By Pepper Parr By Pepper Parr

November 3rd, 2023

BURLINGTON, ON

Leaving the GO train and heading into the downtown core of Toronto Kay behaved perfectly. Some of the passengers on the train were surprised. The people who run the GO train service have partnered with the Royal Winter Fair to encourage people to attend the event that started today and runs through to next Sunday, the 12th.

For people riding the GO train into the City on Thursday there was a passenger that no one expected to see – Kay, a female sheep. No word on whether or not the animal paid for the ride.

Kay was no stranger to the Royal. She was there last year and won a prize. Her owners, sheep farmers located in Ridgetown which is halfway between London and Windsor found that she was very good with people around.

She took the GO train into the city and walked through Union Station out on to Front Street and made her way to the CNE grounds where she will have a stall of her own.

The pooper scooper followed “Kay” very closely as they walk through Union Station out to Front Street

By Pepper Parr By Pepper Parr

November 2nd, 2023

BURLINGTON, ON

Lydia Thomas Lydia Thomas delegated at City Council today.

We would love to talk to her.

Reach out Lydia – you made some important points and apparently have some ideas that you are prepared to share with Council.

We would love to share them with the public.

Send us an email – publisher@bgzt.ca

By Pepper Parr By Pepper Parr

November 2nd, 2023

BURLINGTON, ON

On Monday October 30th, Wendy Fletcher delegated to City Council virtually.

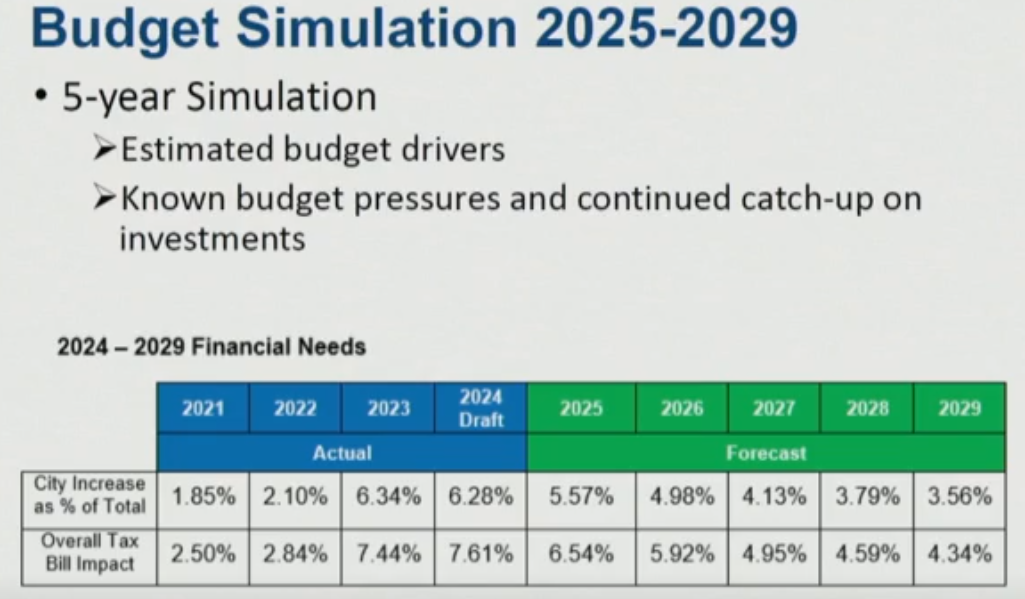

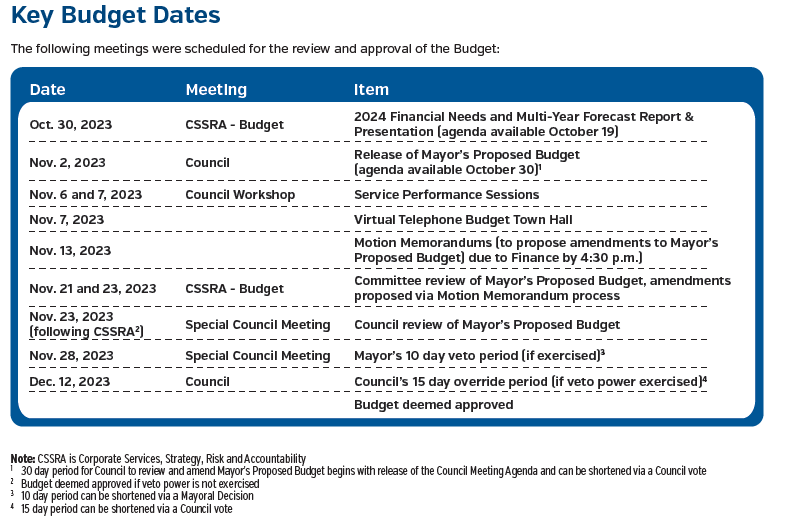

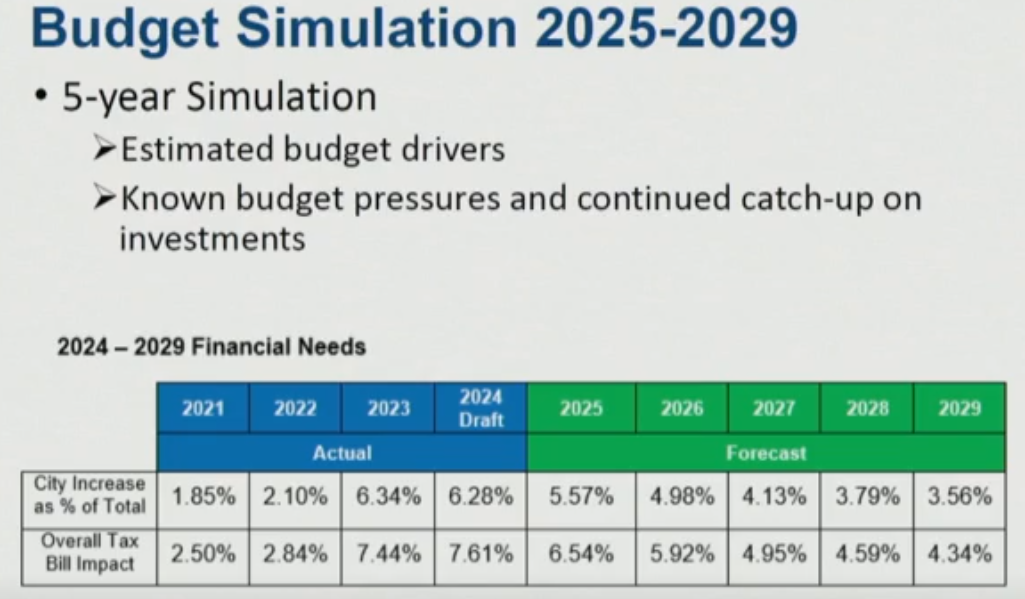

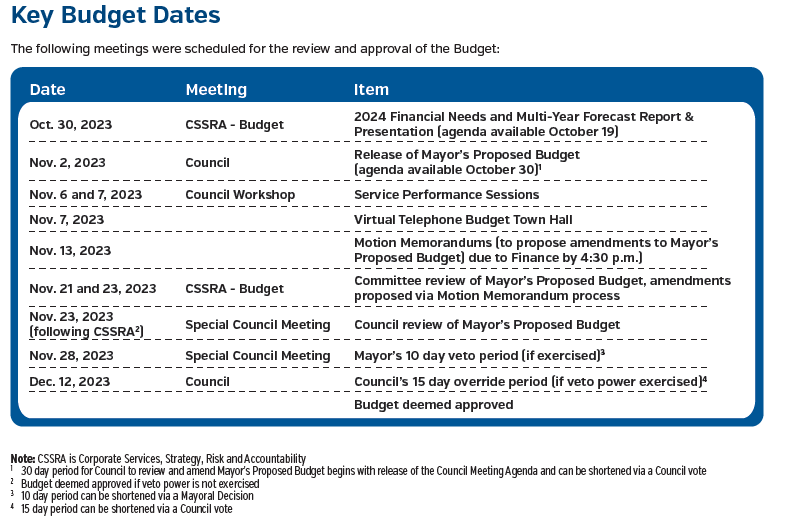

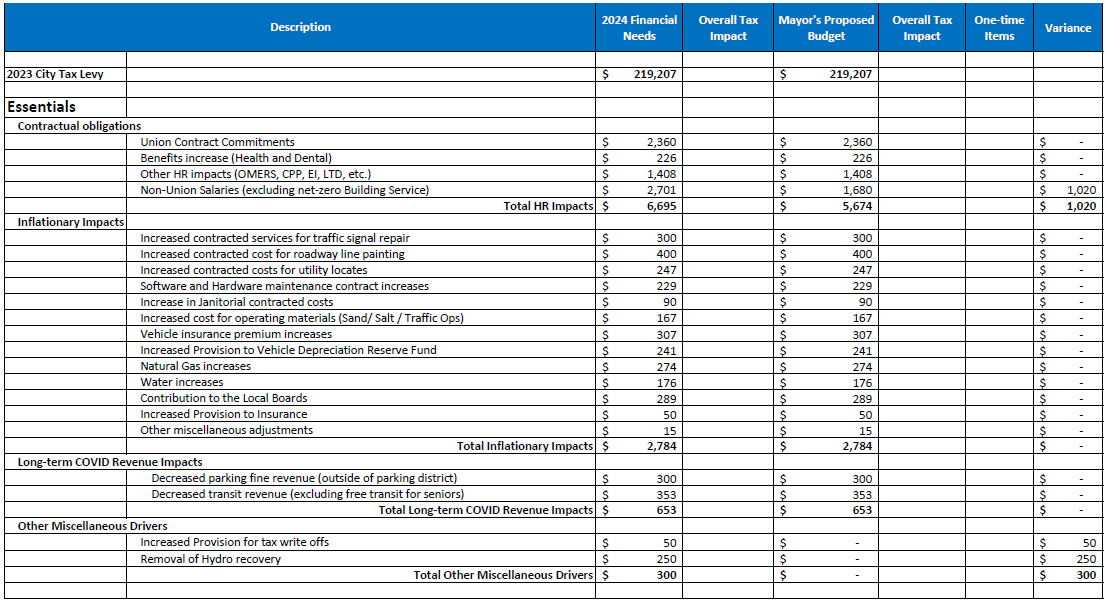

Her delegation was about the budget that was being discussed by Council. On the day she delegated Councillors were hearing what the City Treasurer had presented, which had been named the Needs document. It wasn’t a budget per se, it was a document that set out in considerable detail (750 + pages) what she, as treasurer, believed the city was getting in terms of revenue and what the city was facing in the way of expenses.

