By Pepper Parr

By Pepper Parr

July 10th, 2020

BURLINGTON, ON

Regional Chair Gary Carr – as proud as a new father over the credit/bond rating

There is one duty Regional Chair Gary Carr carries out every year – and that is announcing how good the Region’s credit rating is.

He used to brag that Halton had a better bond rating than the United States of America.

The Gazette used to find that annual bond rating level amusing – who cares?

We all care – especially at this time of huge declines in revenue and expenses that were not even thought about.

The municipalities are going to need money. The rules say that funds cannot be borrowed for operating costs. That may change – for these are changing times.

When a municipality has to borrow they send their needs to the Region – it is the Region that goes to the market with a bond offering thus the Region’s credit rating is what matters.

The Region is the banker on the bond side for the municipalities.

Halton Region’s AAA credit rating affirmed by S&P Global Ratings

Last month S&P Global Ratings affirmed its top credit rating for Halton Region. Their research summary praises the Region’s strong fiscal policies and budgetary performance while confirming its confidence in Halton’s ability to uphold this standing into the future despite impacts from COVID-19.

“Receiving this AAA Credit Rating from S&P Global Ratings confirms our strong financial position—the result of diligent planning and transparent reporting—which helps us support a high quality of life in Halton,” said Halton Regional Chair Gary Carr.

“This top credit rating will allow us to support ongoing investments in infrastructure while ensuring top value for taxpayer dollars, and we are proud to have earned this distinction for another year.”

Maintaining a top credit rating provides Halton and its Local Municipalities with continued access to the best capital financing rates available, which minimizes long-term infrastructure capital financing costs. As a result, public funds go further when invested in Regional works that help improve essential services in the community, such as road, water and wastewater projects.

S&P’s rating analysis included the following rationale in support of the AAA rating:

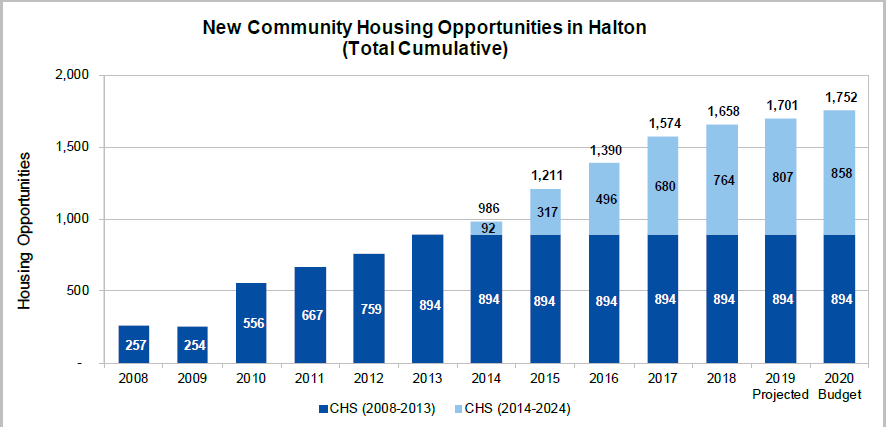

Consistent growth in the community housing sector of the Region keeps bond/credit rating agencies happy.

• steady population growth, high income levels, and a broad economy foster stability in the Region’s property tax base despite the negative impact from COVID-19;

• prudent financial management practices and solid economic base;

• excellent budget performance and limiting debt issuance; and

• exceptional liquidity position and satisfactory access to external liquidity for financing needs.

The Region has maintained top credit ratings from S&P Global Ratings (AAA) since 2002 and Moody’s Investors Service (Aaa) since 1989—a successful track record of more than 30 years. Earning this distinction from both agencies each year is a key objective of Halton’s annual Budget and Business Plan.