By Ray Rivers

By Ray Rivers

May 9th, 2019

BURLINGTON, ON

My conservative friends are forever lecturing me that governments should always run a balanced budget and avoid debt like the plague. But then they also tell me that government should operate like a business or a household. So which is it?

The average family today, particularly those starting out, finance their biggest expenses: their home, automobiles and major appliances. The choice often is to buy on credit to replace a major appliance or automobile, or face even higher operating and maintenance costs when the item becomes totally cost-ineffective. So personal debt is a fact in our lives – and thus all those annoying commercials for Credit Karma.

Modern business also runs on credit for just about everything they need. In fact the level of corporate debt continues to increase – and why not? When interest rates are low, below the potential rate of return of new investments, time is right to invest and grow their markets and build their capacity to better meet increased demand. The ability to afford and to manage debt is what matters, not the absolute amount.

Modern business also runs on credit for just about everything they need. In fact the level of corporate debt continues to increase – and why not? When interest rates are low, below the potential rate of return of new investments, time is right to invest and grow their markets and build their capacity to better meet increased demand. The ability to afford and to manage debt is what matters, not the absolute amount.

As with business and your average household, it is an outdated economic notion that government should always have to balance income and cash outflow in the short term. During the last federal election the two leading parties were promising balanced budgets which would have necessitated more economic austerity and pushed the economy deeper toward recession and greater unemployment.

So the voters opted for the party with a positive program to take advantage of low interest rates to expand the economy. And sure enough Canada’s economy responded with higher levels of growth, lower unemployment and the best performance in the G7. Given the economic success of that policy, Canada is in less danger of losing its triple A credit rating regardless of its deficit spending.

In fact our ability to afford debt is the best it has been since 1981, and the debt to GDP ratio is projected to continue to decline even as the government maintains relatively high annual deficits. That is because, much like a householder’s credit rating, it is not the absolute size of the deficit or debt that matters but its relationship to income and wealth.

The latest big thing in economics is called Modern Monetary Theory (MMT). It may help explain why Donald Trump can run-up debt like a drunken sailor with his head stuck in a barrel full of rum – and the US economy doesn’t capsize.

MMT says that a government which prints its own currency can almost spend till the cows come home – providing inflation is kept penned up in the barnyard. That is particularly the case if the debt is largely held domestically, which has been the case in Canada.

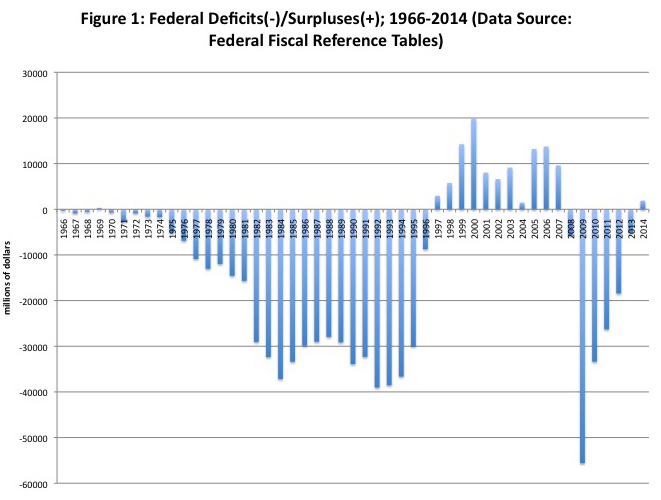

The data isn’t all that current – but it does show how often the federal government ran a deficit.

Perhaps the New Democrat or Green parties will go out on the limb as far as advocating a Canadian green new deal in our federal election this October. That would be gutsy given the controversy surrounding the proposal in the US, even among Democrats. And it is a full year before the concept will be tested on the US voting public.

But we shouldn’t expect to see the Liberals back away from their rather more modest spending plans. They are unlikely to knee jerk to austerity because some of yesterday’s voters and the conservative opposition parties still harbour a hollow and dated notion of always paying your way with what you are carrying in your pant’s pocket.

Today’s interest rates are the lowest in a couple of generations and investing now to build capacity, enhance incomes and reduce unemployment is a wise option for our national government. It might also be the best time to expand those social programs in which economies of scale end up costing society less even if it costs government more.

Programs like pharmacare or mitigating climate change come to mind. That kind of investing is exactly what a smart household or business would do. Would our children’s children really value a fiscal debt-free inheritance over one with the kind of environmental deficit we are heading towards?

This coming election can be expected to see fixated discussion, ad nauseum, about the size of Canada’s deficits and debt. Alarmists on the opposition benches will promise another imaginary fiscal balance should they get elected. But in the end, the math is simple. Budgetary deficits are a consequence of either too much spending or too little taxation. And financing, be it in business, the home, or government, is a just bridge over troubled waters.

There are always strong and opposing views when it comes to taxation.

Finally, it is a rare moment when any of today’s ‘arm chair economists’ will even mention increasing taxation – the price of government services. And since there are important economic consequences associated with all fiscal levers, their hesitancy is warranted.