The report delivered to Council on Monday October 30th. The treasurer determined that a tax increase of 7.6% would be needed.

Mayors in Ontario were given stronger powers on July 1st and had the right to submit their own budget and make any staff changes they felt were necessary including firing the City Manager. Mayor Meed Ward has consistently said she did not have the right to delegate any of the Strong Mayors powers and that she was required to create a budget.

Ward 2 Councillor Lisa Kearns chastises a delegator during her presentation. As Deputy Mayor she oversees Citizen Participation. Fletcher began to give the following delegation. She was brusquely interrupted by the Standing Committee chair Lisa Kearns who objected to comments Fletcher was making about city Staff.

The Gazette has published below the complete delegation with the words Fletcher was told she could not use set out in red.

Fletcher had a Petition she wanted to present as part of her delegation but was not permitted to do so.

On Oct 31, 2023, the day after she delegated, Fletcher got an email from Arjoon (City Clerk) advising her that the petition she wanted to submit was moved to Nov 14, 2023. No reason was given. Fletcher commented: “Regardless of any reason he may conjure up subsequently, this refusal to allow me to participate and to refuse to allow my petition which was submitted well within the required timelines, to be included as part of the public record on the date of the council item it was objecting to, constitutes a violation of my rights as a taxpayer.”

What are Arjoon was doing was moving a citizens petition that opposed a budget the Mayor was presenting to a date after the Mayor had formally presented her budget.

Ms Fletcher maintains doing so “… is a deliberate move by the city to prevent taxpayers from knowing of its existence until all city participation in the budget has ceased as no one visiting the city’s website for the Nov 2 call or the Nov 7 meeting will have any knowledge of the material. It will be as if it doesn’t exist. Further it is a deliberate move to disallow me to participate in this process, a right I am granted by law.

“By refusing to allow my petition to be on record until Nov 14, it also impinges on the rights of every person who signed the petition. As well it violates the rights of every property owner in the city of Burlington as you take away their right to make alternate decisions by withholding information from them.

“City council had no problem accepting a similar petition with respect to the potential development in Millcroft going so far as to include it in press releases. But a petition against the proposed property tax increase gets removed until a point that it’s past all public input?

“In addition to violating my rights on several levels, this move is unethical, lacks integrity and is massively oppressive. The City of Burlington claims they want city involvement. There are almost 2000 people saying they don’t want this tax increase. And city hall’s response is to silence them. That’s not taxpayer involvement. That’s dictatorship. Given the violation of my rights and your own policies, I have filed a complaint with the Ombudsman’s

“I want my petition marked as part of the public record for Nov 2 ,2023 as I was told it would be, and as is my right under law.”

The following is the delegation Wendy Fletcher gave on October 30th

The operating budget underwent a line-by-line review by the CFO and Service Leads. This review checked the operating budgets for reasonableness and adjusted where appropriate to find budget savings and reduce costs. If this is true, maybe we need a new CFO. One who doesn’t need almost 8% increases to do her job. Ms. Joan Ford clearly didn’t read the budget survey results that overwhelmingly do not support these increases

Pg 33 of Financial Needs and Multi Year Forecasts uses BMA and a group average to try to say that Burlington taxes are lower than Oakville and Toronto. Just like many of the ways City Hall presents information to taxpayers, it is flawed, skewed data that’s manipulated to serve the city’s purpose. The fact is that Burlington residential taxes are significantly higher than both Oakville and Toronto. That information buried so the amount per 100,000 or the residential tax rate (RT) is not easily found. Other cities are upfront. Burlington is not. It is purposely deceitful. Both in these glorified presentations and on the City’s website.

Burlington’s residential urban rate is 0.00861442

Oakville’s is 0.760437% or 0.00760437

Toronto is 0.506079% or 0.00506079

Mayor Marianne Meed Ward For the 2023 tax increase the city used the budget survey to support the tax increases. That they did so is unethical given they failed to properly inform. The city will deflect that the budget was available. But as indicated by your own data, only 57 people actually looked at the budget. For 2024, many of those who became aware of the tax increase only become aware because I told them. How is it that as a solitary citizen that I can reach more people than the Mayor or Council? The city can’t use the survey for 2024 as 55% of residents want either taxes cut or services cut. Overwhelmingly they do not support further increases in property taxes.

In addition, in Appendix C of 2024 Budget Survy Results, when asked in Question 8, “As a resident of Burlington, what is the most important issue facing your community, that is, the one issue you feel should receive the greatest attention from your City Council and should be a priority in the 2024 budget”. An astonishing 211 responses out of 711 stated specifically that taxes need to be cut or minimally not raised with many making passionate pleas of the deleterious effects the high rates of tax are having on their ability to maintain their homes. Another 30 made reference to the high taxes by way of suggesting salaries and services need to be cut or that the cost of living was too high. This is 30% of all respondents directly stating taxes are too high. This number would be much higher if everyone taking the survey had been aware of the tax increase in the budget but they weren’t. Only 57/801 respondents read the budget which is only 7% of respondents. That makes the responses by those who didn’t know about the tax hike highly questionable as to their validity as they may have responded very differently had they known.

City Council in a virtual meeting. Delegate claims Mayor and Council and City Hall are deliberately attempting to keep information from taxpayers As to the 57, that’s not even 1/2 % of the entire population. It says there is a vast lack of knowledge as to what’s going on at city hall with respect to raising our taxes by taxpayers. That’s the fault of this Mayor and Council and City Hall’s deliberate attempts to keep that information from taxpayers

Beyond this data, many many letters have been sent to the Mayor and Council by taxpayers who are upset or angry about these taxes. I know this because many of these people have reached out to me, several telling me their stories.

It’s clear Burlington taxpayers do not agree with the rate of taxation in this city and they most certainly do not support another tax hike of 7.82% or anywhere near it. They want taxes cut or a minimal increase of 3% of less. Indeed, I’ve taken polls that support this. I also have a petition against this tax hike and stating taxpayers will not agree to anything greater than 3%. As of 830am this morning that petition is at 1205 signatures. Whether Mayor Meed Ward is going to heed the taxpayers and refuse to raise taxes or minimally keep them below 3% remains to be seen. At some point Mayor Meed Ward stopped listening to taxpayers. I propose Burlington taxpayers should call for her resignation if she decides to ignore taxpayers and put this tax increase or anywhere near it, through.

The petition that Wendy Fletcher wants to present to City Council:

The City of Burlington raised property taxes by 7.52% in 2023. They have proposed another unprecedented increase of 7.82% for 2024. This is 15.34% over 2 years. From 2023-2027, this Mayor and Council are planning a total increase of 32% in property taxes.

We, the undersigned, do not agree to this proposed increase in property taxes for 2024. We, the undersigned do not agree to any property tax increase over 3%.

If you would like to sign the petition – you can do so HERE.

|

By Pepper Parr By Pepper Parr

November 2, 2023

BURLINGTON, ON

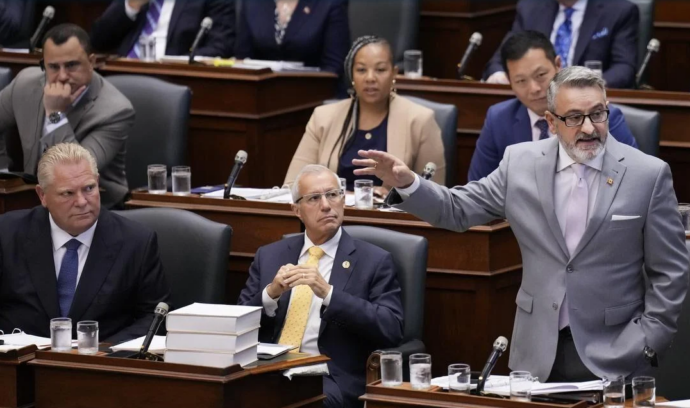

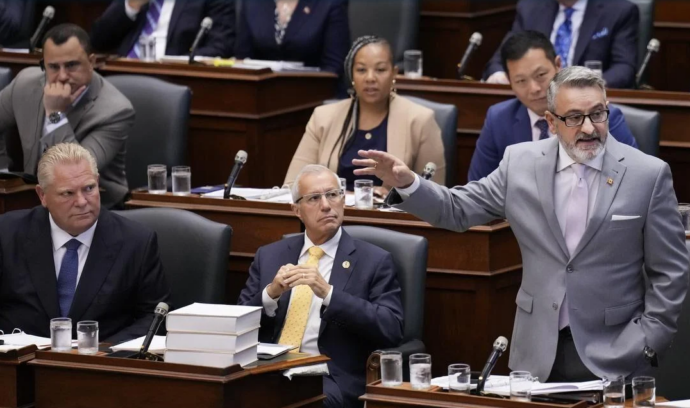

The Mounties have begun questioning officials at the Ministry of Municipal Affairs and Housing over Premier Doug Ford’s $8.28-billion Greenbelt scandal.

Media reports have Housing Minister Paul Calandra telling reporters: ““They’ve not been in touch with me, but my understanding is they have been in touch with the ministry.”

As first disclosed by the Star, the RCMP’s Sensitive and International Investigations unit, the branch that probes political crime and corruption, is examining “allegations associated to the decision from the province of Ontario to open parts of the Greenbelt for development.”

NDP Leader Marit Stiles said “it’s clear that the premier can’t keep his story straight right now” so it is encouraging that “the RCMP are digging in now.”

“I just want answers for the people of Ontario. This has already pushed this government and the province off of the agenda of actually building the housing that we really need,” said Stiles.

“It’s a terrible, terrible situation, but we do need to get to the bottom of it and people in this government and the premier himself need to be held to account,” she said.

Media are reporting that “Ford has not yet been contacted by the police, but he has promised to co-operate with the investigation.”

By Pepper Parr By Pepper Parr

November 1, 2023

BURLINGTON, ON

Two pieces of information had to be corrected: the date on which the request to delegate was made and the number of names on the petition.

We received the following from Wendy Fletcher, a Burlington resident.

“On October 27, 2023, I filled out a delegation and submitted it to the clerks office. The delegation was to submit a petition in opposition to the budget. I spoke to Lisa Palmero shortly afterwards who advised me that the meeting on Oct 30 was the wrong one and that it was the Nov 2. 2023 Regular Council meeting that it needed to be presented at. She said I didn’t have to do anything, she would ensure it was attached. She said I could send in an updated signature list by noon Nov 1.”

The meeting at which Ms Fletcher wanted to speak was not a budget meeting – the rules are that the matter on which you wish to delegate has to take place at the proper meeting – dumb rule – but I didn’t create it. Budget matters get discussed at budget meetings.

Ms Fletcher continues: “As per the city’s own rules of engagement, I am entitled to oppose a matter on an upcoming agenda. This is exactly what my intention was in making the delegation for Nov 2. My intention was also for this petition to be part of the public record in opposition to the budget, at the time the budget was released.”

The link below set out the rules:

https://www.burlington.ca/en/council-and-city-administration/engaging-with-city-council.aspx

Ms Fletcher points to the section that concerns her.

“Petition titles will be listed in the minutes of the meeting, which are posted to the City’s website, and the full petition kept on file as part of the official public record. As part of the public record, petitions may also be distributed to other members of the public on request.”

She continues:

City Clerk – Kevin Arjoon “On Oct 31, 2023, I was sent an email by Kevin Arjoon (City Clerk) stating my petition was moved to Nov 14, 2023. No reason was given. Regardless of any reason he may conjure up subsequently, this refusal to allow me to participate and to refuse to allow my petition which was submitted well within the required timelines, to be included as part of the public record on the date of the council item it was objecting to, constitutes a violation of my rights as a taxpayer.”

What are Arjoon was doing was moving a citizens opposition to a budget to a date after which the budget is being presented to city Council. Mayor Meed Ward will be presenting her budget to a Council meeting during which she will explain what her budget is about and justify why she made the decisions she did.

Ms Fletcher continues: “It is a deliberate move by the city to prevent taxpayers from knowing of its existence until all city participation in the budget has ceased as no one visiting the city’s website for the Nov 2 call or the Nov 7 meeting will have any knowledge of the material. It will be as if it doesn’t exist. Further it is a deliberate move to disallow me to participate in this process, a right I am granted by law.

“By refusing to allow my petition to be on record until Nov 14, it also impinges on the rights of every person who signed the petition. As well it violates the rights of every property owner in the city of Burlington as you take away their right to make alternate decisions by withholding information from them.

“City council had no problem accepting a similar petition with respect to the potential development in Millcroft going so far as to include it in press releases. But a petition against the proposed property tax increase gets removed until a point that it’s past all public input?

“In addition to violating my rights on several levels, this move is unethical, lacks integrity and is massively oppressive. The City of Burlington claims they want city involvement. There are almost 2000 people saying they don’t want this tax increase. And city hall’s response is to silence them. That’s not taxpayer involvement. That’s dictatorship. Given the violation of my rights and your own policies, I have filed a complaint with the Ombudsman’s

“I want my petition marked as part of the public record for Nov 2 ,2023 as I was told it would be, and as is my right under law.”

The Gazette has asked for a copy of the petition which we will publish in full when it is received.

For those who want to sign the petition you can do so HERE

By Pepper Parr By Pepper Parr

November 1st, 2023

BURLINGTON, ON

At the end of the month we should have some sense as to how politically damaging the Greenbelt scandal has been to Premier Doug Ford.

Could it get any worse. Yup – it could. The polls are still giving the Premier good news – they like him.

Will that change? If it does change when will it become evident?

There is a by-election taking place for the Kitchener Centre seat where the New Democrat who held the seat resigned. The Liberals would dearly love to win the seat. Is there enough interest in the Liberal Leadership race taking place to create a bit of a buzz for a Liberal candidate?

Will Bonnie Crombie insert herself into the Kitchener Centre campaign?

She appears to be the leading candidate.

Is the Premier listening intently or is he scowling Will the Progressive Conservative candidate track well or will the voters in that riding use the by-election to tell the Premier “we were not pleased”.

Politics is about power – once you have it – you do everything you can to keep it. Will Doug Ford at some point realize that he is going to have to take the fall (is as well he should) and let someone else lead the party. Could Paul Calandra use the damage control job he has been doing quite well and leverage that into a leadership bid?

By Staff By Staff

November 1st, 2023

BURLINGTON, ON

The provincial government shovels out about ten, sometimes more, announcements each day telling the public about a long term care home that is going to be built in Pefferlaw or about money being spent to improve internet service in rural Oxford County.

The removal of HST will apply to new purpose-built rental housing, such as apartment buildings, student housing and senior residences built specifically for long-term rental accommodation. The legislative reform is part of the federal and provincial government’s response to the ever-rising cost of residential housing in Canada and the corresponding lack of available affordable housing. An announcement today on the plans to remove the full eight per cent provincial portion of the Harmonized Sales Tax (HST) on qualifying new purpose-built rental housing in order to get more rental homes built across the province is significant.

The removal of the provincial portion of the HST would apply to new purpose-built rental housing such as apartment buildings, student housing and senior residences built specifically for long-term rental accommodation, that meet the criteria. The enhanced rebate would apply to qualifying projects that begin construction between September 14, 2023 and December 31, 2030, and complete construction by December 31, 2035.

Together, the provincial and federal actions would remove the full 13 per cent HST on qualifying new purpose-built rental housing in Ontario.

Currently, the Ontario HST New Residential Rental Property Rebate is equal to 75 per cent of the provincial portion of the HST paid, up to a maximum rebate of $24,000. The enhanced rebate would be equal to 100 per cent of the provincial portion of the HST, with no maximum rebate amount.

In the example of a two-bedroom rental unit valued at $500,000, the enhanced Ontario HST New Residential Rental Property Rebate would deliver $40,000 in provincial tax relief. When combined with the enhanced federal GST New Residential Rental Property Rebate, this would amount to $65,000 in tax relief.

To qualify for the enhanced HST New Residential Rental Property Rebate, new residential units must be in buildings with at least four private apartment units or 10 private rooms or suites, and have at least 90 per cent of residential units designated for long-term rental. To qualify for the enhanced HST New Residential Rental Property Rebate, new residential units must be in buildings with at least four private apartment units or 10 private rooms or suites, and have at least 90 per cent of residential units designated for long-term rental.

Some questions do come to mind.

Where will the savings be realized? At the developer level or at the tenant level.

And if at the developer level is there any oversight to ensure that the benefit is actually realized by the tenant.

We will do what we can to follow up on this.

By Staff By Staff

November 1st, 2023

BURLINGTON, ON

Any student from about grade 5 on with even a little curiosity should be given an opportunity to attend the Sound, Just Sound event at the Joseph Brant Museum.

Joseph Brant Museum is pleased to announce a new special exhibition opening. Sound, Just Sound, is a production of the Sherbrooke Museum of Nature and Science with the contribution of Heritage Canada and the Quebec Ministry of Culture and Communications.

Joseph Brant Museum  The exhibition will be on view from November 14, 2023 to March 30, 2024. The exhibition will be on view from November 14, 2023 to March 30, 2024.

Any impact creates vibrations in the air that translates into sound. The impact of the wind on leaves, the air flowing from our lungs on our vocal cords, a door closing, the shuffle of ants moving, the electronic impulses of a bell. Sound waves are everywhere. This exhibition is an immersive experience. Visitors will experience sounds with all their senses.

See them, through high speed cameras and measuring devices; touch them, by playing with musical instruments and specialized acoustic materials; feel them, through the science of psychoacoustics.

“The exhibition is broken down into themes that examine the science of sound. There are interactive games and experiments that are fun for people of all ages” says Curator, Jessica Benjak-Waterous.

Visitors can also add a film screening to their Museum visit on select Saturday afternoons. “Making Waves: The Art of Cinematic Sound” reveals the hidden power of sound in cinema, introduces us to the unsung heroes who create it, and features insights from legendary directors with whom they collaborate. The film will be showing on December 2, January 13, February 10, and March 2. The film begins at 1pm and is 1h 34min long. Learn more about this award winning film at makingwavesmovie.com.

Joseph Brant Museum is open Tuesdays – Saturdays, 10:00am to 4:00pm, Sound, Just Sound is included with the price of regular admission.

Museum admission prices:

Adult | $10

Child | $6

Senior/Student | $8

Family (up to to 2 adults and 4 children) | $30

Movies and the Museum prices:

Adult | $12

Child (age 3-12) | $10

To purchase a seat for the film screening and for more information on the special exhibition, please visit: museumsofburlington.ca.

By Staff By Staff

November 1st, 2023

BURLINGTON, ON

Friday, November 17, 2023, the Art Gallery of Burlington (AGB) presents REVEL: The Ultimate Art Bash! This “extraordinary” night of contemporary art, thrilling entertainment, and a unique culinary experience, set to captivate all of your senses.

Event Details

Date: Friday, November 17, 2023

Time: 7 pm – 12 am

Location: Art Gallery of Burlington

REVEL is set to redefine the boundaries of art and entertainment, offering an unforgettable experience that combines electrifying digital performances, mesmerizing DJ sets, and enchanting mystical encounters. REVEL is set to redefine the boundaries of art and entertainment, offering an unforgettable experience that combines electrifying digital performances, mesmerizing DJ sets, and enchanting mystical encounters.

The event is hosted by Kimberly Calderbank, host of Community Cultures YourTV Halton, and partner of Burlington’s Yellow Robot Media & Design firm.

To elevate the revelry, REVEL will showcase immersive installations created by a stellar lineup of artists, including Omar Badrin, ORXSTRA (Alex McLeod and Tala Kamea), Tyler Matheson, Christopher Reid Flock, Diana Lynn VanderMuelen, and Stefana Fratila. These talented artists will bring their unique visions to life through sound, light, projections, and captivating live performances.

DJs and Musical Guests

DJ Cindy AO will set the mood with a selection of chill tracks, while Luckystickz will breathe life into the Sybil Atteck exhibition, adding to the magic of the evening. The Shoreline Room will also become a dancefloor with music by DJ Grandmother Sago and DJ Sahra Suda.

Artist and Tarot Reader

Kiera (Kiki) Boult, local artist and Tarot reader. Kiera (Kiki) Boult, local artist and Tarot reader will be reading futures for a select number of people in a rare and mystical experience.

Live Auction

Professional auctioneer Don Stewart will be auctioning off fabulous, priceless, and curated experiences for all to enjoy the best arts, culture and entertainment in the region.

Culinary Art with Local Star Chefs, Restaurants, Wineries and More

REV up those taste buds because both food and drinks are included with the cost of admission. The ticket includes a top-notch evening of exclusive dishes created by local chefs, including Chef Matteo from Spencer’s on the Waterfront, the Wandering Locavore, Vic Caterers & Bakery, Jonny Blonde, and Christy’s Gourmet Gifts. Mixed drinks, wine, beer and non-alcoholic cocktails will be provided by Arterra Wines Canada, Maverick Distillery, and Nickel Brook Brewing.

Tickets- $200 per person. Click HERE to order

By Pepper Parr By Pepper Parr

November 1st, 2023

BURLINGTON, ON

It was during a discussion about a new approach to issuing development permits that Ward 4 Councillor Shawna Stolte said to Michelle Diplock, Manager of Planning and Government Relations for the West End Home Builders’ Association: “I think you’re the right person for me to ask this question.

Ward 4 Councillor Shawna Stolte “Given the fact you represent the building industry, so you’re not speaking for any developer in particular, but I tasked you to consider going back to have a conversation with the members of your association (WEHBA ) – now this is going to be a little bit inflammatory but I’m going to say anyway, – when you use the terms economic viability, or that this new bylaw may impact the ability for developers to provide housing and the way the city wants. I think each of those terms needs to be followed with the extension of that sentence by saying economic viability based on the development industry’s present business model, or impact the ability to provide housing based on the development industry’s present business model.”

“My question is, do you think there is an appetite within the development community to work with the city within this bylaw, to collaborate so that if the development industry is looking to accommodate their business model, that they’d also be willing to look to amend their business model to make sure that Burlington is getting the housing it needs?”

Michelle Diplock is a Registered Professional Planner and the Manager of Planning and Government Relations for the West End Home Builders’ Association. Diplock responded: “I think there’s two parts to your question. I think in terms of the baseline in terms of what a developer needs to build, and the profit margins that they are required to demonstrate to the banks and the financial institutions to proceed is a 15% requirement. So if a developer can’t prove they’re going to meet that 15% profit margin, they are not able to proceed with that development.

“And so they will consider kind of doing a different type of development or doing something somewhere else where they can meet that because if they cannot get the financing from the banks, and I think this is an increasingly important piece, as interest rates are going up, and as banks are kind of calling and saying like, how are you leveraged on what does your entire kind of company’s portfolio look like? That’s a really important piece.

“And so just acknowledging the fact that like, if the, if you’re going for private sector, new development, you need to be able to meet that 15% threshold on your pro forma or the numbers, like don’t work and nothing gets built. I think there is an appetite on behalf of the industry to work with the city to see how we might do kind of the piece of our business that is really to deliver market housing supply in a way that also supports a number of the city’s other objectives, as well.

“But I think right now, and in today’s current context, one of the primary objectives needs to be new housing supply to address our current kind of backlog of shortage and take the pressure off of the entire kind of housing continuum spectrum.”

Stolte replies – “Good, thank you. I appreciate that. I don’t know the building industry well enough to understand is there.

“Is it present practice or do you think there could be some room for a property owner were to own two properties, one of which was geographically located to accommodate luxury units therefore the potential for profit margin could be much higher than 15% and approach that as a package where on another property they may own that may be more suited more suitable on say a public transit route for more affordable or attainable housing.

“Do you see there being the possibility of approaching banks with a package arrangement where one property subsidizes the other so that everybody in Burlington gets access to housing that they can afford?

Michelle Diplock promoting Arbitrary Lines, a book that highlights the alarming problems with municipal zoning. Ms Diplock did not write the book. Diplock: “So I’m going go off script – we were hosting a meeting this morning with a variety of nonprofits and for profit builders to discuss these challenges in Hamilton. And I think one of the biggest kind of barriers for the nonprofit and delivering the affordable housing side is they don’t have the money to do the initial kind of pieces to push forward projects like that.

“So they can’t approach a bank and ask for a loan if they don’t have that kind of collateral within their portfolio which nonprofits typically do not. I think there have been some examples of builders collaborating with nonprofit organizations, but I think it’s very difficult to do across different properties. So that is one, I guess, answer, I think.”

Stolte. Thank you for that. Really helpful.

By Pepper Parr By Pepper Parr

November 1st, 2023

BURLINGTON, ON

Back to that drip, drip, drip stuff.

Environmental Defence published a statement earlier today setting out a major concern. The first paragraph below sets out the context – what caused them to make Freedom of Information requests. The meat begins in the second paragraph. The reports that the RCMP have begun to make phone calls inviting people in for a conversation adds a little spice to what is taking place.

Drip, drip, drip – do read on.

In November 2022, the Ontario government announced that it would force through massive expansions of urban boundaries in municipalities across the province, despite those municipalities having determined those expansions would be unhelpful and even counterproductive in boosting housing supply. This includes expanding Halton’s settlement boundary by more than 3,000 hectares, and expanding Hamilton’s city boundary by 2,200 hectares.. These expansions were done in addition to the land removals from the Greenbelt and similarly lacked a fact-based rationale as more than ample lands were already available for development to meet the province’s home building targets. In Hamilton, forced boundary expansions were even accompanied by a forced reduction in the minimum share of housing Hamilton’s Official Plan committed to add within existing settlement boundaries.

Ecojustice – on behalf of Environmental Defence – made four freedom of information requests for documents dealing with urban boundary and Greenbelt changes In response, Ecojustice – on behalf of Environmental Defence – made four freedom of information requests for documents dealing with urban boundary and Greenbelt changes that occurred in late 2022. The groups have obtained four orders from the Information and Privacy Commissioner in relation to these requests as a result of appeals when the Ministry failed to respond. Of the four requests, two have now resulted in partial releases.

Last week, just days before the release of official plan documents, the Ontario government announced that it was reversing its proposed changes to urban boundaries, and legislation was tabled to reverse the Greenbelt changes. These u-turns are necessary and welcome, but both the absence of any credible good faith reason for these boundary expansions and lack of transparency regarding how they were made raises serious and lingering concerns as to what influence real estate investors and sprawl developers have at the highest levels of government over our keystone land use planning policies.

