December 30th, 2019

BURLINGTON, ON

The city has to contend with the reality of the market – the bank rate (the amount Bank of Canada charges BIG banks for the money they borrow) which means the city pays more for what it borrows – and the city borrows a lot.

Based on the economics of the market, staff, in a report to Council, said they “will maintain the following investment strategies leading into 2020;

• Maintain investments in the City’s long-term portfolio taking the opportunity to invest in new bond issuances. Once the interest rate environment stabilizes, invest in longer durations to maximize rate of return while managing risk to ensure there will not be a liquidity issue to meet commitments.

• Trade bonds for capital gains by taking advantage of market fluctuations generated by economic data. Staff will focus on maximizing capital gains at the appropriate times and reinvest in the market taking advantage of higher interest rates at a longer duration.

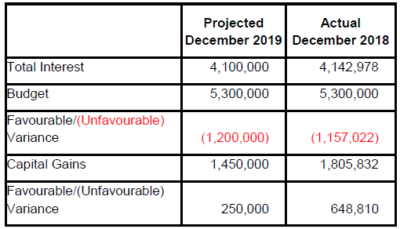

Investment income is projected to meet budget for year-end based on the detailed below which is up to and including September 30th.

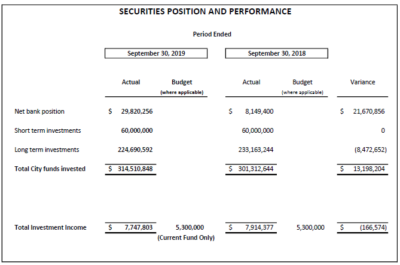

Appendix A, below, shows investment income (interest earned, and capital gains realized) to September 30, 2019 on the total investment portfolio. The net bank position as of September 30, 2019 has increased by $21.7M. This increase is slightly offset by a decrease in the long term portfolio.

The remaining increase is attributed to the receipt of $5.6M from the Federal Government for the one-time top up payment related to the Gas Tax as well as unexpended capital funds allocated to capital projects.

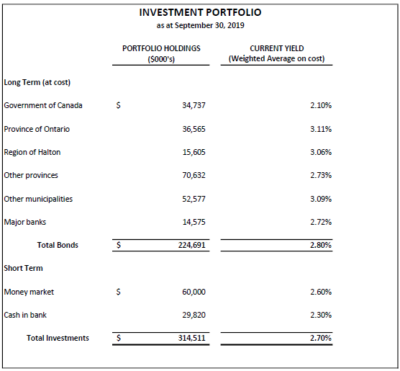

Appendix B provides a listing of the current portfolio by type of investment, and weighted average yield, in accordance with the Ontario Regulation 438/97. In following the City of

Burlington’s investment policy, the City can purchase Region of Halton bonds, up to but not greater than, the amount of the debenture issued on behalf of the City. As of September 30, 2019, the City’s investment portfolio included $15.6 million Region of Halton bonds.

As at September 30, 2019 the City’s investment portfolio is compliant with the guidelines set out in the City’s investment policy and goals adopted by the City.

PROPERTY TAX COLLECTION

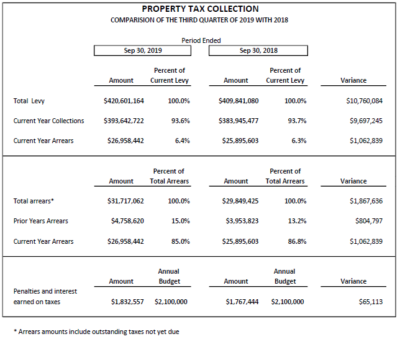

The City of Burlington collects property taxes for the city, Region of Halton and the Halton Boards of Education as legislated under the Municipal Act, 2001. Appendix C reflects the property tax status at September 30, 2019 compared to September 30, 2018. The 2019 total levy is $420.6 million compared to $409.8 million in 2018.

The City of Burlington collects property taxes for the city, Region of Halton and the Halton Boards of Education as legislated under the Municipal Act, 2001. Appendix C reflects the property tax status at September 30, 2019 compared to September 30, 2018. The 2019 total levy is $420.6 million compared to $409.8 million in 2018.

Collections for the current taxation year are 93.6%, which is consistent with prior years as highlighted in the chart below and detailed below:

Arrears notices are sent four times per year to aid in collections. In addition to arrears notices, tax collection letters are sent to owners with arrears in both the current year and two previous years; business properties are sent letters in the first quarter and residential properties in the second quarter.

A property title search is undertaken in November on accounts with three years of arrears and any lenders are notified. This results in most accounts being paid.

For those properties that remain three years in arrears, the Municipal Act, 2001 allows for a tax sale process to begin in January. The owner or any interested party has one year to pay out the tax arrears. If arrears remain after the one year period, the city may proceed with a municipal tax sale. Since 2000 there have been seven tax sales in Burlington.

The city offers multiple payment options including three pre-authorized payment plans which provide a convenient and reliable payment method for property owners. Approximately one third (20,000) of all property accounts are enrolled in pre-authorized payment plans.

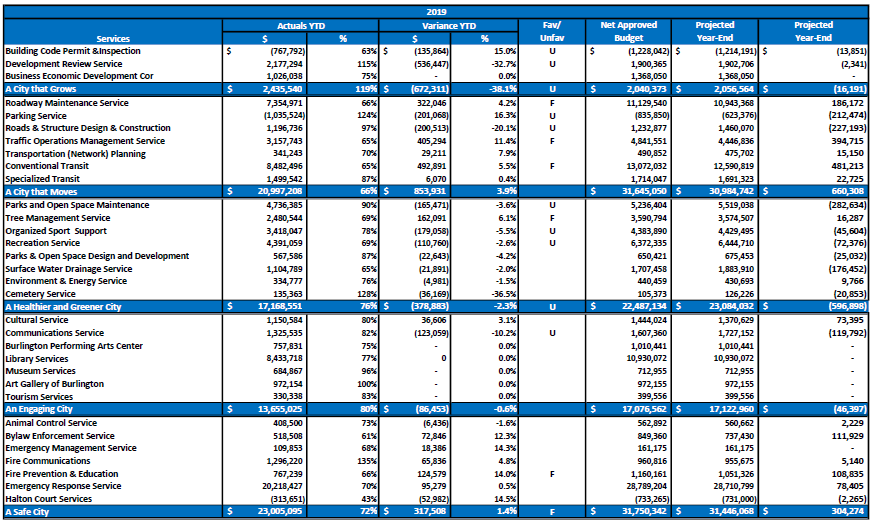

The big picture: