and

- increase housing options.

This direction also builds on the City’s recent update to its Additional Residential Unit policies which now allow up to three residential units per urban residential lot. There will be community engagement on property criteria for ARUs and before more changes are made to the City’s Official Plan and Zoning Bylaw to allow up to four units.

What are Additional Residential Units (ARUs)?

Additional Residential Units are self-contained living units with their own kitchen, bathroom and sleeping areas. They are on the same property as a primary home, including single detached homes, semi-detached homes and townhouses. They can be inside or attached to a primary home, or in a separate accessory building like a detached garage. Examples of ARUs are basement apartments, attached suites, tiny homes and coach houses. The Additional Residential Units page provides details about how to apply for an ARU on your property.

Get Involved

Residents will be invited to join staff in their work to change policies and regulations to allow four units per lot. Staff will also consult with the public in their review of the existing standards in the City’s current zoning bylaw for ARUs. This may include what might be allowed for the height of accessory buildings with ARUs, such as detached garages, or parking space requirements.

Updates and opportunities to get involved in 2024 will be posted on the Housing Strategy Get Involved page.

Quick Facts

- In November 2022, The Government of Ontario passed Bill 23. This included changes to the Planning Act, allowing two Additional Residential Units (ARUs) on an urban residential lot with a detached house, semi-detached house or townhouse. Across Ontario, up to three residential units on a residential lot are now allowed.

- To comply with these provincial changes, the City updated its Official Plan and Zoning Bylaw Additional Residential Unit policies. These updates are in alignment with the City’s Housing Strategy.

- In the 2022 federal budget, the Government of Canada created the Housing Accelerator Fund to provide incentive funding to local governments encouraging initiatives aimed at increasing housing supply.

- In August 2023, the City of Burlington submitted its application to the Housing Accelerator Fund for approximately $40,000,000 and its approval is expected to be contingent on allowing four units-as-of-right on residential lots.

Burlington Mayor Marianne Meed Ward: “Burlington City Council unanimously voted to allow four units as-of-right on any residential property. This is key to adding much-needed housing in our community. We know the City of Burlington has a role and opportunity to address providing affordable and attainable homes, and a wider variety of housing types. Our first ever Housing Strategy, released last June, emphasizes this commitment to realize our housing goals of 29,000 units by 2031. Allowing four units as-of-right will be pivotal in adding much-needed housing in our community through sensible development and growth.

“We will create a made-in Burlington solution to accommodate these units in an appropriate way in our city, with consultation with our community. Everyone who wants to live in Burlington deserves a safe and affordable place to call home.”

Links and Resources

Additional Residential Units

Report PL-53-23

Housing Strategy Get Involved page

Housing Strategy

City Council Motion

By Pepper Parr By Pepper Parr

November 21st, 2023

BURLINGTON, ON

At 1:10 PM – Council is close to totally confused.

The only thing we have learned after lunch is that the increase will be 6.68% – increase was due to a new budget from the Regional government.

Mayor Meed Ward Photo from Gazette photo library The Mayor has just asked if there was a benefit to delaying the whole budget process to February, CFO Ford said that there was a benefit to setting a budget in order to get lower construction and supply costs.

If this keeps on going to way it has been going – there is going to be little in the way of satisfaction from the public. Understanding what Council is doing will be a challenge.

By Pepper Parr By Pepper Parr

November 21st, 2023

BURLINGTON, ON

Ann Marsden, a frequent delegator at City Council meeting was blunt and direct when she said:

Our delegation today means doing our best to ensure citizens of Burlington can access a budget process that meets all and we mean all the legislated requirements. It is after all, our budget, not the Mayor’s Strong Powers budget and not councils, and certainly not staffs, many of whom likely can’t afford to live in Burlington or hit traffic such as we now have an A grateful to get back to their communities.

We thought, but we’re obviously mistaken, that both the mayor and us we’re on the same page pre-election. No Strong Powers simply a strong council would set the budget. Bearing in mind taxpayers are at a breaking point when it comes to income versus expenses. No matter how carefully they have planned their family budget, something we are sure you will be hearing more about this morning from other delegates less fortunate than ourselves.

Many of us have expressed our opinions that the mayor’s position that she has no choice in following the strong mayor process for this budget is pure spin and not in line with transparency requirements. We don’t believe this is any way to get the community’s confidence when dealing with its very confusing process or that this process is better than what we had or will see effective decision making.

That is in the best interests of the community. We believe the mayor to be acting in accordance with we believe the man to be acting in accordance with legislation and the City of Burlington Code of Conduct must set the record straight that this budget and the ridiculous increase is her choice and not a requirement of the provincial government as she has so often stated.

Without their admission this process is not a process that will meet the needs of best interests of this city, we can guarantee there will be no appeasing those who believe transparency and public engagement are legislated requirements of the process.

We’re only going to make one comment on the budget change from Councillor Nisan.

In this financial environment I cannot understand why he would want to take $38,000 for a community garden program out of this budget.

The number of delegations alone should tell this committee that this community has had enough of the tax increases and will continue their support of those like Eric Stern and Lydia Thomas, who will be speaking today. Both, along with Wendy the petition organizer, have tried to make you understand – enough is enough.

You need to take an entirely different view of what taxpayers can and cannot afford to remain in their homes. Thank you for your attention to those of us who have captured we believe the majority public opinion which we believe you must be guided by is a true 0% city tax increase. Thank you very much for your time.

Councillor Sherman: First question I have is with respect to the strong mayor requirements of the province that has been placed on mayors around the province. Do you agree with the provinces decision that they should give strong their powers?

Marsden: I think the question is misleading. There is no requirement to have a strong mayor powers. The government offered them to those who wish to receive them and use them. Many municipalities, as you know, have turned them down. They said they will have nothing to do with strong powers. They want a strong counsel.

Sharman: I will ask Staff if your interpretation is correct.

Sharman: Are you suggesting that this council make that kind of decision that we’re going to cut off service to certain qualified people?

Marsden: No, I’m not.

Marsden was cut off before she could complete her answer.

By Pepper Parr By Pepper Parr

November 21st, 2023

BURLINGTON, ON

The Corporate Services, Strategy, Risk and Accountability Budget Committee Meeting that lifts off at 9:30 this morning will hear 10 people delegating on the budget. Based on the comments we are seeing in the Gazette this should be interesting.

We will report in depth on all of them.

There are also 50 pieces of correspondence on the 2024 Budget Review – that people will not hear and we suspect very few will take the time to dig into the web site and read letters written.

We wonder how many members of Council have taken the time to get the funny bone ticked and read what the people of the city have to say.

In the 12 years we have been covering city council we have never seen anything like this.

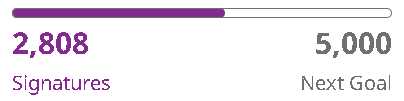

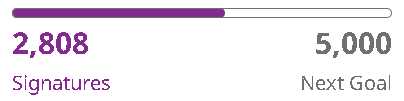

There are now 2898 signatures on the citizen based petition.