Staff Ryan Amato, Chief of Staff to the Minister of Municipal Affairs and Housing Steve Clark. The partial release reveals the chaotic, developer-led process that did an end-run around the normal planning approval process and was driven by political staff in the Minister’s office. The documents show that Minister of Municipal Affairs and Housing’s Chief of Staff Ryan Amato directed senior ministry staff to keep their mouths shut about the changes and made clear that maps showing how some of the preferred developer properties had been moved forward needed to be provided to the Premier’s Office. All of these changes, which favoured particular developers, were rushed through without proper consideration of the impact on existing planned land uses, sensitive natural features, water or agriculture.

Many of the documents, including ones from September and early October, are redacted on the basis that they are Cabinet privileged, even though the Minister and the Premier have claimed under oath that they did not know about the changes until late October 2022.

These redaction’s call that timeline into question.

By Staff By Staff

October 31st, 2023

BURLINGTON, ON

This is different.

The Burlington Performing Arts Centre has launched a new monthly after-work series of networking events, where we bring together the local business community to mingle and learn more about local charitable organizations.

Hosted by

COGECO in Support of United Way Halton & Hamilton

Wed Nov 15, 2023 at 5-7pm

BPAC Family Lobby

Click > Registration is FREE!

Catering, Door Prizes and Cash Bar.

By Pepper Parr By Pepper Parr

October 31st, 2023

BURLINGTON, ON

Relentless describes the manner NDP Leader of the Opposition Marit Stiles is taking to the Greenbelt scandal and the Doug Ford government.

In the most recent NDP media rlease they open with the line: Come for the Ford Wedding and Stay for the MZOs and then add that Ford’s Conservatives issued as many Minister’s Zoning Orders (MZOs) to benefit just the guests at a single Ford family wedding reception as the previous government issued during its entire 15 years in power

“From the Greenbelt grab to forced urban boundary expansions to MZOs, Ford has a deeply troubling pattern of putting his friends ahead of everyone else,” said Stiles. “The Ford Conservatives are already under RCMP criminal investigation for the Greenbelt.

That does not look like a friendly glance from the Premier to Minister Calandra. Is the Premier feeling challenged? “This is yet more evidence of sketchy land deals that show just how deep this corruption goes. ”

“The former Liberal government issued 18 MZOs between 2003 and 2018.

The Ford government issued 18 MZOs benefiting just the guests at Ford’s daughter’s wedding reception, which took place on September 25, 2022.

“How many times does this government have to get caught before Ontarians see some accountability?” asked Jeff Burch, NDP critic for Municipal Affairs. “With rumours of a further MZO review on the table, we have to wonder – what is Ford afraid of? What else is he trying to get ahead of?”

MZOs are a favourite tool in Ford’s preferential treatment system. They can dramatically increase the value of land with the stroke of a pen, and they often seem to be given out to Conservative Party donors, Ford friends…and Ford family wedding guests.

Who invites wealthy business people to a wedding reception for their daughter?

Apparently these developers got invited – they certainly didn’t crash the event.

They did show up with detailed information packages setting out which of their properties they would like to see being taken out of the Greenbelt where they were protected.

Financial donations to the couple are reported to have been part of their being invited to a Stag and Doe event; something to help them cover the cost of the wedding. What – Dad didn’t have the wherewithal to pick up the tab?.

Mobsters do stuff like that

Premier Doug Ford with his daughter on her wedding day. There is a photograph of the Premier dancing with his daughter who had just married a police office.

The scene of the crime happened to be the Pearle Spa that is located in the Bridgewater development in Burlington.

Very swish, very well run and very expensive.

The location is superb – you walk out into the court yard area and you have a great view of the Pier, the Skyway and everything in between. Sunsets at this location are beautiful.

A bit of background for those who haven’t been following the hottest news story of the year

On Oct. 6, the Auditor General confirmed it is investigating the government’s use of MZOs, which have disproportionately benefited developers with personal, political or donor ties to Doug Ford and the Conservative Party.

The Provincial Integrity Commissioner and the Auditor General, at the request of the Ontario NDP launched investigations that have have already forced the Ford government to backtrack on its Greenbelt and Urban Boundary plans. Housing Minister Paul Calandra has hinted that a review of MZOs might be next.

By Pepper Parr By Pepper Parr

October 30th, 2023

BURLINGTON, ON

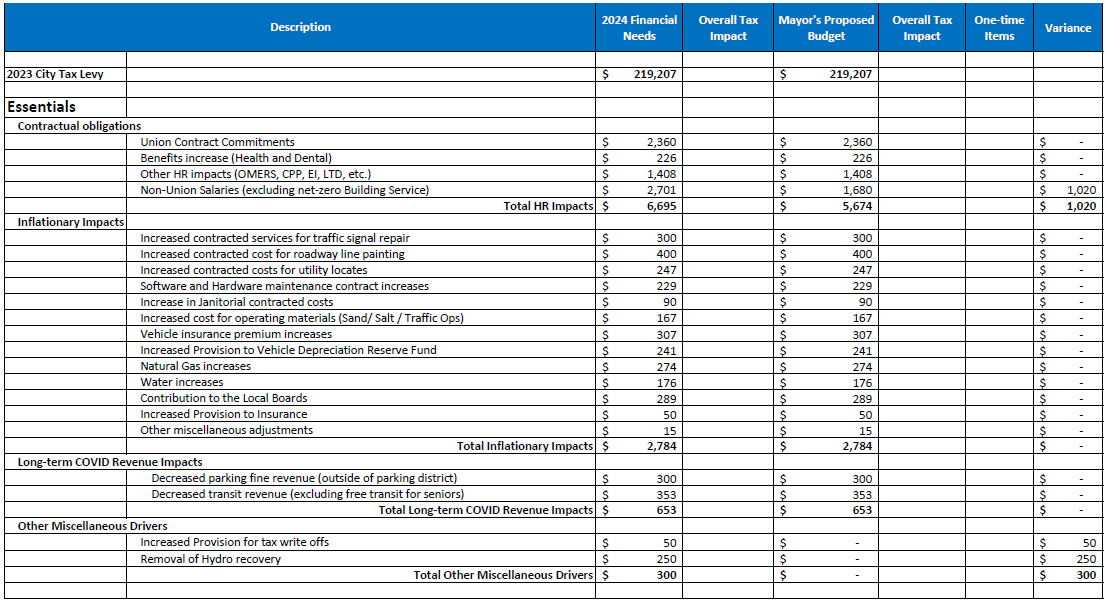

Here is how she did it.

The Mayor submitted a budget that would reduce the city portion of the tax levy by more than 3 points.

