By Staff

By Staff

July 10th, 2018

BURLINGTON, ON

We are at one of those more delicate political points in the life of a city council’s term of office.

Staff have their budget forecasts well under way and they are now ready to take their projections on both the spending and revenue side of the city’s finances to the Standing Committees.

Staff have their budget forecasts well under way and they are now ready to take their projections on both the spending and revenue side of the city’s finances to the Standing Committees.

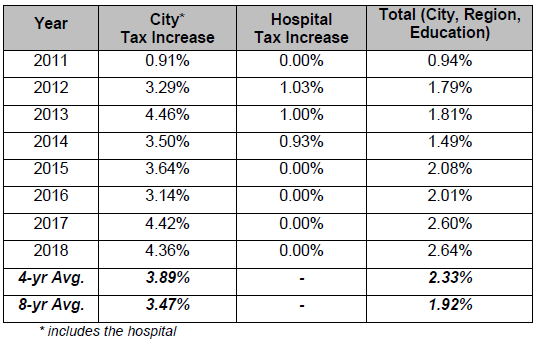

Budget increases during the past 7 years have averaged 3.89% – the projection for 2019 is 4.1%

This happens every year – what makes the 2019 budget deliberations more germane – is that this is an election year. Members of council who are seeking re-election are coming across as much more solicitous and accommodating. Five of the seven have filed their nomination papers – two have decided to take their pensions and watch from the sidelines.

We are getting the distinct impression that Councillor Taylor, who will not be running again may become a regular delegator at council meetings in 2019.

Staff have set out a framework for the 2019 budget.

Budget timelines have been adjusted from previous years as a result of the municipal election and in accordance with the Municipal Act. The inauguration of the new Council will take place in December 2018.

Both the Capital and Operating Proposed Budgets will be presented to Committee in January 2019. It is anticipated that budget approval will occur in late February or early March based on the timing of Committee meetings still to be scheduled.

In future years we will be targeting more aggressive timelines which would bring both the Capital and Operating Budgets forward together in advance of year-end (excluding election years).

Below is a brief timeline of the 2019 budget process.

• COW – Capital and Operating Budget Overview January 24, 2019

• Capital Council Information Session January 31, 2019

• Operating Council Information Session TBD – February 2019

• COW – Capital and Operating Budget Review TBD – Feb / Mar 2019

• Council Capital and Operating Budget Approval TBD – Feb / Mar 2019

Budget drivers and policy decisions are what have guided staff. Burlington’s Long Term Financial Plan was determined in November of 2012 when the strategic objectives and policies to ensure financial sustainability and responsible financial management were put in place.

The Strategic Plan grew from four year – one term of council – to a 25 year document.

The Strategic objectives, set out in the Strategic Plan, which is now a 25 year plan –it used to be a four year plan created by each council reflecting the aspirations of a council.

There is no mention of a Strategic Plan review in the creation of the 2019 budget – there should be.

In March 2015, the city received the BMA Financial Health report that provided recommendations that enhanced the existing financial policies. In May, 2017, the Asset Management Financing Plan maintained the recommended increases to the dedicated infrastructure renewal levy.

The City has a 20 year simulation that was presented to Council in January 2018. It provides a forward looking outlook on the city’s budget impacts. Since the 2018 budget approval, minor adjustments have been made to estimates resulting in a forecasted city tax increase of 4.1% for 2019.

Business cases are presented for any service level changes. Snow and leaf removal always get debated.

The budget process is supported by the 2016 Asset Management Financing Plan; Phase 1 Financial Plan for the 2015-2040 Strategic Plan; the 20-Year Simulation of Forecasted Budget Drivers; the BMA Financial Condition Assessment and the city’s Long Term Financial Plan.

Staff have said they will continue to focus on maintaining service delivery. Changes to levels of service will require a business case to outline the details of the change in a transparent manner.

The 2019 operating budget will continue to be presented in a service-based format with two years history for comparison.

In addition, all business cases will include commentary as to how the requested change aligns to one or more of the following items:

City’s Strategic Plan

Burlington Leadership Team (BLT) Work Plan

Departmental Work plan

Service Business Plan

The capital budget continues to remain a 10-year program, broken down by asset categories with projects further categorized as renewal, growth or new / enhanced infrastructure.

Over the last four years the average city tax change is 3.89% (including the hospital)

The tax bill residents get includes the Regional tax levy and the Board of Education tax levy. The city has zero input or impact on the school board budgets and limited impact on the Regional budget.

Despite these facts members of council and city staff make the comment that the overall tax change is 2.33%.

City council is the level that is responsible for tax increases every year for the past seven year that are very close to 4%.

Civic officials and politicians gather around the $100,000 piece of public art erected on Upper Middle Road west of Appleby Line

During debate on public art at a Committee of the Whole meeting on Monday Councillor Sharman said he felt the $50,000 that is allocated for public art was far too little for a city like Burlington and he was prepared to put forward a Staff Direction instructing staff to consider boosting that to $100,000. He didn’t get much blowback on that idea. The only objection was that this wasn’t the time to be talking about budget matter.

With budgets that are consistently above inflation – how does a fiscally prudent city council advocate additional spending?

A planning view of the new Burlington – looking south on Brant from just north of Caroline.

Easy – build like crazy in the downtown core, (and anywhere else you can approve infill developments that change the feel of a neighbourhood, collect all those development charges and send out even more tax bills to those thousands of people who are going to live in the city.

When does the public get a chance to say what they think about the budget? In the past the city has held public meetings that have had varied levels of participation.

In the past the meeting has filled a large room at the Art Gallery; on other occasions there has been less than five people in attendance with two of them former candidates.

One year the attendance was very poor – it was snowing like cracy and everyone blamed the weather – except that the ice rink in the next space at the Mainway Arena was packed with parents watching their children play hockey.

Not hard to approve 4% tax increases year after year with those levels of participation.

Yes, a 4.1% increase in taxes is substantial – and is far higher than the Toronto residents are paying! Just wait until the taxes increase to accommodate subsidized housing for the thousands of existing homeless, and homeless newcomers for generations to come! The Government needs to put together some intelligent brain power to see where the “Canadian” future is heading. There sure is no thought process in the planning thus far, and perhaps the reason why the search for another liveable planet is so important. As far as Canada having to meet our obligation – who was so thoughtless to put a number on an obligation at all, at our expense, that we cannot handle? Do we run our country or does the UN mandate what we have to do? Mr. T. needs to prioritize his obligations to his first and foremost, his country and tax payers, that put him in office! His loss of focus is getting mighty scary!

I make no claim to financial expertise, but on the surface a 4.1% increase sounds both excessive and untenable, especially when inflation is running at about 2%. If the City, the Region and the Board of Education’s budget increase is 2.64% it begs the question: who is and isn’t holding the line on public sector spending?

Unlike the City Manager who reaped a 14% salary increase last year many residents in this community are not so fortunate. Seniors, persons on disability, and many others on fixed incomes will be lucky if they see a 1% increase in their pensions or support payments. Most employees or independent business people would love a 4.1% increase.

The real budget savings are going to be realized through: 1) automation and online technology; 2) elimination of duplicated services; 3) rationalization of staff; 4) outsourcing of services; 5) tightening up of internal processes and controls; 6) improvements in the competitive bidding process. Those kind of economies are only going to be identified through an independent, value for service audit conducted by trained professionals and supported by a public service who are truly committed to cost savings and rationalization of services.

Sadly, looking at pretty pie charts and bar graphs in a three hour budget meeting so that City Hall officials can tick the box on their performance reviews claiming public engagement and consultation isn’t going to be purposeful, and least of all for beleaguered taxpayers.