It will take some time to work through all the correspondence. Taken at random:

I oppose the 2024 tax increase. We believe there are many things in this budget that are not necessities and not required on an emergency basis.

It appears that this City government is spending money unnecessarily and it seems foolish given the fact that many can’t afford food, mortgage payments, utilities, etc. The spending should be much more controlled considering the economic climate we’re currently in.

Many things in our opinion should be scrapped or left for another more prosperous time.

Smart spending and no fluff.

There is something going on out there.

And if you are interested – the city is doing a Zoom on what would you like to see done with Civic Square.

Public engagement opportunities

By Staff By Staff

November 20th, 2023

BURLINGTON, ON

Oanh Kasperski is the new Director of Corporate Communications and Engagement.

With over 20 years of experience in communications and engagement leadership, Oanh has a proven track record of building strong reputations and fostering collaborative relationships. With over 20 years of experience in communications and engagement leadership, Oanh has a proven track record of building strong reputations and fostering collaborative relationships.

Oanh’s most recent role was the Director of Marketing and Brand at the University of Waterloo. Her experience also extends to previous leadership roles at McMaster University, CBC, and Seneca College.

In her various roles, Oanh has provided strategic advice and leadership on communications and stakeholder engagement. This experience will be an asset for the City’s commitment to excellence in communications and engagement and strengthening community relationships.

Oanh will start in the role on December 11, 2023.

By Staff By Staff

November 20th, 2023

BURLINGTON, ON

On November 2nd, a new report, At what Cost? Ontario hospital privatization and the threat to public health care confirmed the negative impact of the Ford government’s plans on Ontario’s public hospitals and patients.

Report author Andrew Longhurst of the Canadian Centre for Policy Alternatives (CCPA) rebuts the government’s rationale for privatization by showing that sufficient funding for public hospitals can significantly improve surgical backlogs.

Among the report’s startling revelations is the massive difference in stated government expenditures on private clinics versus the actual spending.

Days after the report was published, we learned that former Health Minister Christine Elliott, who gave private clinic Don Mills Surgical Unit a 278% funding increase while she was minister, is now a lobbyist for the clinic’s parent company, Clearpoint Health Network. Her official registration says her lobbying goals are to “engage the government in updating and increasing the base funding amount available to Clearpoint.” Days after the report was published, we learned that former Health Minister Christine Elliott, who gave private clinic Don Mills Surgical Unit a 278% funding increase while she was minister, is now a lobbyist for the clinic’s parent company, Clearpoint Health Network. Her official registration says her lobbying goals are to “engage the government in updating and increasing the base funding amount available to Clearpoint.”

A CBC investigation found that procedures at Don Mills Surgical are paid for by the government at double or triple the cost of procedures performed in public hospitals. These findings are the tip of the iceberg of the lack of accountability, higher costs, corruption and profiteering that the Ford government is unleashing with Bill 60.

The Ontario Health Coalition is holding an on-line forum on Tuesday November 28th at 7 pm eastern

If you are interested Please register and fill in the information here (you will receive the Zoom link by email after you register):

https://us06web.zoom.us/meeting/register/tZEpdemrrzwtHNL1RXFYd_uZv7woAZRskSPf

Join them for this forum to hear from researchers and advocates about how Ford’s reckless policies can be exposed and defeated.

- Andrew Longhurst, research associate, Canadian Centre for Policy Alternatives; author of the recently published report, ‘At What Cost? Ontario hospital privatization and the threat to health care‘

- Pam Parks, nurse, co-chair, Durham Health Coalition

- Kevin Skerrett, Ottawa Health Coalition

- Natalie Mehra, executive director, Ontario Health Coalition

Co-Sponsored by: Brampton-Caledon Health Coalition, Durham Health Coalition, Grey-Bruce Health Coalition, Halton Health Coalition, Hamilton Health Coalition, Kingston Health Coalition, London Health Coalition, Mississauga Health Coalition, North Bay Health Coalition, Ottawa Health Coalition, Oxford Coalition for Social Justice, Peterborough Health Coalition, Port Dover Health Coalition, Renfrew County Health Coalition, Simcoe Health Coalition, Waterloo Health Coalition.

By Pepper Parr By Pepper Parr

November 20th, 2023

BURLINGTON, ONTARIO

Tidbit of information we came across.

The subject matter was AI Artificial Intelligence;

“Banks, for all their usual moaning about regulation, would be nowhere without legal requirements that they keep years of detailed customer records. “We’ve got 17 million clients, and I’ve got 16 petabytes of data,” says Martin Wildberger, executive vice president of innovation and technology at Royal Bank Canada, the country’s largest bank. “Banks, for all their usual moaning about regulation, would be nowhere without legal requirements that they keep years of detailed customer records. “We’ve got 17 million clients, and I’ve got 16 petabytes of data,” says Martin Wildberger, executive vice president of innovation and technology at Royal Bank Canada, the country’s largest bank.

“Sixteen petabytes is roughly equivalent to 320 million tall filing cabinets stuffed with paper. It’s what allowed Wildberger’s team to create a model so deep it can show RBC the tiny variations in customer behavior that might signify fraud.

“An executive at another big bank told me his model can send an alert when a customer who frequently eats vegetarian charges a meal at a steakhouse.”

How does that make you feel about your personal privacy? Think about that for a minute.