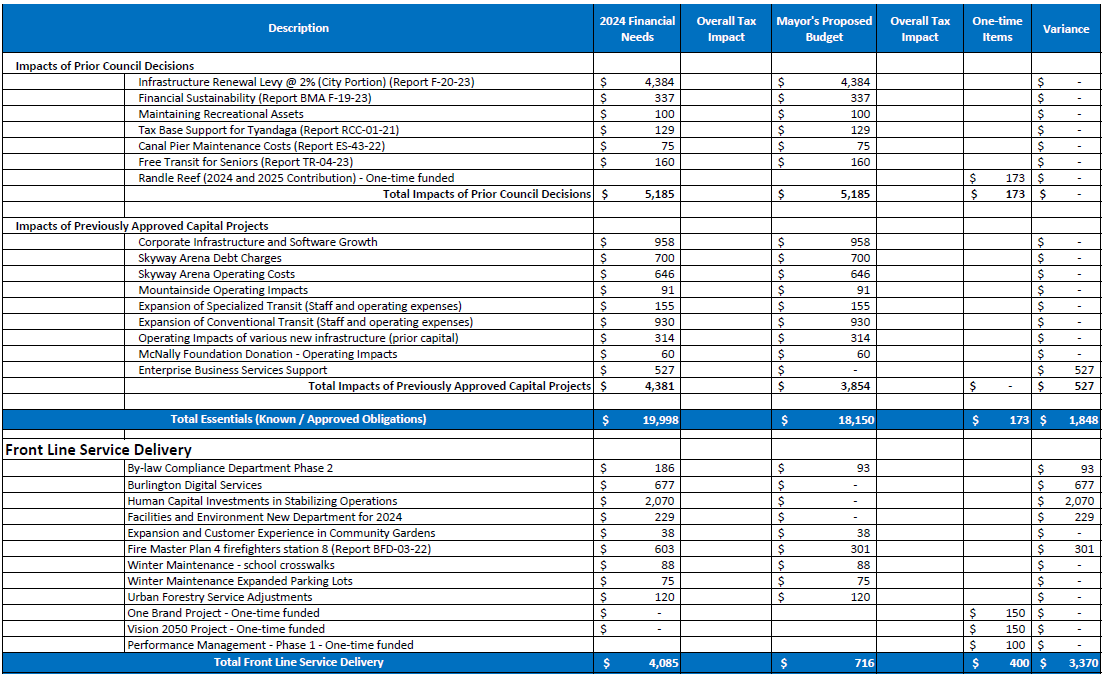

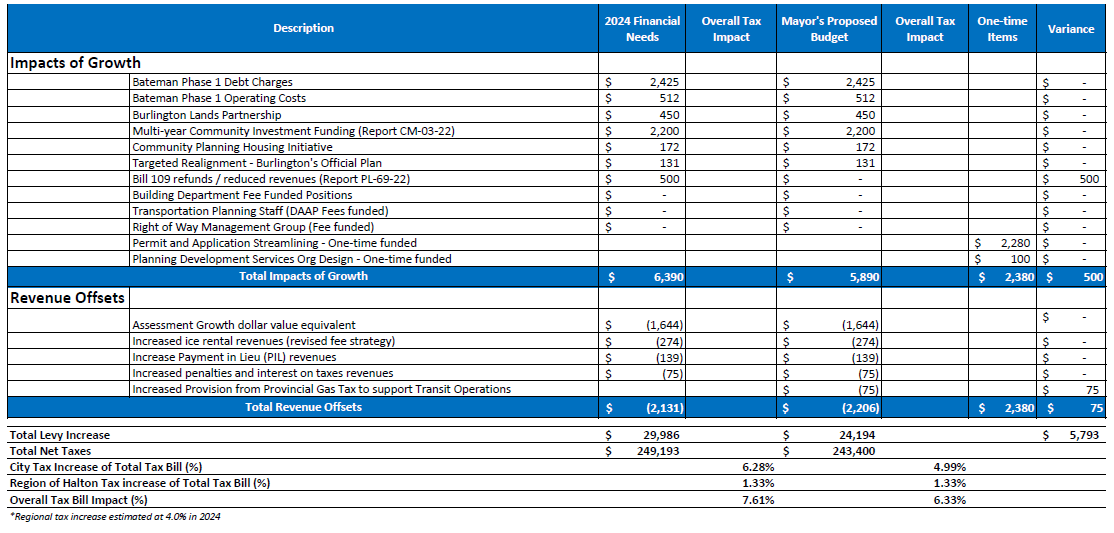

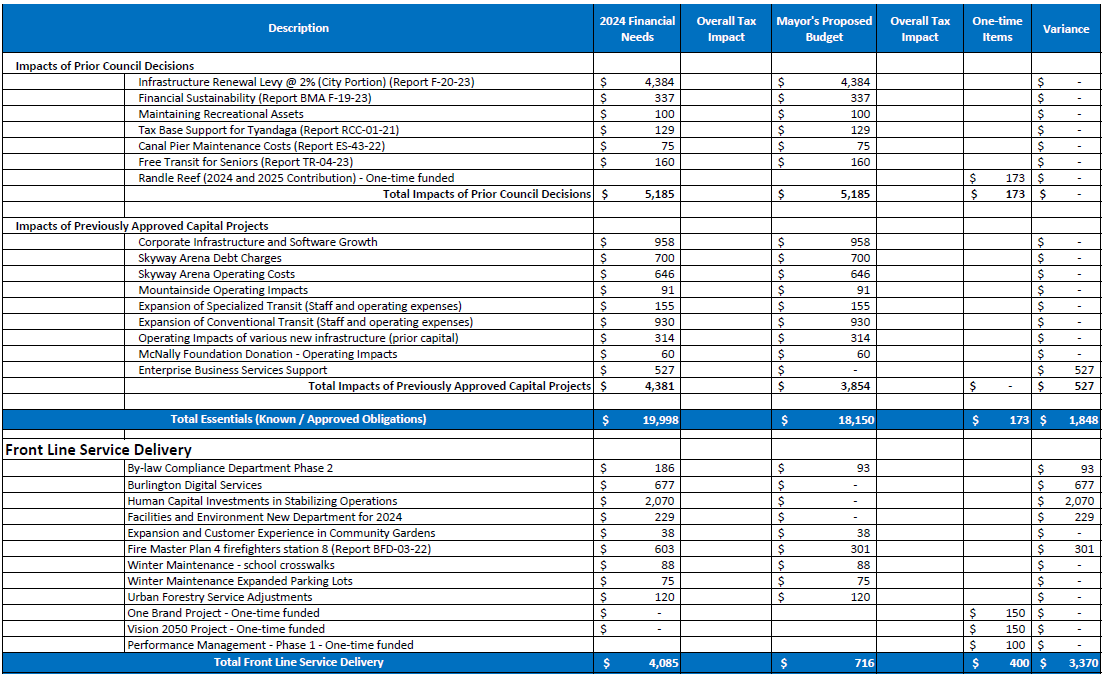

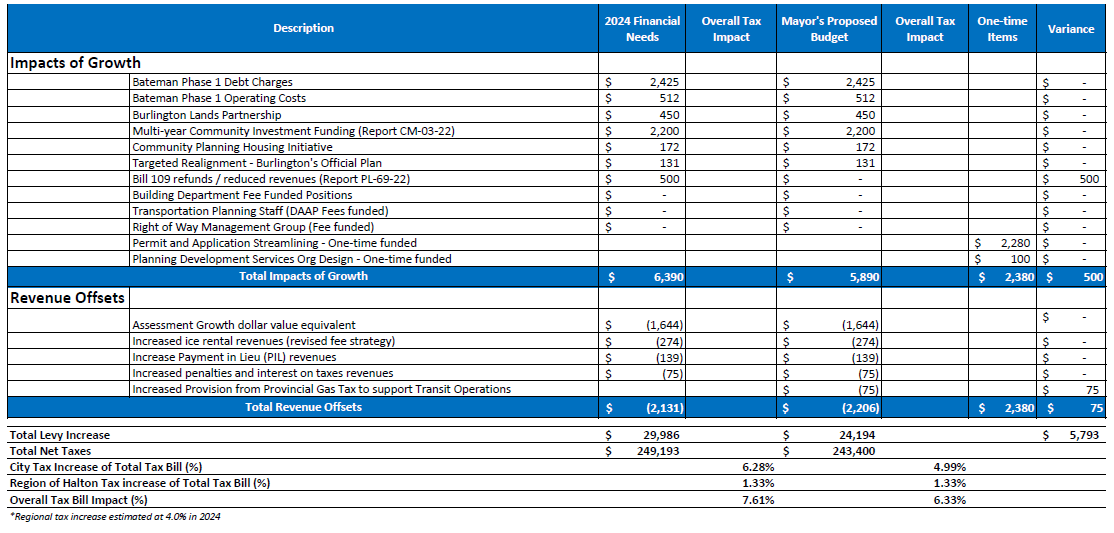

In the three charts set out below the Mayor sets out what was part of the Financial Needs report in one column and shows what her budget amount would be and in a third column she shows the variance.

The numbers deserve some comment, however we are going to wait until the Mayor formally presents her budget to City Council – that will take place in Thursday November 2nd.

Roll your cursor over the image to get an enlarged version

Mayor Meed Ward was very fulsome when she commented on her budget which will be formally presented to Council on Thursday.”I do want to thank staff for all of the work and the thinking that has gone into this. This is not easy. These are not easy times and they are not easy decisions and I do appreciate that. What has been presented is a clearer picture of the city’s needs. And it is now up to council to determine how quickly we are able to address those. I also want to thank the Deputy Mayor of strategy, budgets, performance and process (Paul Sharman) who has been enormously helpful to me and and to the staff and to the team who has been sitting around the table with all of our deep discussions to try to understand and ask questions about this budget presented in a way that is clear to the community.

Mayor Marianne Ward There are different ways to receive it – if you want to read all 700 and change pages it is online.

There are summary reports. The the presentation that we got today even is more summarized in terms of some of the challenges that we face and we will continue the collective way.

I know I’ve gotten many emails, I’m sure other members of council have. There has been a mix of we want more services.

We want you to you know things like snow clearing of paths to school so kids can walk which is in line with climate change. It’s in line with our mobility goals and so many other things. So, as noted, the legislation requires me to present a budget so from here on out all amendments will be to that budget, we will not be amending the staff financial needs.

The budget is on the agenda for the November 2 council meeting which is this Thursday. It will be formally presenting it at that time. I believe that it’s really important to maintain as much collaboration on the budget as we can possibly get recognizing the legislation has changed things a bit. This will allow us as a council to come to ground on what we think our priorities are going forward how quickly we want to address certain things.

Councillor Paul Sharman At the end of the day, this budget will not be the mayor’s budget. This budget will be the mayor and Council’s budget informed by what staff have shared with us. truly collaborative as all our budgets have been and informed by the detailed responses that we’ve seen from the public to date.

There will be opportunities for public comment on the online telephone town hall November 7, plus two more committee meetings that residents can delegate to and of course you can reach out to any one of us at any time. So with that I look forward to continued discussion and collaborating to come up with the best budget that we can in the circumstances that we are in.

By Pepper Parr By Pepper Parr

October 30th, 2023

BURLINGTON, ON

Another senior staff member rides into a Retirement Sunset.

Laura Boyd who has been with the city for decades has retired. The Communications staff didn’t release any notice – City Manager Tim Commisso just mentioned that there was an Acting Executive Director.

Laura Boyd Boyd was not everyone’s cup of tea. She bought into the Notices of Trespass that former City Manager James Ridge issued without the authority to do so.

Several years ago Boyd issued a strongly worded report on just how poorly the different departments were not working together all that well.

As news people the Gazette applauded that report.

Boyd did see the city into a staffing growth plan that was a challenge to manage.

There was a culture problem that we don’t think was all that well understood. Some very good people left Burlington to work is municipalities that were very close by.

Hamilton got two that were doing fine work – they just found that the environment wasn’t what they were comfortable with.

There was an assistant city clerk that found future growth didn’t offer much promise.

City Manager Tim Commisso has made some superb staff selections – most are female and young.

Tim will be vacating the City Manager office early in January – Will the Mayor talk him into serving the city is as a consultant?