Still if government is supposed to be a business, shouldn’t it try to operate like one?

Ray Rivers writes regularly on both federal and provincial politics, applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers

Ray Rivers writes regularly on both federal and provincial politics, applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers

Background links:

There is no return to balance under Trudeau. The deficit is projected to be 19 billion this year.

The math is simple. The Liberals increased spending by 22 billion. There would be no deficit if the spending hadn’t been increased. The Liberals promised a balanced budget by this year during the last election. They are now talking about balancing the budget by 2040. There will almost certainly be a recession between now and 2040. By not balancing the budget during the good times they will make the bad times more difficult than they have to be.

Businesses and households as you are referencing invest in assets expecting a return. I will acknowledge that families buying a home have a lot of emotion with it too but their expectation is that it will provide a return on their investment via capital increase to support retirement. Companies expect income growth through a cost reduction, more revenue or a combination of the two. How you can morph basic investment economics into what any of our governments have been doing, is laughable. They are borrowing to spend money on pure operating costs (i.e. programs). There is no actual revenue return to the government. As you mention, all governments regardless of party have been guilty of this. I condemn them all for that. By funding programs (new and old) with deficits, we’ve raised generations of Canadians with expectations that governments have limitless funds and you can see this by all the demands from every corner and every ‘special’ interest running to the “Nanny State” t provide for them. The reality of course is that this is not reasonable but politicians of all stripes have created this mess in their focus on getting elected versus governing. We need two things if we are ever to get restoration of sensible government at any level. Rules for government financial spending that are beyond the control of governments to change, which will force them to make the trade-offs of what to fund the same as any business or household. Secondly we need use based charges for using government services. This can be modest and token amounts but have to apply to everyone regardless of income as this will instill in people that the services are not free. Until we do both, the merry-go-round will continue with partisan fighting over who can hand out the most ‘candy’ to the wailing masses. If we want democracy to collapse, this is the way to do it, as it ultimately becomes un-affordable.

Actually, during the last election the Liberals promised to run a small deficit and have a balanced budget by this years election. The last budget wasn’t balanced. Any surplus will be due to unexpected revenue. The Liberals aren’t even talking about balancing the budget until 2040. Very convenient that the chart doesn’t show the years since 2014. Not sure who the 2015 deficit belongs to , but the 2016 to 2019 deficits are all Liberal.

2015 -1.0 Billion

2016 -17.8 Billion

2017 -19.0 Billion

2018 -14.9 Billion projected

2019 -19.8 Billion projected

This years budget could have been balanced but the finance minister announced $22 billion in new program spending.

Our deficits are caused by too much spending, or if you prefer by not raising taxes to cover new program spending. The math is simple.

Golly Gosh Ray, I guess we should just spend way more and print more

money and that would make things even better. Socialists (masquerading as progressives of course) haven’t a clue where money comes from and don’t care as long as they get to spend it. Unbelievable how you ignore the massive and already “progressive” programs in place for all facets of modern society. The people that take huge risks and employ people and pay our already outlandish tax requirements are fed up and are leaving town so you socialists can cluelessly wonder what happened. Regardless of your miss guided pile on the debt encouragement, the piper has to be paid at some point. Shocking how this fact is not clear to adults.

Good article. Re raising fears over deficits beginning to look like a political tool…It’s been that way for some time. Re running a country like a business or household – the major difference is the fact that government has the tool to raise its income at its fingertips via taxation. There was an interesting piece this morning by Lynda McQuaig: referencing Ontario’s situation, “…the CCPA (Canadian Centre for Poilcy Alternatives) shows that by cancelling Ford’s tax cuts, adding a very small increase in corporate and personal taxes (excluding those with taxable incomes below $50,000). The result would be a declining deficit, and the restoration — even expansion — of our social programs.” Now wouldn ‘t that be great – a government that really is FOR the people!

Federally, I think we are in good shape. The Liberals have introduced modest spending on social programs designed to lift people out of poverty at the same time trimming obvious waste. It looks like the Liberals will actually have a surplus in the last fiscal year, well ahead of the planned balanced budget.

I hope that finally puts to rest the incorrect notion that only CON’s can balance a budget. Because as we all know, Mulroney and Harper pilled on our national debt, while it was Liberal governments that actually balanced the budget for years.

The return to a balance budget by Trudeau is great news for Canadians and we need to continue with the plan for economic growth under the Liberals.

Provincially, Doug Fraud isn’t doing anything remotely responsible. He is taking an axe to anything progressive, social or anything held dear to Liberals. He claims to do this in the name of balancing the budget, but in fact he is spending more than the previous Liberal Government.

Instead, he is wasting huge amounts of funds on broken contracts, severance, nonsensical legal challenges, and corporate tax cuts. Balancing the budget is the farthest thing from his mind. It is all about payback for anyone or anything that insulted him or our former crack head mayor of Toronto. In four years, we will still have a deficit shortfall in Ontario, and hopefully we will be able to kick Doug to the curb.