By Pepper Parr By Pepper Parr

November 20th, 2023

BURLINGTON, ON

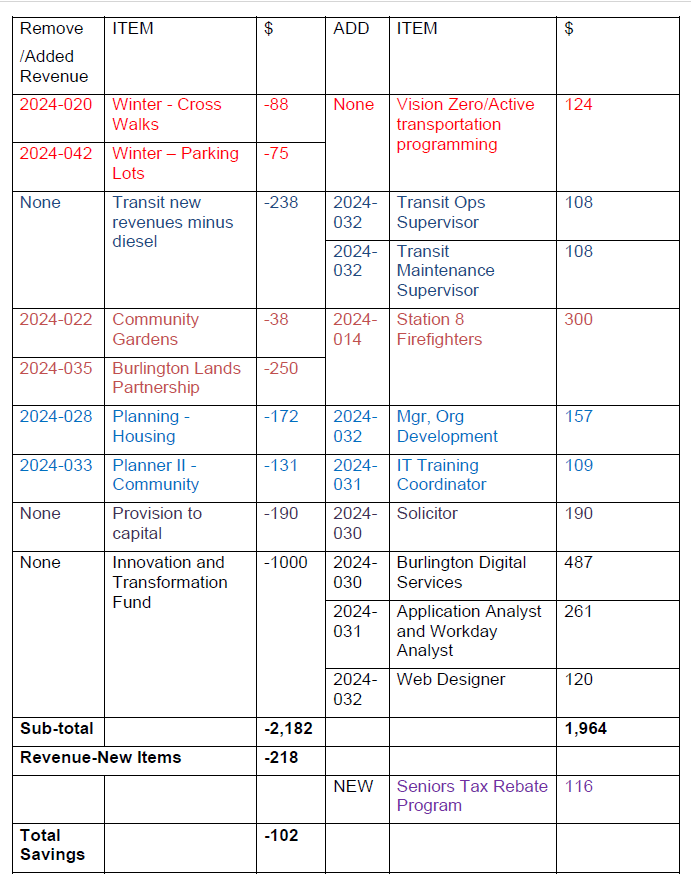

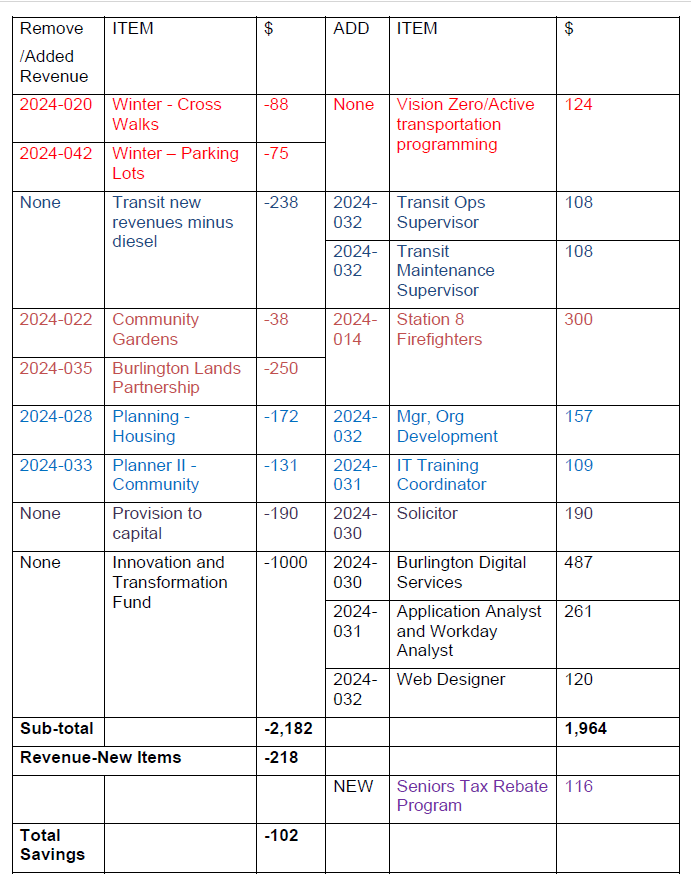

Rory Nisan Councillor for ward 3 – submits 19 motions. The following are the 19 Motions to amend the Mayor’s Budget submitted by Ward 3 Councillor Rory Nisan.

Motion for Council to Consider:

Consider a package of amendments to maintain the reduced tax rate of 4.99% while funding top and high priority positions.

Reason:

Below is a summary table of amendments I am putting forward. Together they represent a rationalizing of proposed FTEs while maintain the tax rate at the 4.99% as proposed by the mayor.

Financial Matters:

Although these amendments do not need to be approved as a package, I am prioritizing the need to maintain the tax rate at 4.99% while funding key positions not currently funded in the mayor’s budget but recently identified as higher priorities. Items below are listed in the thousands.

Motion Seconded by: Not Required Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add 2024-032 – Manager Organizational Development ($157,373) to 2024 budget, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

While this is a very challenging budget, the above position has been identified as a top priority by staff.

Financial Matters:

This item is recommended to be included in the budget through savings found elsewhere so that the tax rate is not increased. Specifically, I suggest redeploying savings from cutting 2024-022 (Expansion and Customer Experience in Community Gardens) and 2024-035 (Burlington Lands Partnership 1.75 FTE) to fund this position. These positions were identified as medium priority.

Motion Seconded by: Not Required Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none City Manager: none

Motion for Council to Consider:

Add 2024-014 – Station 8 Firefighters – Year 2 ($301,419) to the 2024 budget, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

While this is a very challenging budget, the above positions have been identified as a high priority by staff and by approving four positions rather than two we can significantly increase the life-saving coverage provided by the Fire Department.

Financial Matters:

This item is recommended to be included in the budget through saving found elsewhere so that the tax rate is not increased. Specifically, I suggest redeploying savings from 2024-28 (Community Planning Housing Initiative-Housing Strategy) and 2024-33 (Planner II-Community Initiatives) to fund this position. These positions were identified as medium priority.

Comments:

City Clerk: none City Manager: none

Motion for Council to Consider:

Remove 2024-020 – Winter Maintenance – School Cross Walks ($88,000) from the 2024 Budget and request that the Mayor consider inclusion of this item in the 2025 Budget.

Reason:

To deliver a tax rate residents can afford, some difficult choices must be made. As important as an enhanced maintenance of school cross walks may be, this motion defers the expenditure to 2025 budget, allowing a lower tax impact to the community.

Financial Matters:

Savings from deferring this item, as well as savings from deferring 2024-042 (Winter Maintenance – Expanded Parking Lots) may be redeployed to fund Vision Zero programming position while maintaining a tax rate of 4.99% for the city portion.

Regardless of whether the Vision Zero position is funded, I recommend deferring the item.

Comments:

City Clerk: none City Manager: none

Motion for Council to Consider:

Remove 2024-022 – Expansion and Customer Experience in Community Gardens ($38,200) from the 2024 Budget and request that the Mayor consider inclusion of this item in the 2025 Budget.

Reason:

To deliver a tax rate residents can afford, some difficult choices must be made. While the community garden program is important, this motion defers the expenditure to 2025 budget, allowing a lower tax impact to the community. I suggest a relook at the program considering the cost per garden plot and ongoing demand.

Financial Matters:

Savings from deferring this item, as well as savings from deferring the 1.75 FTEs included in 2024-035 (Burlington Lands Partnership) may be redeployed to fund two FTEs identified as top priorities: 2024-031 (Enterprise Business Services Support – Workday/EAMS Training Coordinator) and 2024-032 (Manager Organizational Development) while maintaining a tax rate of 4.99% for the city portion. Regardless of whether these top priority positions are funded, I recommend deferring the item.

Motion Seconded by: Not Required

Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Remove 2024-028 – Community Planning Housing Initiative ($172,414) from the 2024 Budget and request that the Mayor consider inclusion of this item in the 2025 Budget.

Reason:

To deliver a tax rate residents can afford, some difficult choices must be made. While bolstering the housing initiative is important, this motion defers the expenditure to 2025 budget, allowing a lower tax impact to the community. This position was noted as a medium priority, and significant investments are being made in the 2024 budget that will promote the housing file (e.g. 2024-036 – Permit and Application Streamlining).

Financial Matters:

Savings from deferring this item, as well as savings from deferring 2024-033 (Planner II – Community Initiatives) may be redeployed to fully fund 2024-014 (Station 8 Firefighters – year 2), a high priority, while maintaining a tax rate of 4.99% for the city portion. Regardless of whether these high priority positions are funded, I recommend deferring the item.

Motion Seconded by: Not Required Share with Senior Staff þ

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add Solicitor – General Litigation, Municipal Law, Insurance Practice (2024-030) for $190,512 to the 2024 budget offset by a recovery from the capital program.

Reason:

While this is a very challenging budget, the above position has been identified as a high priority by staff and can be funded by savings on capital projects that will no longer require outside legal counsel to the same degree.