Every City Manager has a style of their own. With the city in the midst of a rapid population growth for the next eight years – whoever Council chooses will have ideas of their own – unless Council chooses one of the Executive Directors to take on the job. There is at least one that has the skill set – the chemistry with Council might not be what Council, especially the Mayor, is looking for.

Related news stories:

Boyd sticks to her numbers – keeps the staff compliment

HR Executive Director comments on culture at City Hall

By Pepper Parr By Pepper Parr

October 30th, 2023

BURLINGTON, ON

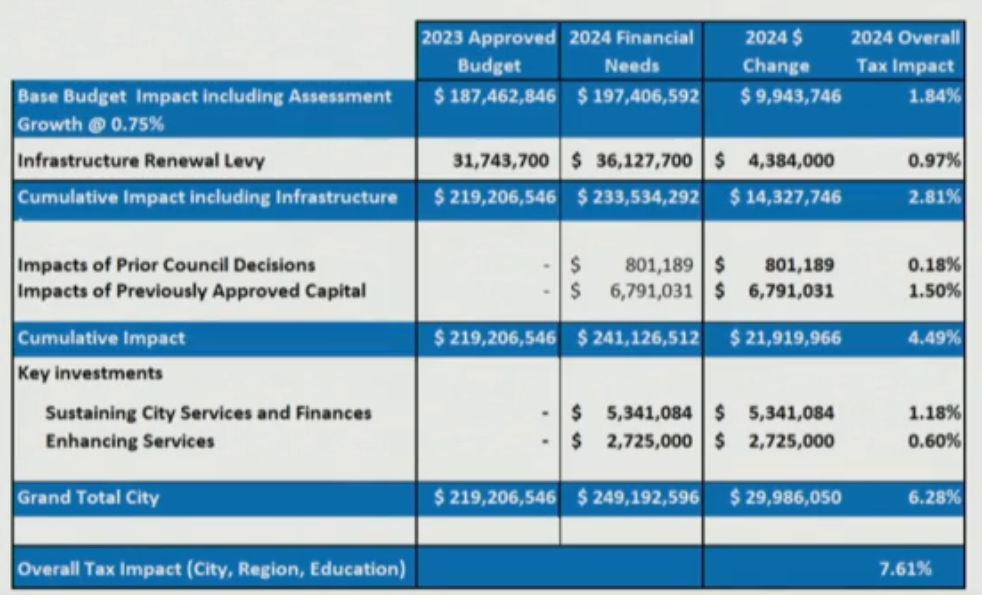

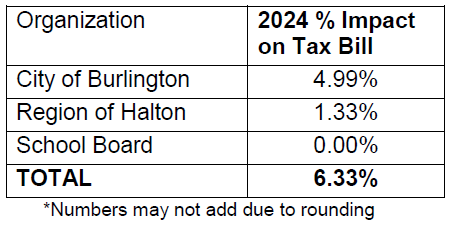

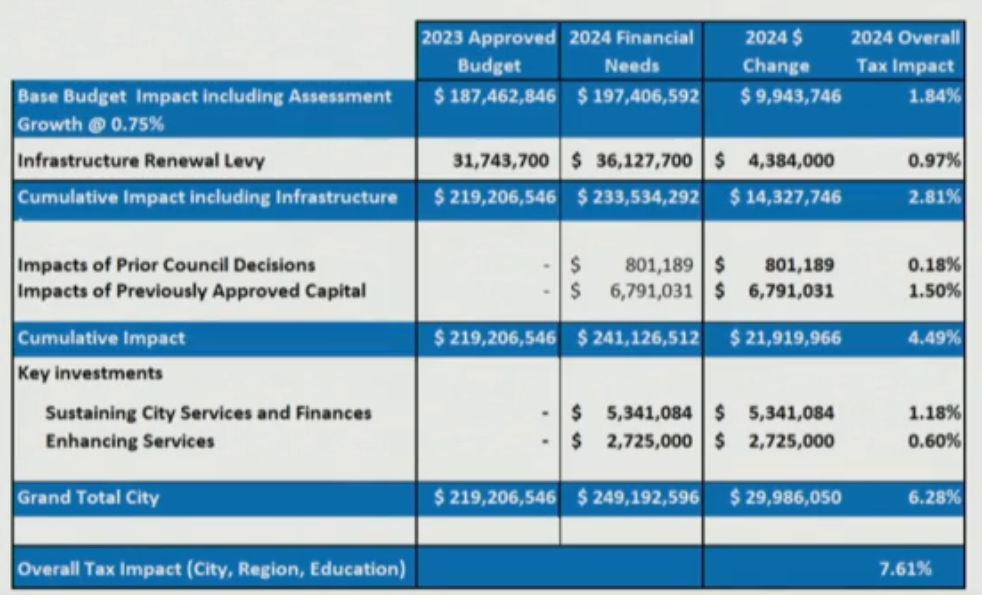

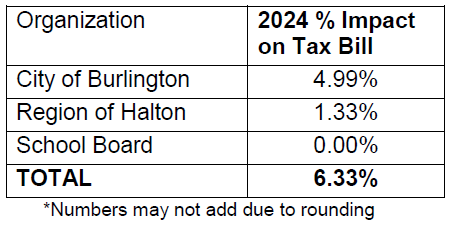

The residential tax bill is made up of three components: City of Burlington (51%), Region of Halton (32%) and School Board (17%). Council’s deliberations will focus on the city portion, as school board tax rates are established by the province, and Halton Region tax rates are decided by Halton Regional Council (where Burlington City Council makes up 7 of the 24 members).

The 2024 Financial Needs and Multi-year Forecast overview prepared by staff would require an increase of 6.28% to the city’s portion of the tax bill. Including the Region of Halton at 1.33% and no change to education. The total potential tax impact to residents would have been 7.61%. The 2024 Financial Needs and Multi-year Forecast overview prepared by staff would require an increase of 6.28% to the city’s portion of the tax bill. Including the Region of Halton at 1.33% and no change to education. The total potential tax impact to residents would have been 7.61%.

The Mayor’s budget proposes a 4.99% tax increase to the city’s portion of the residential tax bill. Including the Region of Halton and education portions the total proposed 2024 Mayor’s budget results in a total tax impact to residents of 6.33%.

The Mayor’s document was just 10 pages long.

We will go through it in detail later in the day – at this point she did manage to reduce what the public is going to be expected to pay in city taxes. If that holds true – give her credit for pulling it off.

By Pepper Parr By Pepper Parr

October 30th, 2023

BURLINGTON, ON

Burlington is a City that now has well over 175,000 people with another 50,000 that will be here by 2031 if the high rise towers get built.

The City signed a pledge to do its part in getting 29,000 people into new housing by 2031.

It is now up to the developers to get shovels into the ground.

Running a city today is a lot different when the current City council was elected back in 2018.

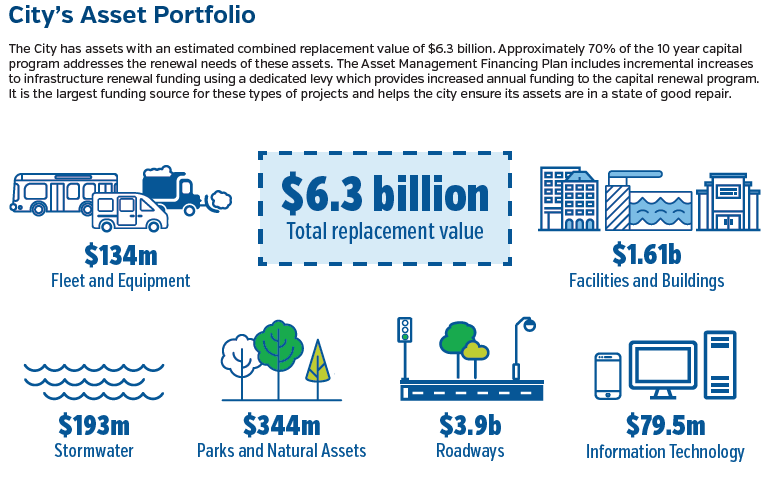

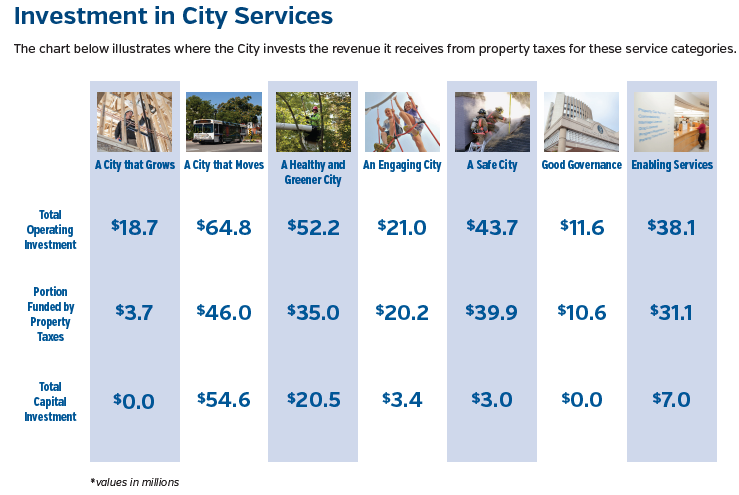

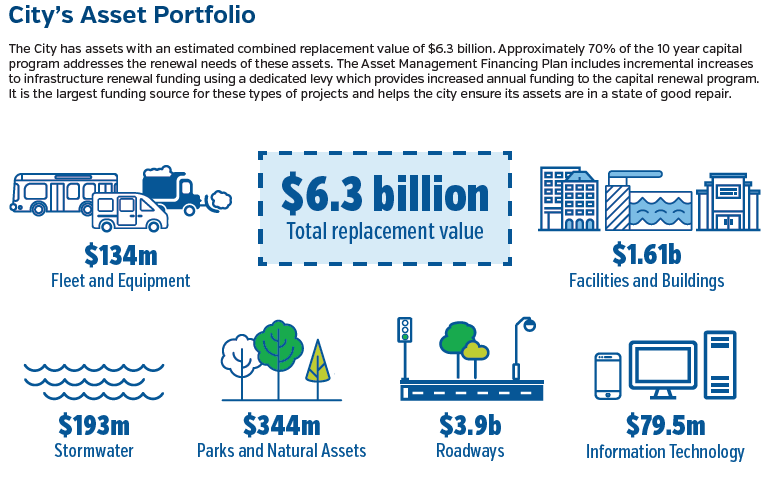

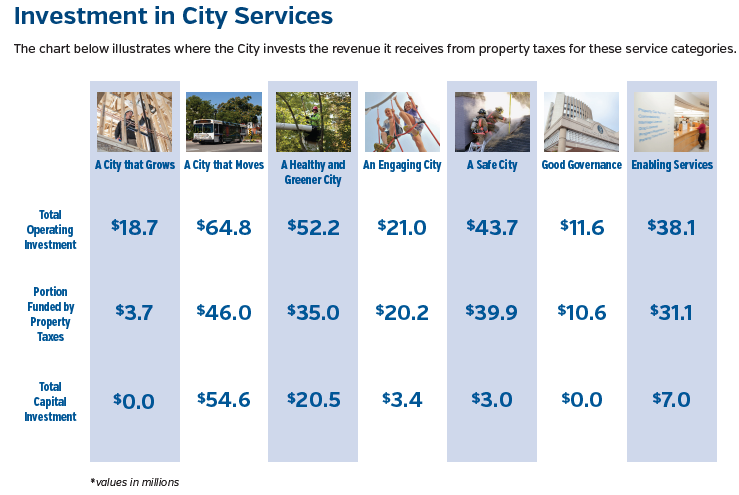

Two graphics set out the size of the City and the services it provides.

Administering a city the size of Burlington is no small matter.

The City uses the word “investment” to describe the cost of providing a service. Communications does its best to put the best possible spin on how money is spent. It was an expense.

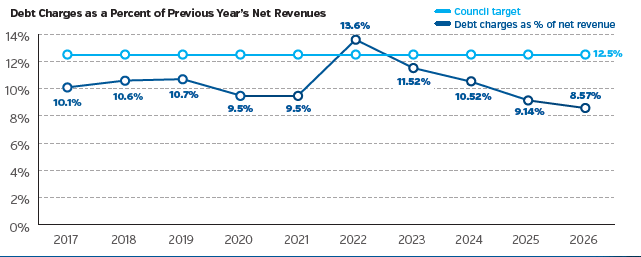

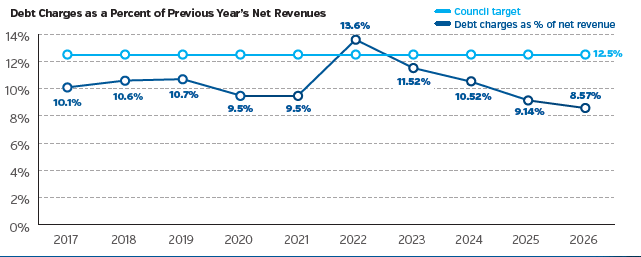

Where does the money come from? Some of it is funded by debt. Burlington’s Finance department has done a superb job of using debt responsibility – there are a few exceptions.

There is a story behind that jump above the12.5% level that is policy: a good story. The data and the comments we are working with come from the Financial Needs report that goes to Council today.

The Financial Needs report is more than 750 pages in length. The data is certainly available to Council members – whether they actually read it all – it a question some people. Mayor Meed Ward claims she will have read every line before she submits how own budget.

By Pepper Parr By Pepper Parr

October 30th, 2023

BURLINGTON, ON

Tax increase on the table – 7.61 % – down a wee bit from a 7.8% number that had been floated.

Council now asking questions based on the Financial Needs report.

There was one delegation – wasn’t pleasant – Chair Lisa Kearns shut down Wendy Fletcher who question many of the numbers that were in the report presented.

We would love to talk to Ms Fletcher – we can be reached at publisher@bgzt.ca

We will expand on just what these numbers mean – Council Standing Committee is still asking questions of Staff.

By Pepper Parr By Pepper Parr

October 30th, 2023

BURLINGTON, ON

An opportunity to confess was offered – I took a pass. The salad they served was good. Halloween – an opportunity for the kids to play Dress Up.

Turns out that adults are now playing Dress Up is as well.

Several of the bars and restaurants in the Downtown core have their staff dressed up

The surprise for us was when Sister Something said she would hear my confession before she handed me a menu.

Saucy for sure.

By Pepper Parr By Pepper Parr

October 30th 2023

BURLINGTON, ON

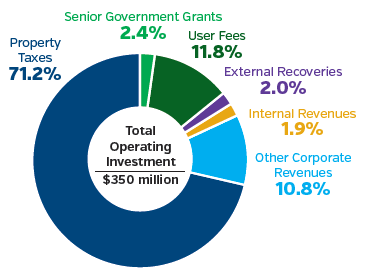

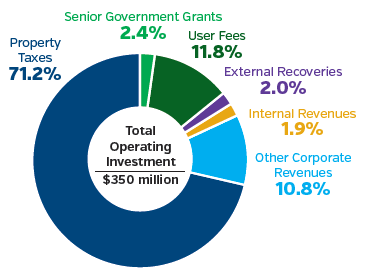

Where does the money come from

Property Taxes

The single largest portion of City funding comes from property taxes.

Senior Government Grants

These grants are provided by provincial and federal governments and are tied directly to legislated cost sharing arrangements. It should be noted that these revenues “flow through” the operating budget and are directly transferred into reserve funds until such time as they may be used for their designated purpose. As such these grants contribute to higher gross revenues and gross expenditures but have no impact on the City’s net operating budget.

User Fees

In accordance with the Municipal Act, 2001, the City of Burlington has by-laws which impose fees and charges for services or activities provided. Examples include: transit fares, permit fees, registration fees and rental revenue for the use of City facilities.

Internal Revenues/Charges

Internal Revenues are related to Internal Charges in that they are the revenues for work done for other services that are internal to the organization. The largest driver of these revenues is the revenue that Fleet Services receives for the work it performs for the other services within the City of Burlington. Other large drivers are the revenue that the City receives from Halton Court Services for a share of the revenue generated as well as the work of some City Services such as Information Technology, Finance and Human Resources perform for the functioning of the Halton Courts.

Other Corporate Revenues

These revenues include returns from the investment portfolio, managed by the Finance department, as well as the dividend and interest the City receives from Burlington Hydro. Other large items include Payments in Lieu of Taxation, Penalty and Interest on Taxes and Supplementary Taxes.

External Recoveries

External Recoveries are the revenues associated with doing work for other agencies such as other levels of government and the school boards. The largest of the recoveries are work the City performs for Halton Region followed by services performed for other municipalities.

The city receives funding from other area municipalities, school boards, other levels of government and agencies.

Recoveries from the Region of Halton and Other Municipalities

The City receives funding to recover the costs of expenditures incurred on jointly procured projects with other municipalities or for work performed on their assets.

The largest of these recoveries are received from the Region of Halton for water and wastewater works and our neighbouring municipalities of Oakville and Hamilton for work performed on boundary roads.

This will be followed by an article on where the money that comes in is spent.

|

|

By Pepper Parr

By Pepper Parr

By Pepper Parr

By Pepper Parr

To qualify for the enhanced HST New Residential Rental Property Rebate, new residential units must be in buildings with at least four private apartment units or 10 private rooms or suites, and have at least 90 per cent of residential units designated for long-term rental.

To qualify for the enhanced HST New Residential Rental Property Rebate, new residential units must be in buildings with at least four private apartment units or 10 private rooms or suites, and have at least 90 per cent of residential units designated for long-term rental.

The exhibition will be on view from November 14, 2023 to March 30, 2024.

The exhibition will be on view from November 14, 2023 to March 30, 2024. By Staff

By Staff REVEL is set to redefine the boundaries of art and entertainment, offering an unforgettable experience that combines electrifying digital performances, mesmerizing DJ sets, and enchanting mystical encounters.

REVEL is set to redefine the boundaries of art and entertainment, offering an unforgettable experience that combines electrifying digital performances, mesmerizing DJ sets, and enchanting mystical encounters.

The 2024 Financial Needs and Multi-year Forecast overview prepared by staff would require an increase of 6.28% to the city’s portion of the tax bill. Including the Region of Halton at 1.33% and no change to education. The total potential tax impact to residents would have been 7.61%.

The 2024 Financial Needs and Multi-year Forecast overview prepared by staff would require an increase of 6.28% to the city’s portion of the tax bill. Including the Region of Halton at 1.33% and no change to education. The total potential tax impact to residents would have been 7.61%.