By Staff

By Staff

May 27th, 2020

BURLINGTON, ON

Burlington City Council Monday evening approved the 2020 Tax Levy Bylaw.

The bylaw allows the City to bill 2020 property taxes and set payment due dates for final tax bills on Aug. 20 and Oct. 20, 2020. Final tax bills will be mailed in early July.

That may sound a little confusing. City Treasurer Joan Ford explains.

Director of Finance Joan Ford found a way to provide some tax relief for people pressed financially during the Pandemic.

“We have two property tax billings mailed out each year – Interim and Final

“The bills are mailed out in January for Interim and normally in May for Final (this year the final bills are being mailed out in July instead of May)

“Each billing has two installment due dates

Here is where it gets tricky. The COVID19 Pandemic and the crisis it created resulted in the city giving people more time to pay their taxes.

The February payment stood as it was; the April payment was moved to June 30th (they called it Pandemic relief) That covered the Interim Billing – which is basically the first half of the year.

The June and September payment dates for the Final Billing were moved to August and October.

The 2020 Tax Levy Bylaw reflects the budget processes that determines tax rate for both the City and Halton Region. The province determines the education tax rates.

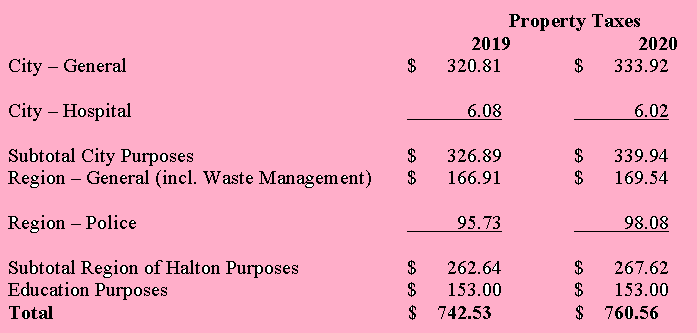

The overall city property tax increase is 2.43 per cent or $18.03 for each $100,000 of urban residential assessment. Tax impacts will vary by property based on actual changes in the assessed value of the property relative to others.

Interim billing generally represents 50% of last years taxes in which the payment is divided into the two installments.

Final billing represents the remaining 50% plus any budget changes for the city & region and changes in education taxes divided into two installments

The Final tax bill will show what the total taxes are for the year less what was levied earlier in the year as part of interim taxes with the balance split between the two installments.

COVID-19 Property Tax Relief

In response to the COVID-19 pandemic, Council approved temporary property tax relief which allows businesses and residents additional time to pay their April property tax installment, without incurring late payment charges.

For property taxpayers impacted by COVID-19 who require additional assistance for repayment of the April 21 instalment beyond June 30, the City is offering enrollment in a monthly pre-authorized payment plan.

This plan will provide for monthly withdrawals from Aug. 1 to Dec. 1 to pay the remaining 2020 property taxes (April, August, and October instalments). No penalty or interest is charged for taxpayers enrolled in this plan. Please visit Burlington.ca/propertytax for more information or email pap@burlington.ca to register.

Here is where the tax money collected goes – the city Treasurer collects for the Boards of Education and the Regional government which includes the police.

The City of Burlington collects property taxes for the city, Halton Region and the Halton district school boards. The total combined tax levy for all three entities is approximately $431 million. The city’s levy is $174 million; the city collects $138 million on behalf of Halton Region; and $119 million on behalf of the Halton district school boards. The taxes levied for Halton Region and the Halton district school boards are remitted to them.

Related news story:

Keeping the city solvent when there isn’t much in the way of revenue and expenses unheard of before

So…the kids aren’t in school and the buildings are shuttered. That means…no school buses, no school bus drivers, no cafeteria attendants, no ancillary expenes, etc. Effectively, nothing going on for three months from March to the end of June. That’s a cost savings, but how does that get reflected in the education tax levy?

And while we’re on the topic of school budgets, let’s all hope that the Halton Distrcit School Board’s planned new administration buildings (estimated cost: $28 million) goes the way of the dodo bird. Many private sector companies, notably Google, Twitter and a couple of major banks, have already realized employees can effectively work from home. They are looking at scaling back signfiicantly their office space.

I’ve stated repeatedly in the past that spending $28 million while we are shuttering high schools (e.g. Bateman) is absurd. In the aftermath of the pandemic there is absolutely no reason why this initiative should proceed. Halton District School Board trustees need to step up to the plate and demand this be scrapped in its entirety! There is no way in hell we should be spending taxpayers’ dollars on a frivolous, unnecessary and irresponsibile proposal, especially when we have over a million people out of work, businesses scrambling to open, and people struggling to make ends meet. Either retrofit the existing premises, lease vacant office space, or have people work from home. Building a new Taj Mahal isn’t on!