Financial Matters:

This item is recommended to be included in the budget through savings found elsewhere so that the tax rate is not increased. Specifically, as this position will create savings by no longer needing to depend on outside counsel to the same extent, it is suggested that the financing be funded through a recovery to capital. Doing so will not result in fewer capital projects being completed.

Motion Seconded by: Not Required Share with Senior Staff þ

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: one

City Manager: none

Motion for Council to Consider:

Add 3 positions (Data Engineer, Manager of Experience Strategy and Design, and M365 Product Manager) in 2024-030 – Burlington Digital Service ($486,569) to 2024 budget, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

This motion does not include the solicitor role which is included in separate case due to being funded from capital.

While this is a very challenging budget, the above positions have been identified as a high priority by staff.

Financial Matters:

This item is recommended to be included in the budget through savings found elsewhere so that the tax rate is not increased. Specifically, I have another amendment to remove the $1M provision to the Innovation and Transformation reserve fund.

- Deliver customer centric services with a focus on efficiency and technology transformation

Motion Seconded by: Not Required

Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add 2024-031 – Enterprise Business Services Support – Workday/EAMS Training Coordinator ($109,220) to 2024 budget, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

While this is a very challenging budget, the above position has been identified as a top priority by staff.

Financial Matters:

This item is recommended to be included in the budget through saving found elsewhere so that the tax rate is not increased. Specifically, I suggest redeploying savings from cutting 2024-022 (Expansion and Customer Experience in Community Gardens) and 2024-035 (Burlington Lands Partnership 1.75 FTE) to fund this position. These positions were identified as medium priority.

Motion Seconded by: Not Required

Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add 2024-031 – Application Analyst Workday / EAMS ($136,391) and Workday Analyst ($124,512) subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

This motion does not include the solicitor role which is included in separate case due to being funded from capital.

While this is a very challenging budget, the above positions have been identified as a high priority by staff.

Financial Matters:

This item is recommended to be included in the budget through savings found elsewhere so that the tax rate is not increased. Specifically, I have another amendment to remove the $1M provision to the Innovation and Transformation reserve fund.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add 2024-032 – Transit Maintenance Supervisor ($108,470) to 2024 budget, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

Funding more buses and drivers means, eventually, support positions must also be funded as part of the expansion of the service. Funding a transit maintenance supervisor will ensure safety of the mechanics and other employees, and improve the overall maintenance of the busses, improving the public transit system.

Financial Matters:

This item is recommended to be included in the budget through saving found elsewhere so that the tax rate is not increased. Specifically, I suggest redeploying savings from increased revenue assumptions to transit to fund this position.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add 2024-032 – Transit Operations Supervisor ($108,470) to 2024 budget, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

Funding more buses and drivers means, eventually, support positions must also be funded as part of the expansion of the service. Funding a transit operations supervisor will improve safety of drivers and riders on the road and improve the overall system.

Financial Matters:

This item is recommended to be included in the budget through saving found elsewhere so that the tax rate is not increased. Specifically, I suggest redeploying savings from increased revenue assumptions to transit to fund this position.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add 2024-032 Web Designer ($119,562) to 2024 budget, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

While this is a very challenging budget, the above position has been identified as a high priority by staff.

Financial Matters:

This item is recommended to be included in the budget through savings found elsewhere so that the tax rate is not increased. Specifically, I have another amendment to remove the $1M provision to the Innovation and Transformation reserve fund.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Remove 2024-033 – Planner II – Community Initiatives ($130,906) from the 2024 Budget and request that the Mayor consider inclusion of this item in the 2025 Budget.

Reason:

To deliver a tax rate residents can afford, some difficult choices must be made. While bolstering the planning department is important, this motion defers the expenditure to 2025 budget, allowing a lower tax impact to the community. This position was noted as a medium priority, and significant investments are being made in the 2024 budget that will promote the housing file (e.g. 2024-036 – Permit and Application Streamlining).

Financial Matters:

Savings from deferring this item, as well as savings from deferring 2024-028 – (Community Planning Housing Initiative) may be redeployed to fully fund 2024-014 (Station 8 Firefighters – year 2), a high priority, while maintaining a tax rate of 4.99% for the city portion. Regardless of whether these high priority positions are funded, I recommend deferring the item.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Reduce the 2024-035 – Burlington Lands Partnership item by the 1.75 FTEs ($250,000) in the 2024 Budget and request that the Mayor consider inclusion of this item in the 2025 Budget.

Reason:

To deliver a tax rate residents can afford, some difficult choices must be made. While the Burlington Lands Partnership is important, this motion defers the expenditure to 2025 budget, allowing a lower tax impact to the community. The $200K purchased services are not included in the deferral and proposed to remain in the budget.

Financial Matters:

Savings from deferring this item, as well as savings from deferring 2024-022 (Expansion and Customer Experience in Community Gardens) may be redeployed to fund two FTEs identified as top priorities: 2024-031 (Enterprise Business Services Support – Workday/EAMS Training Coordinator) and 2024-032 (Manager Organizational Development) while maintaining a tax rate of 4.99% for the city portion. Regardless of whether these top priority positions are funded, I recommend deferring the item.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Remove 2024-042 – Winter Maintenance-Expanded Parking Lots ($75,000) from the 2024 budget and request that the Mayor consider inclusion of this item in the 2025 budget.

Reason:

To deliver a tax rate residents can afford, some difficult choices must be made. While plowing more parking lots is important, this motion defers the expenditure to 2025 budget, allowing a lower tax impact to the community.

Financial Matters:

Savings from deferring this item, as well as savings from deferring 2024-020 (Winter Maintenance – School Cross Walks) may be redeployed to fund the Vision Zero programming position while maintaining a tax rate of 4.99% for the city portion.

Regardless of whether the Vision Zero position is funded, I recommend deferring the item.

Motion Seconded by: Not Required Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add Vision Zero / Active Transportation programming position ($124,129) to 2024 budget, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

The Integrated Mobility Plan has been unanimously supported by committee and is an on-the-ground transportation reality going forward.

A Vision Zero plan has been a priority for council since at least 2019 when it was referenced in our Vision to Focus strategic plan. Recent tragedies on our roads reinforce the need to accelerate our work to make our roads safe for all. Active Transportation Coordination is critical to the Vision Zero plan. Approved plans need to be operationalized with sufficient funding.

Financial Matters:

This item is recommended to be included in the budget through saving found elsewhere so that the tax rate is not increased. Specifically, I suggest redeploying savings from 2024-020 (Winter Maintenance – School Crosswalks) and 2024-42 (Winter Maintenance – Expanded Parking Lots) to fund this position.

Motion Seconded by: Not Required Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Remove the provision to Innovation and Transformation Fund ($1M) from the 2024 Budget and reduce 2024-036 Permit and Application Streamlining by $1M.

Reason:

To deliver a tax rate residents can afford, some difficult choices must be made. While the Innovation and Transformation Fund was developed with the right intentions, one of those was to reduce pressure on future year tax rates as a safety valve for strategic items. This has not worked out as expected as the financial needs tax rate is nearly as high as last year.

