May 16, 2017

BURLINGTON, ON

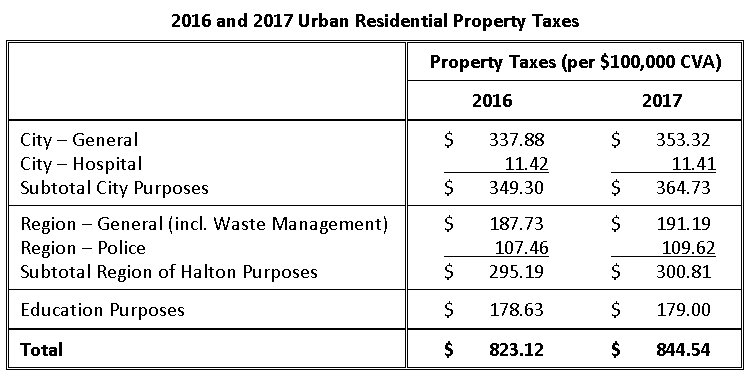

Yesterday City Council approved the 2017 Tax Levy Bylaw that allows the Finance department to end you a tax bill on with payment dates of June 21 and Sept. 21, 2017.

Highlights of the budget which was approved in January include:

• The 2017 budget delivers a base budget increase that continues to invest in existing services and reflects the objectives of the city’s long-term financial plan.

• The budget maintains the $4.8 million annual contribution toward the Joseph Brant Hospital reserve fund to meet the city’s $60 million commitment to the redevelopment project.

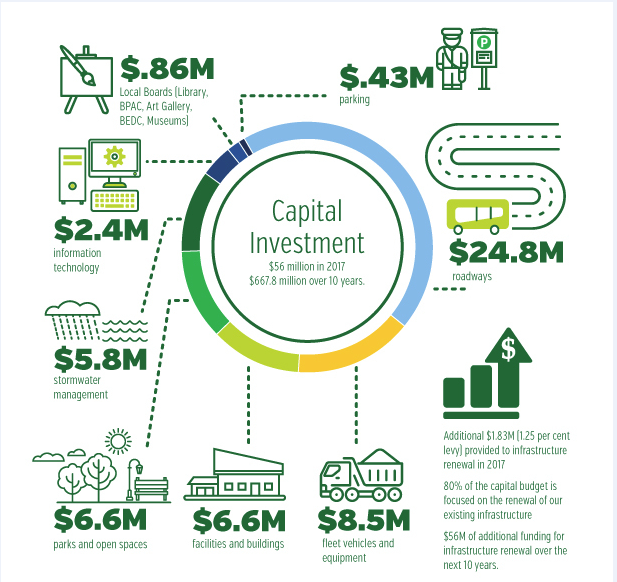

• This budget continues City Council’s commitment to a dedicated annual tax increase to address infrastructure renewal based on the city’s Asset Management Plan.

• The city’s approved operating budget of $238 million for 2017 provides a wide range of services and programs, including the maintenance of roads, community facilities, fire protection, parks and transit.

Additional service investments for 2017 include:

$254, 000 for maintaining the urban tree canopy

$200, 000 for the maintenance of sports fields

$80,000 in enhancements to washrooms in waterfront parks

$30,000 to support ongoing community events.

The budget is made up of two parts –

Capital budget

Operating budget

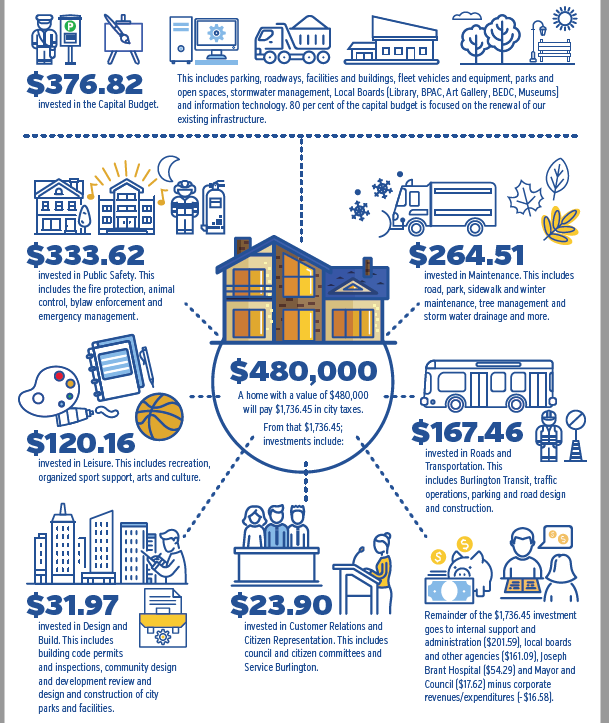

The city provides an infographic setting out where those tax dollars are spent.

Taking a look at the budget: why can’t we see real numbers? We are fed a bunch of misleading information. Taking a quick look at the 2016 budget, the City touted a 2.72% tax increase. Looking at their total expenditure, they increased their spending year over year by 4.1% in real dollars.

We are fed a bunch of garbage about cost increase per $100k of property value. What is not being shown is that property values are going up, and so are the City’s total income. We should actually have much closer to a 0% increase in ‘tax rate’. The City had a staggering 4.1% expenditure increase last year. What is it this year?

Am I missing something?

Neat infographic. Is $480k home value a reasonable representation for Burlington?

I think it’s also a little misleading to say ‘city taxes’ and not property taxes. Sure, the city takes less tax because the Region takes some, but the Region also provides those services that the city does not.