Financial Matters:

Savings from deferring this item may be redeployed to fund eight FTEs identified as top priorities: 2024-030 (Burlington Digital Services) 2024-031 (Application Analyst and Workday Analyst) and 2024-032 (Recruitment Coordinator and Web Designer) while maintaining a tax rate of 4.99% for the city portion.

Motion Seconded by: Not Required

Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Increase the Senior’s Tax Rebate from $575 to $837, increase the City’s provision to support this program by a further $116,000 and request that the Region of Halton continue to participate in the cost sharing of their portion of this program, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

Many residents are facing difficult decisions with their home budgets next year. The most vulnerable residents are low and fixed-income seniors who have little or no capacity to increase their income or reduce their already minimized expenses. The Low- Income Seniors Property Tax Rebate currently offers $550 per year to support this vulnerable community. Staff recommend an increase to $575 this year.

I recommend a rebate of $837. This will result in the average senior currently accessing the program receiving an increased rebate that mitigates the proposed 4.99% city tax increase. This is based on the average home value (CVA) of a qualifying senior currently in receipt of the program. The total cost to City to allow for the increase to

$837 is a further $116,000 in addition to the $150,000 currently budgeted for this program.

The Region of Halton and School Boards participate in the cost sharing of the current program. The rebate for the education component of the rebate is automatically shared by the School Boards. To note, I will be approaching the Region of Halton to seek their continued participation for their increase for their portion of the rebate to ensure full mitigation of the overall 2024 tax increase to Burlington residents accessing this program. Should the Region of Halton not continue to fully cost share in this program the amount of the Region’s share would be the responsibility of the City to fund requiring a further budget increase of $31,000.

These figures are based on the current number of residents in the program and does not account for additional participants.

More details on the program and eligibility requirements can be found at https://www.burlington.ca/en/property-taxes/low-income-seniors-property-tax- rebate.aspx

Financial Matters:

This item is recommended to be included in the budget through saving found elsewhere so that the tax rate is not increased. My overview document includes $218k in savings.

Motion Seconded by: Not Required

Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

By Staff By Staff

November 20th, 2023

BURLINGTON, ON

The Official Opposition NDP has tabled the Cleaning up Corruption Act as a step towards restoring ethics and accountability to Queen’s Park.

Leader of the Queen’s Park Opposition Marit Stiles “Ford’s Conservatives have eroded Ontarians’ trust in their government – from the Greenbelt grab to speculators buying tickets to Ford’s family functions to corrupt planning policies that benefit land speculators – the lack of accountability is stunning,” said Marit Stiles. “Ford repeatedly prioritizes the interests of wealthy insiders and land speculators over everyone else. I’m proud to be leading our Ontario NDP team as we restore trust and accountability to Queen’s Park.”

The Cleaning up Corruption Act will be debated on November 30.

“Ford has been taking advantage of the loopholes regarding preferential treatment in our integrity laws and putting the needs of his friends and wealthy insiders above everyone else,” said MPP Chris Glover, NDP critic for Democratic Reform. “With Doug Ford’s Conservatives under RCMP criminal investigation, it’s clear that our integrity laws need to be tightened. We need to put an end to Ford’s preferential treatment.”

Quick Facts:

The Cleaning up Corruption Act implements recommendations from the Auditor General (AG) and Integrity Commissioner (IC) to strengthen Ontario’s integrity laws, including:

- Empowering the IC to launch their own investigations, with expanded scope

- Strengthening the Member’s Integrity Act to prevent MPPs from acting in a way that furthers their own personal interest or could reasonably be perceived to further an individual’s personal interest, or that of their extended family

- Preventing preferential treatment by MPPs through the Members’ Integrity Act, a standard already in place at the federal level

- Amending the Auditor General Act to help the AG access information during an audit (Ford blocked the AG from accessing information in the audit of Laurentian University).

By Pepper Parr By Pepper Parr

November 19th, 2023

BURLINGTON, ON

Angelo Bentivegna Ward 6 Councillor Angelo Bentivegna submitted the following Motions to change the Budget Mayor Meed Ward presented to Council in October.

Motion for Council to Consider:

Remove item # 2024-037 Planning Development Services Organization Design including the one-time funding of $100,000 from the 2024 budget.

Reason:

The Provincial Government has not finalized the responsibility roles currently of Conservation Halton nor that of Halton Regions. The transition plan has not been outlined and there is no clear timeline moving forward.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Remove the Planner 2 position (Targeted Realignment of Burlington’s Official Plan # 2024-033) from the 2024 budget resulting in a reduction of $130,906 and continue to retain this position as over-complement on a contract basis.

Reason:

Planner 2 position area of responsibility is focused on area specific planning work for the city’s primary growth areas around our three Major Transit Go Stations. We have continuously discussed that developers have been reluctant to put shovels in the ground due to poor condo high-rise sales. Economists are predicting that these trends will continue in 2024.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Reduce the Burlington Lands Partnership item (# 2024-035) from $450,000 to $225,000 in the 2024 budget. Request that $225,000 of the $238,000 of net savings identified in Transit from additional budgeted fare and shelter advertising revenues less increased diesel expenses be applied to support BLP.

Reason:

Council has been supported of BLP and it’s progress these past few years. It is anticipated that these activities will continue to progress in the future. Without having a continuous source for funding, BLP programs will not be able to fulfill the goals it was intended to accomplish. We will need to make some difficult decisions and look for opportunities to re-distribute funding resources that will advance our future needs.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Reduce the Bateman Phase 1 Operating costs of $512,000 to $256,000 in the 2024 budget resulting in a reduction of $256,000.

Reason:

Bateman’s target Phase 1 opening (UoB) is slated for September 2024. I’m unclear why

$512,000 will be needed for operations in 2024 knowing that only Brock University will be the tenant. Therefore, I am suggestion that conservatively 50% of the operating funding cost be removed.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Remove the 1 By-law Licensing Clerk position (2024-027) from the 2024 budget resulting in a reduction of $92,940.

Reason:

2023 Budget was set up to stabilize operations by centralizing service department for bylaw matters. Additionally, to implement Customer Service Management and an Administrative Penalty System. The APS progress will be reported in 2024. Once implemented this initiative will allow staff to collect violations funds quicker, adding a main revenue source for the department. Business licensing is another area of revenue for this department. Various business data is available from numerous agencies to ensure that business who are required be licensed to operate are actually paying their fair share. Presently only about 1100 business are registered and a number of them have not paid for their license to operate. Collecting the funds outstanding would reduce the dependency to raise taxes.

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Remove the One Brand project (#2024-039) including the one-time funding of $150,000 from the 2024 budget and request that staff complete the project using existing internal resources, citizen advisory committees and other stakeholders.

Reason:

The “One Brand” story was created in 2002. Since then, much has changed. Having said that, our city is going through the biggest change that we at the present time due to changes downloaded from the federal and provincial governments. Other than knowing our growth targets at the present times, there are numerous uncertainties. As mentioned previously in committee workshop, perhaps we need to engage with citizens, businesses, and other stakeholders first to determine what their thoughts on what Burlington should and will become.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none City Manager: none

Motion for Council to Consider:

Remove Performance Management Phase 1 (#2024-038) including the one-time funding of $100,000 from the 2024 budget.

Reason:

The Financial needs Multiyear Forecast Binder ( Pg 117) says.

“Phase 1 is intended to include non-union staff training, system configuration, that will result in implementing individual goal setting, tied to the strategic Plan, Department Workplans, and individual targets.”.

My concern is what is the timetable for phase 1. What is expected in phase 2 and at what cost?

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Remove the business case for Winter Maintenance – School Crosswalks (#2024-020) from the 2024 budget resulting in a reduction of $88,000.

Reason:

Sidewalks are presently cleared in and around school crossing areas. Trying to coordinate school bell times with clearing school walks can be a scheduling nightmare. I have not heard a single complaint from any resident in Ward 6 since I’ve been a Councillor. This appears to me that these school cross walks will be cleared twice….once at school bell times, and again when the regular sidewalk plow drives by to clear the same sidewalk up the street. This is a “Nice to Have”

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Reduce Skyway Arena Operating Costs from $ 646,000 to $ 215,332 for the 2024 Budget to reflect four (4) months operating costs vs twelve (12).

Reason:

Skyway will not be open until the Fall of 2025 (September?)

The reduction amount was calculated by removing the funding allocation from January to August. The annual $646,000 amount allocated for operations and divided by 12 months equaling $53,833 to operate per month. Using September 2024 anticipated opening the amount for four (4) months amounts to $269,167.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: one

City Manager: none

Motion for Council to Consider:

Approve the Transportation Planning Staff (#2024-023) to be funded from Planning Application fees but defer the hiring of these positions until Planning Application volumes and associated revenues have recovered from current levels.

Reason:

Concerns about fee funded options, subject to bounce back of planning application moving forward. Concerns that if there is not enough activity development-wise- funding will need to come from Reserves.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Remove Urban Forestry Service Adjustment (# 2024-021) from the 2024 budget resulting in a reduction of $120,000.

Reason:

This budget item ask is to cover operational expenses due to insufficient funding in the base budget to maintain a 7-year cycle for preventive tree maintenance as per approved level of service.

Do we need to have a discussion about investigating new criteria or service levels in the future. Do all areas of the city need a 7-year cycle. Some city areas have less trees and are less dense than others.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Remove Vision 2050 project (2024-040) including the one-time funding of $150,000 from the 2024 budget and request that staff complete the project using existing internal resources, citizen advisory committees and other stakeholders.

Reason:

Council has set the vision and there has been some shared uncertainty on this topic.

In a previous amendment I removed “One Brand” from the 2024 budget stating that we would be better served at this time by engaging with residents, businesses and other stakeholders. I believe the same is true with respect to “Vision 2050”

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Remove item Winter Maintenance Expanded Parking Lots (#2024-042) from the 2024 budget resulting in a reduction of $75,000.

Reason:

These parking lots have not been cleared previously. They are not adjacent to recreation facilities, nor are they a short cut for students going to school. Have there been reports on risks occurring. Do we need more city trucks on the roads. This is a “Nice to Have”

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Reduce the total 2024 inflationary impacts identified in the 2024 budget from

$2,784,000 to $1,464,000 resulting in a reduction of $1,320,000.

Reason:

Although overall inflation for September was 3.8% the economists are predicting continued lower inflation for 2024 and possible recession. I am not aware what dollar values are of each contract assigned. What is the inflation value percentage-wise for each individual contract. Why was there an inflation factor negotiated?

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Remove the Manager of Housing Strategy position (Community Planning Housing Initiative #2024-028) from the 2024 budget resulting in a reduction of $172,414.

Reason:

Currently housing strategy discussions to date have been complex due to continuous legislated changes at the Provincial level. Developers have experienced financial pressures with interest hikes and softening of condo sales. These pressures are ongoing and will limit the opportunities to implement and administer without a clear understanding and direction of the province with respect to their role in legislation and available funding to Municipalities. I also would add that this Council has committed to create to a new citizen, stakeholders and Councillor lead committee to create a strategy that is a made in Burlington Housing Strategy. This Budget request position is premature currently.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Reduce the Permit and Application Streamlining business case (#2024-036) by 50% to

$1,140,000 and reduce the one-time funding accordingly in the 2024 budget.

Reason:

Reduce the use of “one-time funding” to begin implementation of program. Operationally this project will eventually enhance the organization ability to improve numerous aspects of our services, optimize workflow, and create efficiencies to achieve fee funding through accelerated permitting. This project should also see efficiencies that translate to a reduction in HR. These strategic initiatives cross all departments and effectively eliminate overlaps.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

By Dara Cruz By Dara Cruz

November 20th, 2023

BURLINGTON, ON

MMA, or Mixed Martial Arts, is a very exciting sport growing in popularity. The sport is a show of force and technique that is usually very fun to watch since it’s like a chess game where the athletes combine martial arts to try to take down the other athlete.

Of course, since MMA is a type of contact sport, it’s not a mystery that injuries are common. After all, it’s a sport where the other athlete tries to render the other athlete through strikes and grapples.

Over the years, we have witnessed countless injuries in the sport, both minor and major. We have even seen multiple deaths in the sport already. However, as brutal as it sounds, it remains one of the most popular fighting sports in today’s generation. That said, what are the most common injuries in MMA?

Head Trauma

An athlete wanting to knock out an opponent, usually goes for the head. This is perhaps the scariest type of injury in any fighting sport. As scary as it sounds, it’s also one of the most common. After all, if an athlete wants to knock out an opponent, they usually go for the head. That said, fighters often take precautions to ensure that their heads are always safe inside the ring to prevent being knocked out and avoid lasting damage that can complicate later in life.

Treatment for this kind of injury is often similar to how other injuries are treated, like surgery. However, the risks involved are often higher since the head is more delicate because it contains the brain. Not only that, but processing head injury is often a lot harder. Sometimes even, the symptoms of brain injury can manifest years later.

Knee Injuries

Knee injuries are common in MMA, especially because many fighting techniques involve using your knee. This is also the reason why a lot of strategies also involve striking it to limit the movement of the opponent. Because of that, a lot of issues can arise to the knee for two reasons: either from use or from being damaged. Some of the most common issues with the knees are the posterior cruciate ligament, or PCL, and the anterior cruciate ligament, or ACL.

Under certain conditions where the damage isn’t severe, the injuries can be treated with a cold compress, physical therapy, and rest. For more severe damages, surgery will be required. On the latter one, problems with usage after the surgery can be attributed, resulting in the knee not being used like normal anymore and, of course, requiring retirement from MMA.

Ankle Sprains

Ankle sprains, muscle tears, and even fractures are pretty common in Mixed Martial Arts Many fighting styles use kicks, so the legs, thighs, and feet will be used. People usually forget that in these strikes, the ankles also get impacted, which can be damaged severely. The ankle joint is stabilized by two ligaments both on the outside and the inside. A sprain occurs when one or both muscles get torn or outstretched.

That said, ankle sprains, muscle tears, and even fractures are pretty common in MMA. This usually happens when the athlete lands wrongly on the ground, an awkward twisting motion, or if the other opponent strikes it. The severity of the ankle sprain usually has two levels: Grade I and Grade III. The former involves mild stretching and damage, while the latter results in a complete tearing of the ligament.

Wrist Injuries

Wrist injuries are also pretty common in MMA, mainly because it involves a lot of action, from standing up from the ground to using it for strikes. However, it’s also no mystery that the wrist is one of our bodies’ most easily damaged parts. If you’ve been a long-time fan of the MMA or a long-time bettor of MMA betting odds, there have been cases where a fighter was rendered unable to fight because of a wrist injury.

One of the worst aspects of wrist injuries is how long it takes to heal. Ligaments hold the bones in your wrist, and when your bones break, they also get damaged. This is why it usually takes for the injury to heal for months and even years. The wrist can be treated with first aid or surgery, depending on the severity.

Shoulder Injuries

Mixed martial arts use a lot of hand movement for striking and blocking, which can cause shoulder injuries. Not only that, but some techniques involve manipulating the shoulder joint aggressively to make the opponent tap out. Of course, this can cause damage ranging from simple to severe.

That said, when the shoulder is not given enough time to rest, the tears in the tendon of the rotator cuff can’t repair themselves, weakening the entire shoulder and even making it more prone to damage.

The sport now includes women. Martial artists can also suffer from slap tears. This type of damage occurs when you tear the inner cartilage of your shoulder joint. This damage tends to result from overuse and injury, making the shoulder experience pain when moving or even movement difficulty.

Toe/Foot Injuries

If you’ve stubbed your toe before, you know how painful it is. Now, imagine if you purposefully use your foot to kick somebody, and of course, your toe would get impacted as well. For the most part, toe and foot injuries are pretty common.

Possibly, the most common are torn toenails. It’s pretty painful, but at this point, it’s par for the course since many fighting styles use kicks. Another common injury is on the big toe. Since it’s the largest toe on your foot, it’s normal to be impacted much forcibly during kicks. Usually, it’s straight-up damage, but sprains on the big toe can also occur.

Final Words

It’s no mystery that MMA is home to the most gnarly injuries. Through the years, we’ve seen many fighters quitting out of the fight and even from their careers because of the injuries they sustained inside the ring. However, the types of injuries above are some of the most common ones you can see in MMA. But even with that, MMA remains to be one of the most popular fighting sports in the world.

By Pepper Parr By Pepper Parr

November 19th, 2023

BURLINGTON, ON

Getting a fix on just where public opinion is on the budget that Council is currently debating.

Members of Council refer to different surveys they say supports what Council is doing.

At the same time a Petition is out there that has drawn more than 2750 signatures. If you want to add yours to the petition click HERE At the same time a Petition is out there that has drawn more than 2750 signatures. If you want to add yours to the petition click HERE

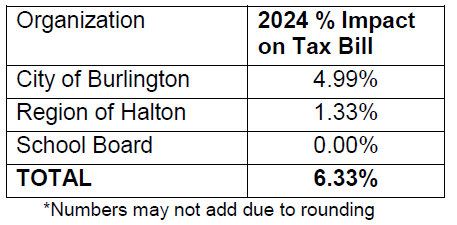

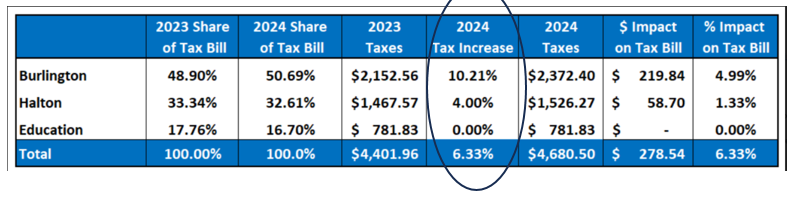

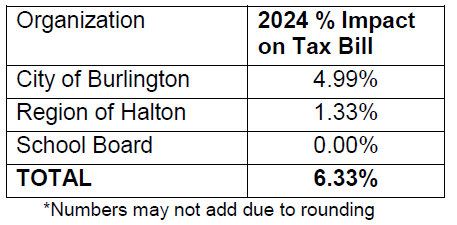

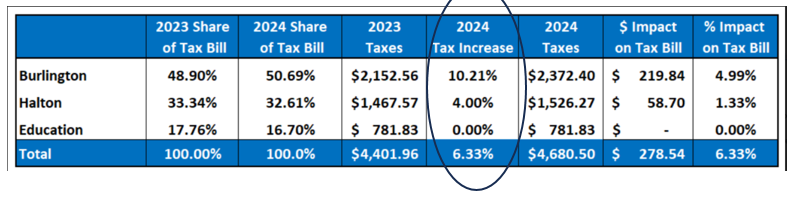

They are differences in just what it is this Council is debating. The Mayor refers to a 4.99% “impact” – the word impact doesn’t get defined. They are differences in just what it is this Council is debating. The Mayor refers to a 4.99% “impact” – the word impact doesn’t get defined.

Eric Stern has delegated and written an opinion piece on what be believes the t2024 tax increase will amount to.

Eric Stern got this chart from the Finance which he maintains makes it clear what the tax rate is going to be. Members of Council have prepared Motions they will debate later this week; Councillor Stolte wants to see $4.5 million set aside to buy land on which future housing will be built.

Councillor Sharman, who probably has the best understanding of the budget, and his view may not be what the City Finance department would like to see, is the man behind where this budget is going to land. Councillor Sharman has said that he believes this council is doing the right thing and that “we will learn is we were right in the 2026 municipal election.

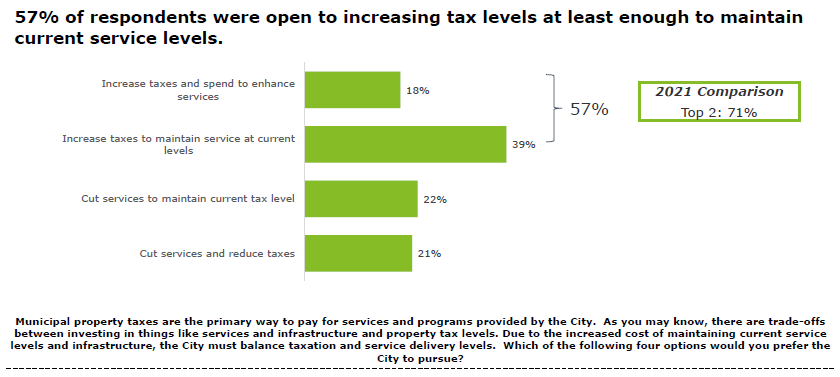

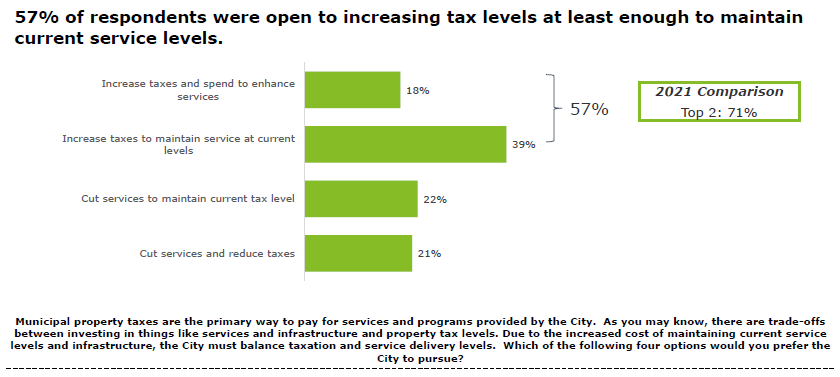

There is one graphic that is probably closer to the truth that much of the stuff is out there. It is shown at the bottom of this article. Public acceptance dropped from the 70ès in 20121 down to the 50’s in 2022.

With no single source offering reliable data, and Council members pushing their own agendas it is close to impossible for people to gain a full understanding on what really is taking place.

This is a terrible state to be in – it isn’t likely to change – especially when there is an administration that serves as a chock on the flow of information.

The important thing to note is what the public liked in 2022 and what they liked in 2021 – the numbers are not going in the right direction.

Related news and opinion piece:

Stern opinion

Link to Stolte ask for $4.5 million

Councillors set out what they would like to see changed in the Mayor’s version of the budget

The impact of Strong Mayor powers

By Pepper Parr By Pepper Parr

November 19th, 2023

BURLINGTON, ON

Motions put before Council by Mayor Meed Ward adding to the budget; motions point to savings that will result from the additional hires.

Motion for Council to Consider:

Mayor Marianne Meed Ward Add two additional Firefighters (item 2024-027) for $301,419 to the 2024 budget funded by reallocating dollars from overtime savings.

Reason:

Two of the four positions requested to fill out Fire Station 8 are accommodated in the Mayor’s Budget. The four positions are not part of the Top Priority positions identified by staff in response to staff direction SD-37-23, presented after release of the Mayor’s Budget, but they are part of the second tier of high priority positions.

Following discussion at committee after release of the Mayor’s Budget, this motion seeks to add the remaining two, funded from overtime savings, to complete the complement.

See page 93 of the budget book for additional details.

According to Appendix C of MO-02-23-1, the staff response to questions from councillors, pg 17, actual overtime expenditures since 2011, when Station 8 was opened, has ranged from a low of $76,704 in 2011, to a high of $1.5m in 2022, which was an anomaly year due to COVID. Actual overtime for 2023 is projected to be

$925,000.

The lack of the four additional firefighters has contributed to this need for increased overtime, so it can be expected that overtime costs will reduce with the full complement added.

Actual overtime for the years between 2012 to 2017 has been in the $300,000 range, with higher amounts in 2018 and 2019 pre-COVID ($400k and $538k respectively) without the additional four fighters.

Overtime for 2024 is budgeted at $600,000, which is higher than actuals for the years 2011 to 2019 by a range of $61,903 to $523,296. Hiring the final two firefighters should contribute to a comparable reduction in overtime in line with actual historic costs of overtime.

This motions seeks to add the additional two fire fighters to the two already accommodated in the Mayor’s Budget, to bring the full complement to four, paid for by reducing the overtime budget for 2024 from $600,000 to $300,000, which is closer in line to actual overtime from the pre-COVID years of 2011 to 2019.

If there are any overages in overtime that may be incurred in 2024, these can be reported out as part of council’s regular variance reports at year end, and an adjustment made in the 2025 budget, if necessary.

Motion Seconded by: Not Required Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Increase budgeted by-law licensing revenues to fund the licensing clerk position accommodated in the 2024 Proposed Budget, thus taking $92,940 off the tax impact.

Add the second licensing clerk position not currently accommodated in the 2024 Proposed Budget, also funded from increased licensing revenues, adding a further

$92,940 to the projected licensing revenue budget, with no tax impact.

Reason:

One of the two requested licensing positions is accommodated in the Mayor’s Budget. The two positions are reflected in the “Other Priority” positions identified by staff in response to staff direction SD-37-23, presented after release of the Mayor’s Budget.

See page 38 of the budget book for additional details.

According to Appendix C of MO-02-23-1, the staff response to questions from councillors, pg 16, the licensing revenue in the 2024 budget only reflects businesses we have historically dealt with. Staff are working with other regional partners to focus on those businesses who are not currently licensed so it is expected that numbers will increase further. On food licensing alone, there is potential revenue of $267,305, which would more than cover both additional licensing clerk positions of $186,000. According to information provided by staff, licensing revenue is further expected to increase to $887k and $1.024m in 2025 and 2026.

If there is any variance in licensing revenue received in 2024, this can be reported out as part of council’s regular variance reports at year end, and an adjustment made in the 2025 budget, if necessary.

Motion Seconded by: Not Required Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add Manager Organizational Development, for $157,373 to the 2024 budget funded by reallocating dollars from unfilled positions in 2023.

Reason:

This position is part of the Human Capital Investments in Stabilizing Operations investment to focus on improving the city’s capability and performance, and implementing the city’s Diversity, Equity and Inclusion strategy and Corporate Learning and Development.

It was identified by staff as one of the top priority positions in response to Staff Direction (SD-37-23) requesting prioritization of new staff positions, released after the presentation of the Mayor’s Budget. See page 63 of the budget book for additional details.

According to Appendix C of MO-02-23-1, the staff response to questions from councillors, page 3, 13 positions of the 42 approved in the 2023 budget remain unfilled as of November. This motion seeks to reallocate funding from one of these lower priority positions that were approved but remain unfilled almost at the end of this year, to this higher priority position, to be determined by staff.

Motion Seconded by: Not Required Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add Solicitor – General Litigation, Municipal Law, Insurance Practice for $190,512 to the 2024 budget offset by a recovery to the capital program.

Reason:

This position is part of the Burlington Digital Services investment and was identified by staff as one of the second tier (Chart 2) “high priority” positions in response to Staff Direction (SD-37-23) requesting prioritization of new staff positions, released after the presentation of the Mayor’s Budget. See page 48-56 of the budget book for additional details, and page 29 of Appendix C of MO-02-23-1, the staff response to questions from councillors.

The memo stipulates that there would have been cost savings annually between $60k and $190k between 2019 and projected for 2023 had the resource been in place which would assist in covering the inhouse solicitor costs.

Additionally, we heard at the Nov. 6 and 7 workshops that this position supports the capital program, which is funded in part by the infrastructure levy, which is significantly increasing this year’s budget.

All staff are budgeted for in operating, however for those that work on the capital program the city budgets a recovery for a portion of their HR costs from capital. Each relevant capital project then includes a budgeted internal charge for this staff time as an expense to the project where internal staff are completing work (as opposed to an external contractor). For example a roads project may have an internal charge for design or inspection time.

Staff time not directly spent on capital does not get recovered and remains as an expense to operating.

As such, this motion seeks that the HR expenses for the solicitor would be offset by a recovery to the capital program, with no net increase in the tax base.

Motion Seconded by: Not Required Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider: